The 36 Critical Illness List And How Coverage Works In The UK

What would you do if you could not work due to a serious illness or disability? Without your income, would your family be able to cover the costs of the mortgage, rent, and other living expenses?

If you’re concerned about financial hardship due to a severe health condition or disease, you might consider investing in critical illness insurance.

Several critical illnesses are typically covered under these policies in the UK. However, cover can vary quite a bit depending on the insurer and the type of policy you purchase.

Let’s look at what you need to know about the 36 critical illnesses commonly covered by critical illness insurance and how coverage works in the UK.

Protect Your Future Against Critical Illness—Get a Free Life Insurance Quote Today

What Is Critical Illness Insurance?

Critical illness insurance is a type of insurance cover that can help protect you from financial hardship if you or a family member becomes severely ill.

This type of insurance offers a cash lump sum payment that can be used toward bills, rent, mortgage payments, and other living expenses if your medical condition makes you unable to work.

There can be significant differences between critical illness policies in the UK, so it’s important to take a close look before signing up so you know what is covered.

The specific diagnoses and illnesses covered by critical illness insurance can vary but are typically very serious, long-term conditions. These include diseases like Parkinson’s, multiple sclerosis, and cancer, or conditions such as heart attack, stroke, or loss of limbs.

Having access to funds can be a lifesaver when a disease or condition has left you paying large sums for treatment and impacted your ability to generate income.

This money can be used for living expenses, such as covering medical costs or paying your mortgage. It doesn’t need to be used for specific purposes—you can use it how you see fit.

Even if you have some income coming in during treatment or due to your illness, such as sick pay from your employer or state benefits, critical illness insurance can help make ends meet.

Critical illness insurance isn’t the only way to protect yourself from the financial burdens of illness– for example, you could alternatively take out income protection insurance. However, income protection insurance tends to be more expensive than critical illness insurance.

Before you decide to purchase a policy, it’s a good idea to consider your various coverage options, so you know you’re receiving the protection that best suits your needs.

The 36 Main Critical Illnesses in the UK

In most cases, a critical illness policy in the UK will cover these primary thirty-six critical conditions.

Furthermore, coverage might include several other severe illnesses depending on the circumstance and the insurer.

| Illness | Description |

|---|---|

| Cancer | Typically covers malignant tumours, but early-stage cancers might not be included. |

| Stroke or Mini Stroke | Cover generally pertains to sudden losses of brain function due to a disruption in blood supply. |

| Heart Attack | Acute myocardial infarctions are often covered, depending on severity. |

| Parkinson’s Disease | Policies usually cover this progressive neurological condition, though drug-induced cases might be left out. |

| Multiple Sclerosis | This autoimmune condition affecting the central nervous system is commonly included in the cover. |

| Kidney Failure | Chronic and end-stage renal failure are normally covered. |

| Alzheimer’s Disease | Cover for this form of dementia can vary amongst providers. |

| Paralysis | Cover often includes loss of muscle function in sizeable parts of the body. |

| Brain Tumour | Malignant brain tumours are generally covered, whilst benign ones might not be. |

| Full Thickness Burns | Cover extends to serious burns that affect deeper tissues. |

| Muscular Dystrophy | Genetic disorders causing muscle deterioration are often included. Read our guide to genetic testing and life insurance for more information. |

| Paralysis (Limbs) | Typically covers loss of muscle function in specific limbs. |

| Cardiomyopathy | This heart muscle disease is commonly covered. |

| HIV | Contracted through blood transfusions or in the course of work, it’s usually covered. |

| Hepatitis (Fulminant Viral) | Rapidly progressing forms of this liver ailment are usually covered. |

| Chronic Aplastic Anaemia | When the bone marrow fails to produce blood cells, it’s often covered. |

| Loss of Speech | Permanent and irreversible loss of speech is typically on the list. |

| Bacterial Meningitis | Cover often extends to severe inflammations of the brain and spinal cord linings. |

| Blindness (Permanent) | Permanent loss of sight is usually included. |

| Liver Failure (End-stage) | Terminal liver conditions requiring a transplant are normally covered. |

| Coma | Lasting unconscious states, not medically induced, are typically included. |

| Deafness (Permanent) | Permanent hearing loss is normally on the list. |

| Heart Valve Surgery | Procedures to mend or replace heart valves are often included. |

| Severe Coronary Artery Disease | Conditions that require bypass surgery are typically covered. |

| Major Organ Transplant | Transplants of key organs like the heart or lungs are normally included. |

| Primary Pulmonary Arterial Hypertension | High blood pressure conditions of the lungs are commonly covered. |

