What Happens When Family Members Do Not Provide Life Insurance Policy Details?

Families are social units, and they can reflect all of such groups’ positive and negative aspects.

While some families are characterized by open communication and transparency regarding all aspects of life, others rarely speak and are shrouded in secrecy.

Many families do not enjoy discussing life insurance because a policy is based on the expected death of the insured family member.

Therefore, many people purchase life cover and fail to tell other members of their family about it.

Secrecy Can Result in Problems

Understandably, talking about your death can be uncomfortable. However, providing family members with details regarding a life insurance policy is essential.

People designated as beneficiaries should be aware of their status, and they should be told whether the policy has been placed in trust to avoid inheritance tax and who the designated trustee is.

Family members should also be provided with the insurance carrier’s name and contact information so they know whom to contact to file a claim.

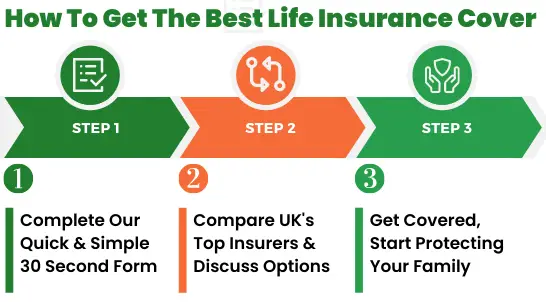

Protect The Ones You Love Today – Free No Obligation Quote

Beneficiaries may never discover that a life policy exists if these basic details are not provided. Many people store policy documents in folders or files with the rest of their personal paperwork.

Surviving family members can take months to review all of this information and determine what can be discarded and what requires action. In the meantime, they may struggle to make ends meet without realizing that money is available to them as a life insurance benefit.

Whether to Reveal Cover Amount

Many people have the most trouble discussing the cover amount of life insurance. Once they reveal this figure to someone else, they feel like it “puts a price on their heads.”

No one wants to be viewed as a personal bank account, so deciding whether to reveal the life cover figure to family members can be difficult. Think about how each beneficiary will process the information and how this news will impact family members who are not designated as beneficiaries.

When it comes down to it, whether to reveal this information is a personal decision. Some people feel more comfortable placing the policy document in a secure location, such as a safety box and providing each beneficiary with a key.

If a family member wants to explore the contents, he or she can; otherwise, the policy details will not be revealed until the insured dies.

Finding Life Insurance Policy Details After Death

Family members including Mums and Dads, who are unaware of whether a deceased had a life insurance policy, can take several steps to find out. Calling the current or former employer should reveal whether the individual had a group life policy.

A family member can contact the insurance company to find out whether this was converted to an individual policy. Reviewing cancelled checks and bank statements from at least the past year may reveal whether a check or electronic payment was made to a life insurance company.

Prospective beneficiaries should also contact creditors to inquire whether the deceased had credit or mortgage life insurance.

If it can be found, the mortgage insurance bill may also prove the existence of a mortgage life insurance policy. The local funeral home might have a copy of the policy if the funeral was prepaid. The Unclaimed Asset Register or Association of Financial Mutuals may also be able to help locate an insurance policy.