What Is The Top 5 Percent Income In The UK 2025?

Much has been said over the last decade about increasing wealth disparity in the United Kingdom and the rest of the world.

Here in the UK, the discussion brings to light a stark scenario that goes back to the days of more active royalty and impoverished working-class people.

Of course, simple income distributions don’t tell the whole story, so let’s explore this further.

Income Bell Curves and the Top 5 Percent

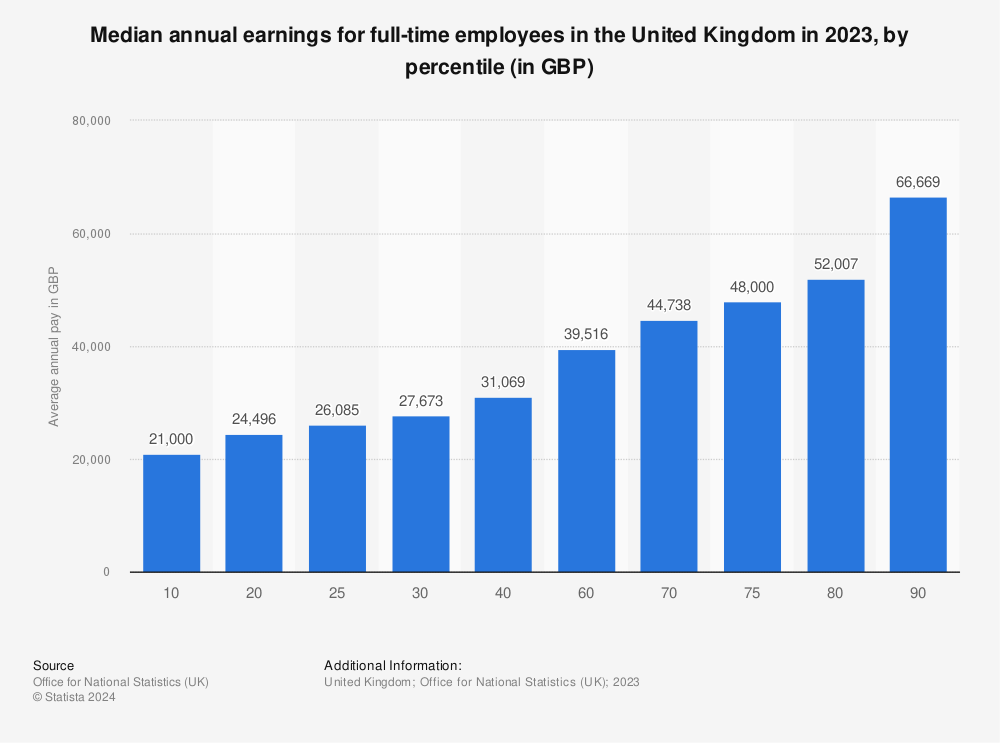

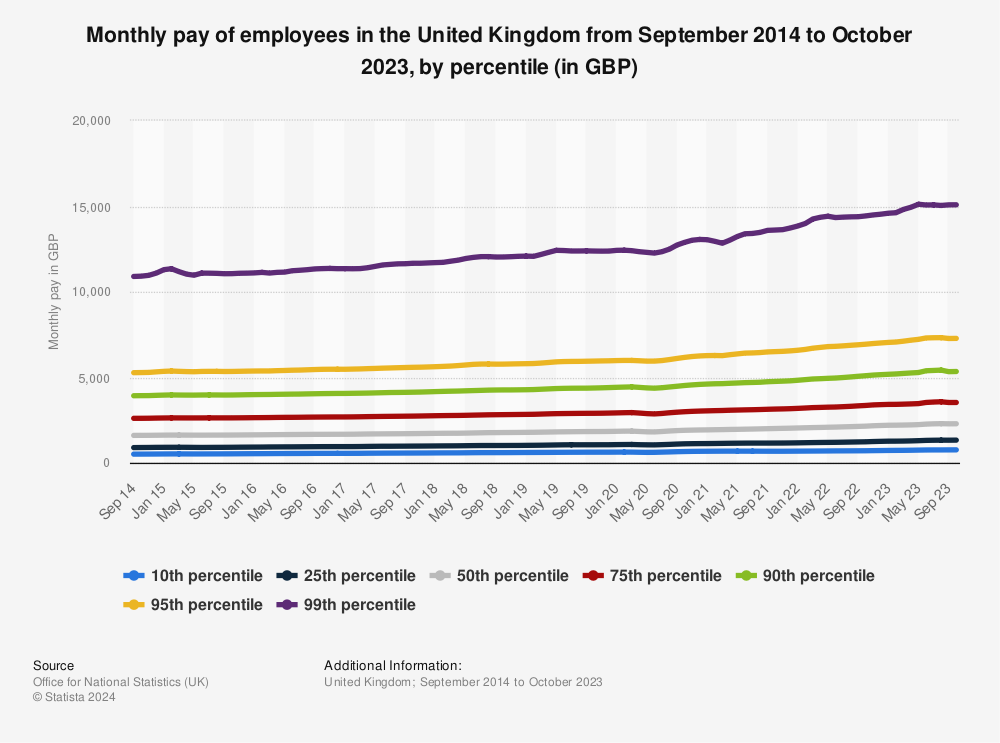

The Office of National Statistics and the Department of Work and Pensions publish annual breakdowns of people at various income levels. This helpful chart from Statista summarises the 2023 findings well.

Moving into 2025, here’s how it stands:

- Around 550,000 people in the UK have zero annual income, whether from a job, pension, or otherwise. Unemployment isn’t always bad – there can be many reasons to have zero income but still be secure – but it’s a significant figure to consider as it brings the averages down.

- The median income was £565 per week or £29,380 per year. Anyone making more than that per year (and this is net, not gross) is in the top 50% of earners in the UK.

- The top 5% earn £7,251 per month or more. That’s shockingly only £87,012 per year. Anyone making a six-figure salary is in the top 5%.

The difference between being in the top 5% and the top 1% is also pretty stark.

The 99th percentile averages at least double the cutoff for the top 5%, at £14,496 per month or £173,952 per year.

As always, though, raw data only tells part of the story. For example, this data from DWP is a sum picture of the whole population. Not many people under ten years old earn an income these days, but they factor into the data, being people who live in the UK.

