How Does Inflation Affect Life Insurance Rates And Payouts?

They say that only two things in life are guaranteed and that those two things are death and taxes. We’d argue a third: inflation.

Deflation is rare, at least in our modern economy. It usually takes a major event like the Great Depression to cause it, and even then, it only lasts for a few years before the economy recovers and continues to grow.

Even if experts are predicting just such a span in the coming years, inflation isn’t something we can easily predict, but it’s significant for long-term planning. You generally need to plan your investments, savings, and other wealth in ways that “beat inflation.” What does that mean?

Well, if the cost of everything rises by 5%, but you have your money stored in a plastic bag under your mattress, your purchasing power is lower than before, and your money is effectively “worth” 5% less.

If your money is, instead, in an account that gains 5% interest, you break even; if your interest rate is higher, you build wealth.

This is all a vast simplification, of course. We’re not here to be an economics crash course. What we’re concerned about is how inflation affects life insurance.

Regarding numbers, two important ones matter for life insurance: your premiums and your payout.

Inflation Is Rising. Will Your Life Insurance Keep Up? Get A Free Quote Today

How Inflation Affects Life Insurance Premiums

You have a few choices when you purchase a life insurance policy and get cover for the future. You pick between term and whole life, and if term, what term? Then you choose the amount of cover you want and the premiums you pay for that cover.

Premiums are the price you pay each month to maintain your coverage. They’re determined using a complex set of actuarial tables that consider many factors, including:

- Your age.

- Your gender.

- Your weight.

- Your smoking history.

- Your family history.

- Your occupation.

- Your hobbies.

- Your overall health.

- Any preexisting conditions.

This helps the insurance company determine how likely you are to pass away during the covered time period.

This is also why whole life cover tends to be significantly more expensive than term; when the definition is “it covers the rest of your life,” you’re pretty well guaranteed to pass within the period.

Term policies typically have relatively low premiums; the longer the coverage, the more expensive the premiums.

Meanwhile, whole or permanent policies feed some of your premium into an investment vehicle in addition to paying for cover, so they’re more expensive than even the most expensive term cover.

One key attribute to all forms of life insurance that is worth considering here. Your premium is fixed when you purchase the policy. If you buy a 30-year term policy, your premium for the first month will be the same as your premium for the last month, 29 years and 11 months from now.

How does inflation impact this? Well, it doesn’t.

Inflation is a constant background factor. It doesn’t directly impact your premiums, which won’t change.

However, if inflation rises and the cost of everything increases, your premium stays the same, which means it can feel cheaper even if the number hasn’t changed. Conversely, it can feel more expensive in times of deflation, however short-term those may be

This is in part because of those actuarial tables. When the insurance company looks at all of those various factors to determine the price of your cover, one factor built into the table is an assumed amount of inflation and an over-time adjustment for it.

When premiums are calculated, the insurance company is essentially estimating the costs to maintain your coverage for the duration of your term and the likelihood that they’ll need to pay out your benefits.

The more likely you are to pass in the given term, the higher the chances of paying out and, thus, the more expensive your cover will be.

They take the scaling costs over the term, add them all together, divide them evenly, and that’s your premium.

Technically, an assumed amount of inflation is already baked into the premium, so it doesn’t need to adjust over time.

Understanding Inflation and Its Impact on Life Insurance

| Subject | Description |

|---|---|

| What is Inflation? | Inflation measures how the prices of goods and services change over time. It’s calculated by comparing current prices to those from a year ago. |

| Inflation Rate Example | If inflation is 4%, prices are 4% higher than a year ago. For instance, if bread was £1 last year and is £1.04 now, it has risen by 4%. |

| Impact on Life Insurance | If the cost of goods and services rises, but the sum assured of your life insurance remains the same, the actual value of the policy may decrease over time. |

Indexation and Life Insurance Policies

| Subject | Description |

|---|---|

| What is Indexation? | Indexation is an optional feature in life insurance policies where the sum assured increases annually, along with the monthly premiums, to combat inflation. |

| Policy Types | Indexation is available for level term life insurance policies but not for Decreasing Term Life Assurance policies. |

| Policyholder Options | Policyholders can generally cancel or refuse indexation. However, providers may vary in how they handle a refusal of indexation increase. |

