What Are The Differences Between Life Assurance And Insurance?

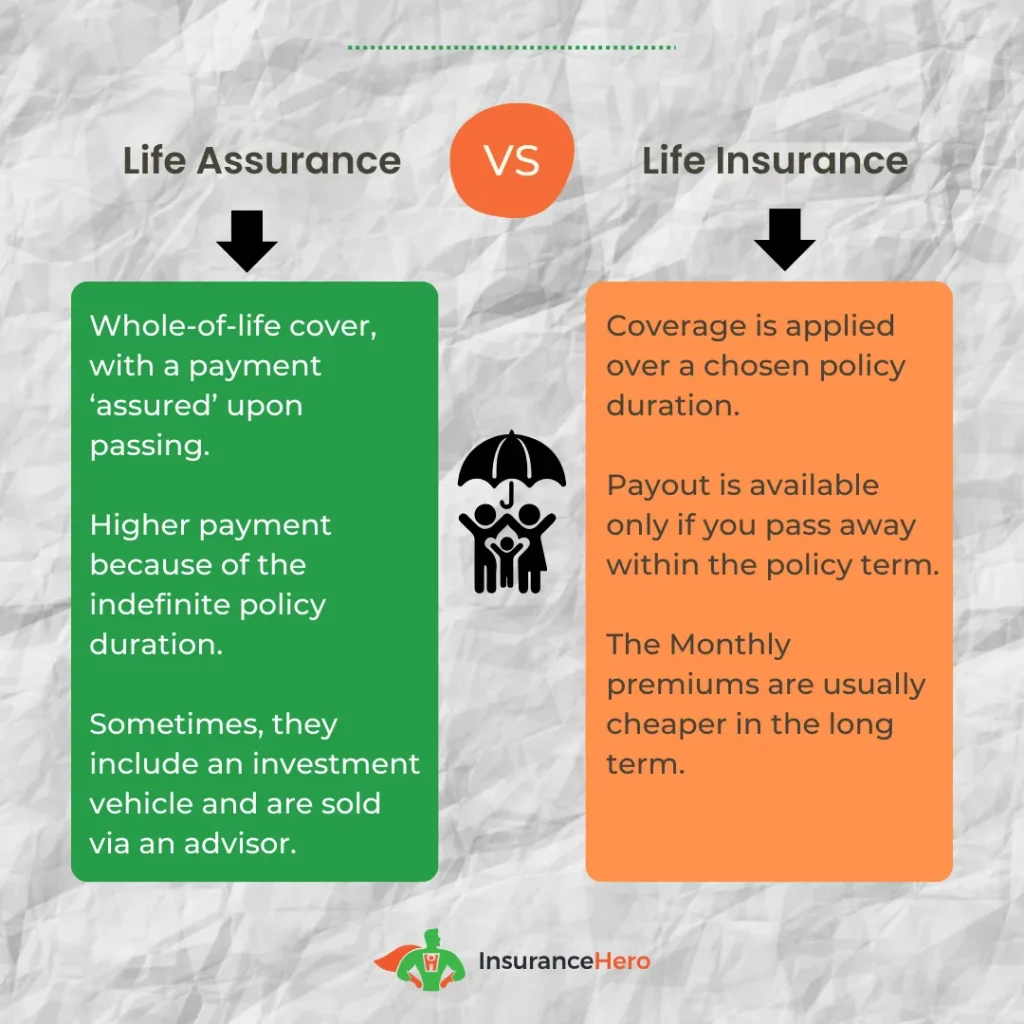

Life assurance sounds like life insurance, but it is not the same concept.

Both were created to relieve beneficiaries when an insured dies financially, but they have different features.

Life assurance has an investment value not possessed by life insurance. By becoming educated about these two kinds of cover, consumers avoid spending money on the wrong type.

Please complete the form below. Insurance Hero can help you decide which product best suits your needs.

Free No-Obligation Quote Form

Life Insurance Overview

Life insurance policies come in various forms, each offering different types of coverage to suit individual needs. The three main types of life insurance policies are level cover, increasing cover, and decreasing cover.

Level cover provides a consistent amount of coverage throughout the term of the policy.

With a level-term policy, the payout amount remains the same, ensuring financial protection for the policyholder’s loved ones in the event of their death. Increasing cover is designed to account for inflation over time.

As the value of money decreases over the years, increasing coverage adjusts the coverage amount to maintain its value. This helps protect the policyholder’s beneficiaries from the impact of inflation.