Income and Tax Breakdown for Top 5% Earners in the UK

| Description | Amount (£) |

|---|---|

| Annual Income (Top 5% Earners) | 82,200 |

| Tax-Free Income Allowance | 12,570 |

| Income Taxed at 20% (Between £12,571 and £50,270) | 37,700 |

| Income Taxed at 40% (Remaining £31,930) | 31,930 |

| Total Income Tax | 20,312 |

| National Insurance | 6,389 |

| Take Home Pay (After Tax and National Insurance) | 55,499 |

Note: This table represents the tax breakdown for an individual earning £82,200 annually, which is the threshold for the UK’s top 5% of income earners.

Why UK Averages are So Low

If you’re shocked that the amount you need to earn to be in the top 5%, or even the top 1%, is so low, well, there are a few significant reasons.

One of the biggest reasons is a combination of the average standard of living and the taxes imposed on high earners in the UK. Current taxes are higher than they have been in decades (nearly a century), and a tax freeze means they’re forecast to stay that way for some time.

Now, taxes aren’t skewing the average as much as you might think. Instead, they’re a form of social pressure that has led to a mass exodus of high earners and millionaires choosing to abandon the UK rather than struggle in a less friendly environment.

Estimates for 2025 forecast that 3,200 millionaires would abandon the country, many leaving for locations like Dubai, Australia, the United States, and elsewhere.

Similarly, Brexit and its impact on the economy, politics, and the everyday citizens of the UK has dragged the averages lower. After all, when the media drops, so does the cutoff point for being in the top percentiles.

The economy never simply breaks down, and we aren’t economists.