| Loss of Independence | When one can’t live without assistance due to illness or disability, it’s often covered. |

| Surgery of the Aorta | Procedures on the main artery of the body are typically included. |

| Terminal Illness | Illnesses with no cure and a prognosis of death within a year are usually covered. |

| Lung Disease (End-stage) | Terminal lung conditions are commonly included. |

| Brain Surgery | Invasive procedures on the brain are usually on the list. |

| Medullary Cystic Disease | Genetic conditions leading to kidney failure are normally covered. |

| Encephalitis | Severe brain inflammations from infections are typically covered. |

| Head Trauma | Serious brain injuries from accidents are often included. |

| Motor Neurone Disease (MND) | Progressive conditions causing muscle deterioration are, in most cases, covered. |

| Angioplasty | Procedures to restore blood flow might have limited coverage depending on the policy. |

It’s essential to look closely at any insurance policy before signing on. The illnesses and conditions covered can significantly vary depending on the insurer you’re working with.

Some policies are fairly limited, while the most comprehensive policies can cover more than fifty different conditions and illnesses.

For example, critical illness coverage often excludes injuries such as broken bones, abnormally high blood pressure, and non-invasive cancers.

Considerations Before Taking Out Critical Illness Insurance

You’ll want to ask yourself several questions before you take out critical illness insurance.

For instance, it’s a good idea to look at any benefits you might receive from your employer if you become disabled or cannot work due to a serious illness.

Additionally, you can analyze your other insurance policies to see if you would be sufficiently covered in the case of a severe illness, such as your life insurance policy and other health insurance coverage.

As stated earlier, it’s also wise to shop around and compare the different types of illness insurance available in the UK.

For example, you can typically have a wider range of conditions and illnesses covered through income protection insurance, and this type of coverage usually offers a long period of coverage. At the same time, it’s more costly than critical illness insurance.

If you determine that critical illness insurance is right for you, closely examine what illnesses and conditions are covered. In most cases, you must be severely ill or completely disabled before successfully filing and collecting a claim.

When you purchase a critical illness policy, you must share your and your family’s complete medical history with your insurer.

It’s not a good idea to leave out important information during this process because your insurer might refuse to pay if you try to claim something that is a pre-existing condition.

If you are shopping for critical illness insurance while you already have a pre-existing condition, your policy may cost more. Ensure any insurer you work with will be willing to pay out for the condition you are already contending with.

Many people feel it is uncomfortable to discuss their sensitive medical information with the salesperson selling them a policy.

It’s worth noting that you don’t have to discuss any of these personal details with them. Instead, you can directly transfer all of your information to the medical officer of the insurance company.

How Critical Illness Coverage Works in the UK

The coverage you receive through critical illness insurance will depend on how much you want to put towards your policy each month and how long you want the policy to last.

Most experts advise that you maintain this type of insurance when your income is significantly challenged.

For example, it is prudent to have this type of coverage when working to pay down a mortgage or cover the cost of a child’s education.

How to Know If You’re a Good Candidate For Critical Illness Insurance

Critical illness insurance may or may not be a worthwhile investment, depending on your circumstances.

For instance, if your income is the primary source of support for you and your family, critical illness coverage could provide peace of mind and be vital in your financial recovery during and after an illness.

Another reason you might consider this type of insurance is if you don’t have enough savings in a building society or bank to cover your cost of living if you were to become disabled or severely ill.

Finally, this type of insurance can be a good choice for people who don’t have an ample employee benefits package that could help cover their living costs while they cannot work for a long time.

On the other hand, you might find that critical illness insurance isn’t the right choice for you. This could be because you have ample savings to cover the cost of living even if you cannot work and are saddled with medical bills.

Individuals free from any financial commitments, such as dependents or a mortgage, may also find this type of insurance unnecessary.

People who receive critical illness insurance coverage through their employee benefits might supplement their coverage through an additional policy or find that what their employer offers is sufficient.