Decreasing cover is commonly used alongside a mortgage or other loans. It decreases coverage as the policyholder pays off more of their debts, aligning with the diminishing financial obligations over time.

Life insurance policies offer a range of benefits to policyholders and their loved ones. First, they provide financial protection to ensure that the policyholder’s family is cared for in the event of their passing.

This can include covering mortgage payments, household bills, and even additional childcare expenses. Life insurance can also provide the opportunity to leave an inheritance to loved ones, offering a legacy for future generations.

It is a way to secure and maintain the financial well-being of one’s family even after the policyholder can no longer provide for them.

Life insurance provides peace of mind by offering financial protection and the opportunity to leave a lasting legacy for loved ones.

Life insurance policies are not one-size-fits-all, as each person’s needs and circumstances are unique. The choice of the type of cover depends on factors such as budget, personal goals, and financial obligations.

It is important to carefully evaluate different life insurance policies and consult a financial advisor to determine the most suitable option. Insurance Hero can help answer any questions you might have.

By understanding the types of life insurance available and their benefits, individuals can make informed decisions to protect their loved ones and secure their financial future.

Below is a table summarising the types of life insurance and their key features:

| Type of Life Insurance: | Key Features: |

|---|---|

| Level Cover | Consistent coverage amount throughout the policy term |

| Increasing Cover | Adjusts coverage amount to account for inflation |

| Decreasing Cover | Reduces coverage amount as mortgage or loan is paid off |

Primary Considerations:

- Life insurance policies come in different types: level cover, increasing cover, and decreasing cover.

- Level cover provides consistent coverage throughout the policy term while increasing cover adjusts for inflation, and decreasing cover decreases as debts are paid off.

- Life insurance offers financial protection, mortgage coverage, payment of household bills, additional childcare, and the ability to leave an inheritance.

- Choosing the right life insurance policy requires careful consideration of personal circumstances.

Life Assurance Overview

Life assurance contains a guaranteed benefit amount and an unguaranteed investment. The value of the investment is determined by the policy’s number of in-force years, the guaranteed sum amount, and the investment performance.

If the individual insured dues during the assurance policy term, the amount paid to a beneficiary is the larger of the annual investment gains value or the guaranteed sum.

The value of the investment gains tends to increase the longer the life assurance policy is in effect. However, investment value decreases if the insured lives past the policy’s termination date.

In this case, the insured receives the annual gains plus a designated terminal payment.

Increases in investment value provided by annual gains permit cash-in of a life assurance policy via the insurance company providing it. However, a specialist investment broker may charge a higher price, and some of these individuals can be found online.

There have been significant declines in life assurance policy investment returns since the start of the financial crisis several years ago.

Another unattractive feature is that some insurance companies charge penalties for early cash-in of policies. These aspects have caused UK life assurance policy resale values to decrease. Recently, the market has started to improve, making life assurance a more attractive option.

In summary, life assurance is a form of insurance that covers the policyholder’s entire life. It offers a guaranteed payout to the chosen beneficiary upon the policyholder’s death, ensuring financial security for loved ones.

While premiums may be higher compared to life insurance, the lifelong coverage and guaranteed payout make life assurance an important investment for those who want to protect the financial well-being of their loved ones.

Deciding on Life Insurance Vs. Assurance

Life insurance premiums tend to be lower than life assurance premiums, and life insurance coverage may provide everything an individual needs. However, anyone interested in providing loved ones with a more significant benefit via an investment feature might want to consider a life assurance policy.

Insurance experts will describe both options and conduct a financial review to determine which policy suits the current and expected financial status.

New for 2025

Life insurance and life assurance are two distinct forms of protection that serve different purposes.

Life insurance provides coverage for a specific term and offers the advantage of affordability. It pays out a tax-free sum to the beneficiary if the policyholder passes away during the term, making it an essential tool for providing financial security to loved ones.

On the other hand, life assurance offers lifelong coverage and a guaranteed payout upon the policyholder’s death.

Although premiums for life assurance tend to be higher, lifelong coverage and guaranteed payout can be advantageous, especially for those with specific needs such as inheritance planning.

It is essential to consider personal circumstances and budget carefully when deciding which option is most suitable.

Whether you opt for life insurance or life assurance, both provide valuable protection and peace of mind. By understanding the differences between the two and assessing your individual needs, you can make an informed decision to ensure financial security for yourself and your loved ones.