Annual earnings for full-time employees in the UK in 2025 by region

Salaries in the UK also vary by region, reflecting the cost of living and economic activity in different areas. For instance, with its higher living costs, London shows higher average salaries across all age groups compared to other regions.

This regional variation highlights the importance of considering the cost of living when evaluating salary data.

You will see yearly salaries (in £’s) by hovering over the different region segments. It’s hardly surprising that the South East leads with an average annual wage of £36,560.

Average UK Salary By Age

The concept of average salaries in the UK varies significantly with age, reflecting career progression, experience, and changes in professional responsibilities.

Understanding these trends is important for employees and employers to know where they stand in the economic landscape and make informed career development and pay decisions.

Salary Progression from Youth to Retirement

Early Career (Ages 16-21)

The journey begins with the youngest working group (16-17 years) earning an average of £10,910, which slightly increases as they gain more experience and education. By 18-21, the average salary sees a notable jump to £17,284, indicating the impact of completing further education or beginning full-time employment.

Establishing a Career (Ages 22-39)

This phase marks significant growth. People aged 22-29 earn an average of £24,600, reflecting entry into more skilled and professional roles. The progression continues for those in the 30-39 age bracket, where the average salary rises to £30,865, often coinciding with peak career development stages.

Mid-Career and Beyond (Ages 40-59)

The 40-49 age group sees the peak average salary at £33,477. However, there’s a slight decrease for the 50-59 age group, with an average of £31,358, possibly due to some men and women starting to transition towards retirement or reduced working hours.

Approaching Retirement (Age 60+)

For those aged 60 and above, the average salary decreases to £27,508, which could be attributed to a move towards part-time roles or retirement.

Table: Average UK Salary By Age

| Age Group | Average Salary (£) |

|---|---|

| 16-17 | 10,910 |

| 18-21 | 17,284 |

| 22-29 | 24,600 |

| 30-39 | 30,865 |

| 40-49 | 33,477 |

| 50-59 | 31,358 |

| 60+ | 27,508 |

Income Vs. Buying Power

Another important aspect of high incomes is what it means.

Two people making the same amount of money can be in vastly different financial situations when one lives in a low-cost living area and the other lives in the centre of London.

Being in the top 5% isn’t astonishing wealth when most of that income goes toward rent and the cost of living. Worldwide inflation and price gouging across the board certainly don’t help.

Often, it’s not about how much money you make but how it’s used. If you’re over-spending on luxuries, even a high salary can feel like it can’t meet the basic needs of your life.

On the other hand, if you live well within your means and budget to save, you have more flexibility and comfort, even if you don’t have the most pleasing auto to drive.

Of course, there are always long lists of financial tips to make it feel like you’re a higher earner than you actually are.

Cutting back on the avocado toast, morning coffee, evening brews, and the like. It’s hard to consider these valid when you can look at global elites like Elon Musk’s antics or any time one of these people makes the news. You might wonder why they deserve it more than everyone else.

There are only so many ways to cut back on spending before inflation catches up, and you’re right back where you started, too.

Pushing for the 5% Cut Line

There are options for UK residents who are nearing the income levels necessary to reach the top 5% and decide to pursue them.

There are always options, whether it’s focusing on personal development, pushing for a raise in the next review with your boss, or taking on additional responsibility to encourage that raise.

And, of course, if your current career is a dead end, you can always switch. Unfortunately, the global culture of company loyalty to long-time employees has dropped precipitously over the years.

It’s generally most effective these days to switch employers every few years. Jumping from role to role, increasing job titles and compensation each time, is the fastest way to the top.

Then, there’s the option for additional income streams.

Whether you dig into investments (with the caveat that you never invest in something like Cryptocurrency or Options Trading with more than you can afford to lose), you pick up a second job, open up an online side hustle, or make the jump to building your own business.

Your only limitation is the number of hours there are in a day.

Top 5% Income Vs. Top 5% Net Worth

Here’s the big one: income only tells part of the story. Net worth means much more.

The data above shows that earning just £87,012 per year is enough to put you in the UK’s top 5% of income earners. But what about overall net worth?