The Cost of Critical Illness Insurance

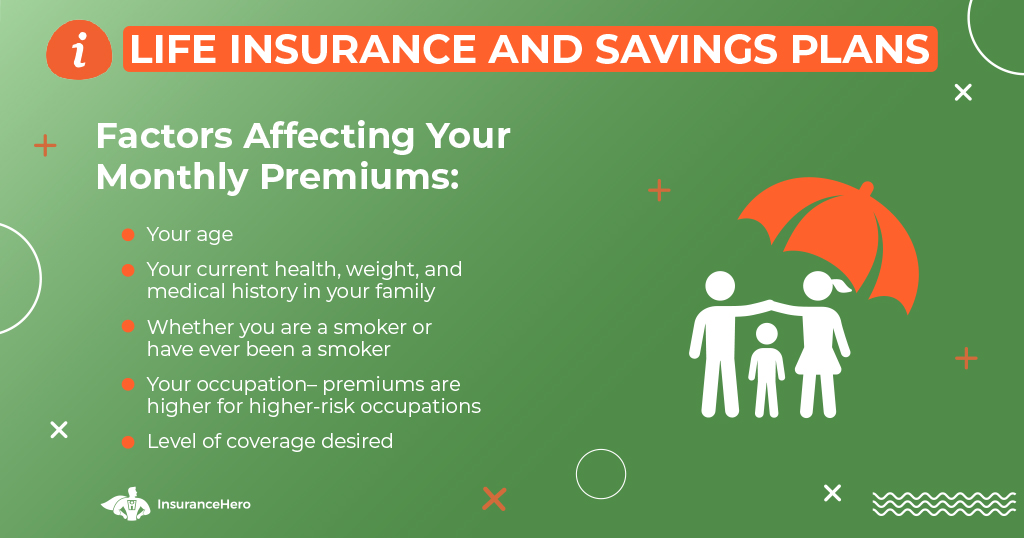

How much you will pay toward monthly premiums is going to depend on several different factors, including:

- Your age

- Your current health, weight, and medical history in your family

- Whether you are a smoker or have ever been a smoker

- Your occupation– premiums are higher for higher-risk occupations

- Level of coverage desired

If you have existing health issues and are considered at risk of a particular illness or condition, the policy might exclude that illness or condition. On the other hand, it might be included in the policy, but you might be required to pay a higher premium each month.

Another factor influencing the cost is whether you pay a guaranteed or a reviewable premium.

Guaranteed premiums are fixed premiums for the life of the policy. In the short term, these can be more costly. However, many find it’s worth the peace of mind to know with certainty how much their premium will cost them each month.

Conversely, reviewable premiums are reviewed after a specific time has passed. In many instances, this period is five years. You can generally expect that the premiums will increase at each review point.

How Much Critical Illness Coverage Do I Need?

It’s common for people to take out other types of insurance policies along with critical illness insurance, such as income protection and life insurance.

You can also find that many insurers will bundle critical illness coverage with life insurance coverage.

How much cover you should purchase is going to depend on a variety of factors, including:

- The amount of debt you have

- The number of dependents you have

- Any mortgage or rent payments you have

- Your take-home pay

- Your work benefits

- Other insurance policies you have

You can create an arrangement that suits your needs based on your financial needs and monthly payments.

Buying Critical Illness Insurance

There are two primary ways you can purchase critical illness insurance in the UK:

- Buying a critical illness policy directly from the insurance company

- Buying a critical illness policy through an independent financial adviser

Insurance companies must assess your situation to determine whether you are a good fit for a critical illness policy.

For this reason, you can’t simply purchase one online. Usually, you need to apply for a quote through the company’s website, and they will contact you once they have reviewed your information.

It’s common for people to be offered critical illness insurance at the same time they are taking out a mortgage. This will usually be insurance provided by the same lender as your home loan. This might not necessarily be the policy best suited to you nor the most affordable option.

It’s generally worth shopping around rather than simply signing up for critical illness insurance through your mortgage lender.

Understanding the Difference Between Life Insurance and Critical Illness Insurance

Critical illness insurance offers a lump sum payment if you have been diagnosed with a specific condition.

This money can help you and your loved ones cover various costs of living or treatment expenses. However, if you pass away, your family typically won’t receive a payout through critical illness coverage.

Conversely, life insurance is designed to help your loved ones cover their essential costs after you pass away.

You typically won’t receive a life insurance payout if you are diagnosed with a critical illness, but only after you pass during your policy term. This money helps your family maintain their lifestyle in the event of your death.

It’s common for insurers to offer both life insurance and critical illness insurance, which are sometimes bundled into the same product.

Both life insurance and critical illness policies pay out in a one-time lump sum rather than issuing payments over time. Coverage only continues so long as you pay for the policy– if you stop making payments, the coverage ends.

The knowledge that your loved ones will be taken care of if you fall ill or pass away can provide great peace of mind.

Finding a life insurance policy that is affordable and suits your needs is easy with Insurance Hero– we make it easy to compare quotes from multiple insurers and find the best policy for your needs and budget.

Whether you’re looking for life insurance, critical illness insurance, income protection insurance, or all three, you can get a no-obligation free quote today.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.