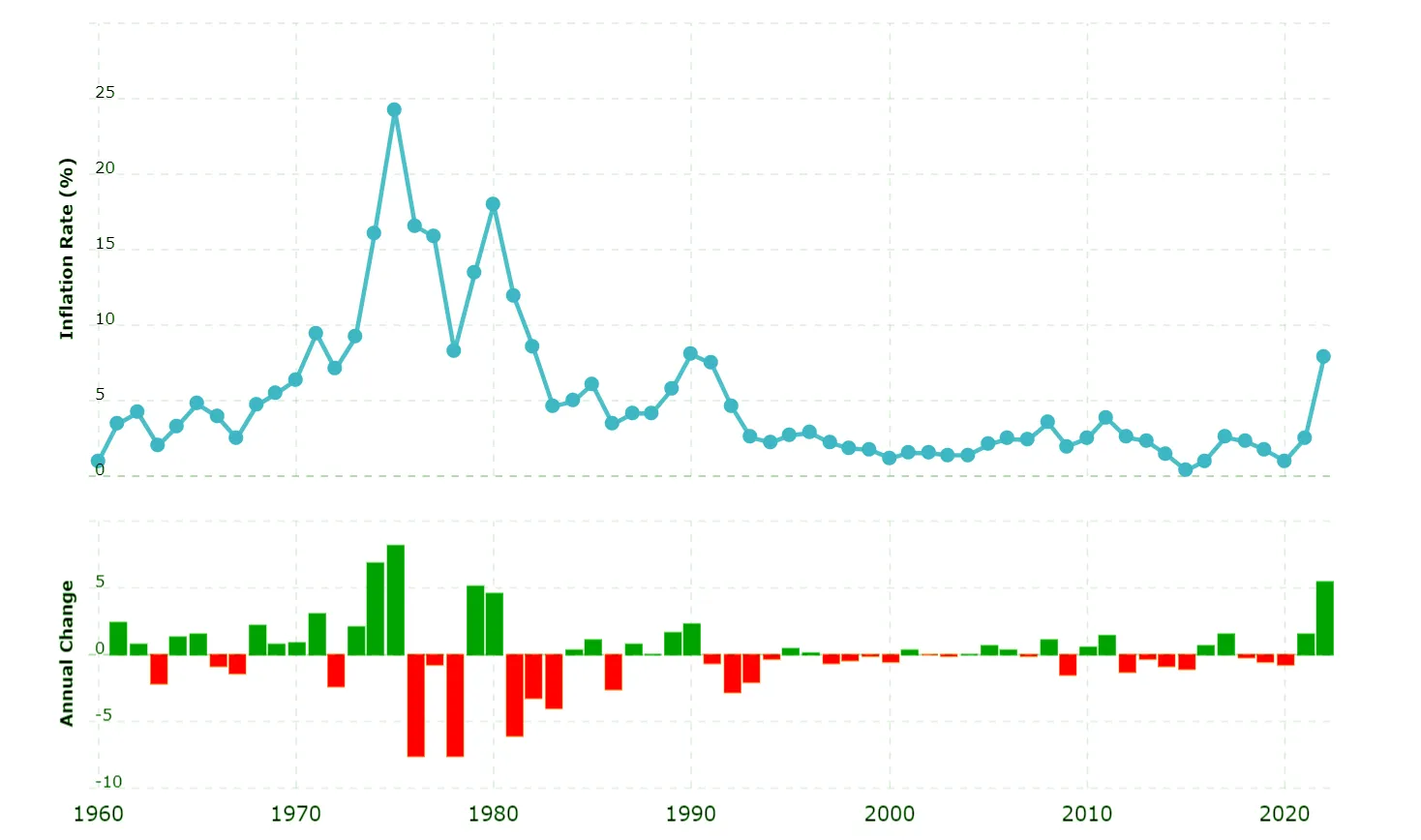

Source: https://www.macrotrends.net/countries/GBR/united-kingdom/inflation-rate-cpi

There’s only one instance where inflation has a significant impact, and that’s when your term expires, and you want to roll over or pick up a new policy to cover the remainder of your life.

For example, if you’re 40 years old and buy a 30-year policy, it expires when you’re 70. You must buy a new policy if you want another 20 years of coverage. That new policy will have a new premium calculated based on your new list of factors.

Inflation will be one of many factors considered in this calculation, and yes, your premiums will generally go up. Truthfully, though, the majority of that increase is simply due to the greater risk of passing during the term the older you get.

So, while inflation is a constant background factor affecting everything relating to money, investments, and the economy, it does not have a huge and tangible impact on your premiums.

As inflation increases but your premiums stay the same, inflation may feel like it’s making your insurance cover a better value.

How Inflation Affects Life Insurance Benefits

Life insurance aims to protect your dependents or loved ones in the event of your passing, mainly if it’s unexpected. It works alongside investments, pensions, and the wealth and assets you build up to provide a payout and financial security for at least a few years.