When you sum up the assets you own, from your home and property if you own, your investments, pension, and other assets, how much do you need to possess to be in the top 5% wealthiest in the UK?

According to the Office for National Statistics, this cutoff is a lot higher. In order to be in the top 5% in terms of net worth, your total wealth must be at least £1,988,500 – nearly two million pounds!

To save up to two million pounds, when you earn that top 5% income of £87,012, you would need to save 100% of your income for nearly 23 years. That’s assuming that you somehow have zero expenses, which is wildly unrealistic for many.

Meanwhile, the top 1% net worth is even higher, at least £3.6 million.

Then you consider the billionaires. Even if you earn at the top 1% cutoff of £173,952 per year, earning a single billion dollars (again, with zero expenses) would take 5,749 years.

To a scale many people don’t realise, a billion is a lot of money. If it sounds unattainable to earn a million pounds, remember that a billion is doing that a thousand times over.

Top 5% Net Worth and Career Paths in the UK

| Category | Details |

|---|---|

| Top 5% Net Worth Threshold | £1,988,500 |

| Potential Career Paths | Medicine, Finance, Law, Corporate Executives, Entrepreneurship, Tech Industry, Professional Athletes, Entertainment Industry, Real Estate Development, Aviation, Engineering and Project Management, Sales and Commission-Based Roles, Consultancy, Pharmaceuticals, Digital Marketing |

Note: The net worth threshold represents the minimum value to be in the top 5% in terms of net worth in the UK. The career paths listed are examples of fields where individuals can potentially earn an income that places them in the top 5%.

Building Wealth and Preparing for the Future

One thing that often sets apart the top percentiles and the “regular” people is the ability to live and thrive simply off the dividends of investments and other forms of passive income and wealth.

Unfortunately, it’s all too common that the source of that wealth is generational. They say the fastest way to have a million pounds is to start with two million.

Many of the richest people in the UK and abroad aren’t rich because of personal effort.

They’re rich because of luck, being in the right place at the right time with the right connections to the right people, and, most importantly, because they have enough generational wealth to insulate them from their failures and allow them to pick up and keep going.

As one analogy puts it, if life is like a lottery, the people at the top can buy thousands of tickets to play, while the people in the middle can often only buy one or two, and the people at the bottom? They’re checking the numbers and don’t have time or money to purchase the tickets.

There are ways to build generational wealth. Of course, it revolves primarily around spending less than you earn, saving money over time, reinvesting not just in yourself but also in your wealth, and investing in your family.

Because, as the name implies, generational wealth is generational. You aren’t the one who will benefit from it.

Your children, and their children, and their children will. You do your best to start them on the path, set them up with the best resources and connections you can, and hopefully, instil in them the same attitudes towards the building rather than using that wealth.

Growing Generational Wealth with Life Insurance

There are many ways to build generational wealth and help support your family, particularly your children, in the future. Technically, any time you leave behind more than nothing, that inheritance – no matter how small – is some amount of generational wealth.

Truthfully, the most challenging part of building that wealth is not passing along assets and value to the next generation. It’s engraining the next generation with the same mindset, allowing them to keep the ball rolling rather than spending it and returning to a baseline.

All of that said, you can make more of an impact in some ways. Life insurance is one such way.

Life insurance is, on the face of it, quite simple. You apply for coverage from a life insurance provider. They offer you a policy that costs X amount of money and pays out Y when the conditions are met.

With life insurance, the X is generally relatively small; many policies are under £20 per month or £240 per year. Meanwhile, the payout they offer can be £100,000 or more; it’s not uncommon to encounter cover with a death benefit of over £1,000,000.

Indeed, many factors adjust this equation. The older you are, the more expensive your cover will be. If you’re in worse health, too, your coverage will be higher. The length of the term, or if you’re getting whole life cover, also makes a difference.

Term cover is often like gambling. You’re betting that you’ll pass away within the term; the life insurance company is betting that you won’t. If you pass away during that time, your designated beneficiary can claim the payout (often a life-changing amount of money for many).

As long as the benefit is paid out, you usually stand to gain more than you put in for the policy. A 40-year policy at £30 per month is a sum total of £14,400 (assuming a flat rate rather than adjustable rates) and is quite likely to pay out significantly more than £14,000.

Secure Your Family’s Future With Life Insurance Today

Don’t let life’s uncertainties catch you off guard. Protect your loved ones with a tailored life insurance plan from Insurance Hero. Get a quick, free quote in just minutes and ensure financial peace of mind for your family.

UK Salary Percentiles

UK salary percentiles describe how salaries are distributed across the workforce in the United Kingdom by dividing the population into 100 groups, from the lowest to the highest earners.

These percentiles are a statistical measure that helps to understand the spread of income levels among different segments of the working population.

By breaking down salaries into percentiles, analysts can provide a clearer picture of income distribution, identify income inequalities, and help people compare their earnings against broader market trends.

The concept of percentiles is central to understanding salary distributions. A percentile indicates the value below which a given percentage of observations fall.

For example, the 25th percentile (the first quartile) is the salary level below which 25% of the population earns.

Similarly, the median or 50th percentile divides the population into two halves, with 50% earning below this figure and 50% above. The 75th percentile (third quartile) is the salary below 75% of workers earn, indicating higher income levels.

In the context of UK salaries, these percentiles help to illustrate the range of earnings among workers, from the lowest-paid to the highest-paid.

They are particularly useful for various stakeholders, including:

- Employees: Individuals can use salary percentiles to gauge their income compared to others in the same field, region, or country. This information can be valuable during salary negotiations or when considering career moves.

- Employers: Companies can analyse salary percentiles to ensure competitive compensation packages. This can help attract and retain talent and maintain fairness and equity in pay structures.

- Policy Makers: Government officials and policymakers can use income distribution data to assess economic health and make informed decisions regarding minimum wage laws, taxation, and social welfare programs. Understanding how salaries are spread across the population helps address income inequality and poverty.

- Economists and Researchers: Salary percentiles provide crucial data for analysing economic trends, studying labour markets, and understanding the impact of economic policies on different segments of the population.

It’s important to note that salary percentiles can vary widely by sector, region, experience, and education level. For example, salary percentiles in the finance sector may be significantly higher than those in the hospitality industry.

Similarly, salary percentiles in London are typically higher than in other parts of the UK due to the higher cost of living.

UK salary percentiles are a valuable tool for understanding how salaries are distributed across the workforce. They provide insights into economic conditions, help individuals and employers make informed decisions, and assist policymakers in addressing socio-economic issues.

How many people under 30 are in the top 5 per cent of earners?

Of the top 5 per cent, less than 1 per cent are under 30. One of the good things about being under 30 is life insurance is very cheap!

High Net Worth Life Insurance for 2025

Smaller amounts of life insurance, like policies that pay out £200,000, are only suitable for families with an already significant net worth, older children, and a largely unencumbered family home.

Most people are advised to buy around ten years of gross earnings, so a parent that earns around £50,000 a year should have around £500,000 of life insurance cover.

The average cost of life insurance can vary significantly based on occupation, postcode, and smoker status.

For people with a significant income and a high net worth, life cover can be a better value than cover for smaller amounts.

The problem with high earners is that even though they are in the top 5%, they can often acquire illiquid assets.

An appropriately sized life insurance policy will protect the remaining family from having to liquidate illiquid assets at a potential discount.

Where to Find the Best Life Insurance Cover in the UK

Don’t get us wrong; life insurance isn’t the only way to build generational wealth. It’s perhaps not even the best way.

However, it’s one of many options available to you, and for a relatively low fee, you get both that option to build wealth and the peace of mind that if something unexpected happens to you, the people you love will be cared for.

We’re here for you if you’re interested in life insurance coverage. We’ve compiled a fast and easy quote process you can fill out here.

Add your details, and our insurance broker network will instantly return quotes.

It’s a straightforward way to shop across the UK’s best life insurance providers to compare quotes and find the cover that works for you.

Why not give it a try? It’s free, so nothing to lose but a minute or two of your time.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.