If you earn £87,012 per year, you’re in the top 5% of earners in the UK. Depending on your lifestyle and factors like your rent or mortgage, your cost of living, and other expenses, you may be comfortable, or you may be living cheque to cheque.

If you pass, would the people who rely on your income be able to survive, or would they struggle? That’s the question life insurance cover answers: by paying out a death benefit upon your passing, you can continue to provide for those people for years after you pass.

If you purchase a policy that provides £150,000 of cover, that death benefit payout is effectively two years of your income, give or take a little.

Two years of security for your family to figure out what to do without you and how to carry on? Many people would find that to be a great deal, especially considering the average cost for that £150,000 of coverage is roughly £38 per month.

You can extend that even further if you’re purchasing cover with much higher benefits. £500,000 of benefits in a policy would amount to nearly six years of financial security for your loved ones.

Of course, this is all napkin math. You still have to account for additional expenses like funeral costs, end-of-life medical care if needed, and the boogeyman of inflation.

Inflation compounds over the years. Over about 30 years – the length of a good long-term life insurance policy – inflation more or less doubles. That means something that cost £10 30 years ago likely costs £20 now.

Thirty years ago, your income likely would have been half of what it is now, but similarly, the price of everything would have been halved as well (you know, proportionally; the actual realities of an advancing career are very different.)

All of this is a roundabout way of asking a question: if you purchase £150,000 of cover today, and it pays out in 30 years, will it still be as valuable? The answer is, sadly, no.

Imagine if, in 1993, you purchased a cover for 2x your income, about £73,000. Today, that’s less than one year of your income, but that’s what the equivalent of £150,000 would have been, accounting for inflation.

You can play with these numbers yourself using the Inflation Calculator provided by the Bank of England.

Your death benefits don’t adjust with inflation any more than your premiums do.

If you received it today, what seems like a considerable amount of money to set your family up for years might not last nearly as long when you pass away in a few decades.

That’s not to say life insurance coverage is worthless. It just won’t stretch as far as you might hope.

Can Life Insurance Coverage be Adjusted for Inflation?

Life insurance companies are not keen on increasing payouts regularly without raising premiums to account for the added expense.

They also won’t front-load that benefit. You can’t get £500,000 of cover for premiums that would pay for £150,000, no matter how much you argue that in 30 years, it’s a lot closer to the same value.

However, insurance companies do recognise that inflation is real, and there are often options you can add to a policy to help account for inflation.

The most common way this works is through a cost-of-living rider, also known as simple inflation adjustments.

Inflation adjustments are pretty simple. You start with your insurance cover, say £150,000. Each year, the insurance company adds a compounding 5% to that cover.

- Year 1: £150,000

- Year 2: £157,500

- Year 3: £165,375

- Year 10: £232,700

You will pay extra in your premiums to compensate for this compounding benefit. Depending on the offer from the insurance company, it may be a flat higher premium, or you may agree to an adjustable premium. Usually, it’s the first option.

The downside is that many insurance companies cap the amount by which the overall value of the cover can increase.

They might max out at 25% or 30% over face value, so your £150,000 would top out at £187,500. Others might apply their compounding growth every 3 or 5 years instead of yearly for slower overall growth.

Most commonly, the adjustment might be a percentage pegged to the actual rate of inflation and not the rate of increase in the price of goods.

Inflation has historically been around 2-3%, but the consumer price index—the actual realised costs of goods and services growing over time, which accounts not just for inflation but also for companies raising prices beyond inflation is closer to 6-8%.

In these situations, the value of your cover falls behind, but by less than it would without any adjustments.

Finally, whole life cover works a little differently. These policies tend to have higher payouts but much higher premiums. They also have investments attached, so they’re like a combination of life insurance coverage and a SIPP or ISA.

These exist primarily to have additional investments above and beyond your standard portfolio and to leave more tax-free wealth for your dependents as part of overall wealth-building and estate planning.

Finding the Right Insurance Cover for You

Confused? Don’t be. In practical terms, all of this is just the facts and realities of the life we live in the economy we participate in.

All you need is some assistance in getting quotes for life insurance coverage and the ability to choose from various plans to find the one that best suits your life situation and goals.

A single young high-earner’s concerns over a long-time married pensioner are very different, but they have one thing in common: We can help.

All you need to do is go to our “get a quote” page here and complete the short form. This is forwarded to the top brokers and insurance firms in the UK, and within minutes, you’ll have a variety of quotes.

From there, it’s simple to look through them, compare them, and pick the one that works best for you. And, if you need help, an explanation of complex terms, or any other assistance, we’re standing by to answer your questions.

Feel free to reach out, and we’ll help you find a life insurance plan that meets your budget and coverage needs.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.