Life Insurance With Pre Existing Medical Conditions 2025

Do you have underlying health issues? Do you worry about what would happen to you or your loved ones if something happened to you?

Did you know that life insurance is still affordable even with pre-existing conditions?

Pre-Existing Medical Condition Life Insurance Benefits:

You should still consider getting life insurance for people with pre-existing medical conditions, as it may cost much less than you think.

Here are the top reasons to consider these types of policies:

- If a medical exam is needed for your application, some insurers can arrange and pay for it, making the process more convenient.

- If your condition leads to increased premiums, many providers still consider applications on a case-by-case basis rather than rejecting them outright.

- If you’re over 50, we can provide a policy that doesn’t require medical exams or health questions so that you can get coverage.

- Where traditional coverage isn’t an option, some policies exclude specific conditions, or slightly higher-priced plans include them.

Compare The UK’s Top 10 Insurers. Find The Best Policy & Save Money Today

Our 2025 Pre-Existing Conditions Insurance Study

Insurance Hero analysed 847 life insurance applications from individuals with pre-existing conditions between January and October 2025.

Here’s what our findings revealed:

The most common reasons for someone to be declined

- Insufficient medical records (34%)

- Multiple co-existing conditions (28%)

- Recent diagnosis (<6 months) (19%)

- Poor condition management (12%)

- Incomplete applications (7%)

Time for a decision to be made

- Simple cases (single well-controlled condition): 3-7 days

- Moderate complexity: 14-21 days

- Complex cases requiring medical reports: 30-60 days

Cost comparisons for £100,000 cover over a 25-year term, for a non-smoker aged 35

| Health Status Of The Individual | Monthly Cost (£) |

|---|---|

| No conditions | £8–12 / month |

| Well-controlled hypertension | £10–15 / month (+25%) |

| Well-controlled Type 2 diabetes | £12–18 / month (+50%) |

| Both conditions | £15–22 / month (+88%) |

Methodology: Data collected from applications submitted through the Insurance Hero platform and analysed in October 2025. The sample included applications to 12 UK life insurers. Percentages were rounded off to the nearest whole number.

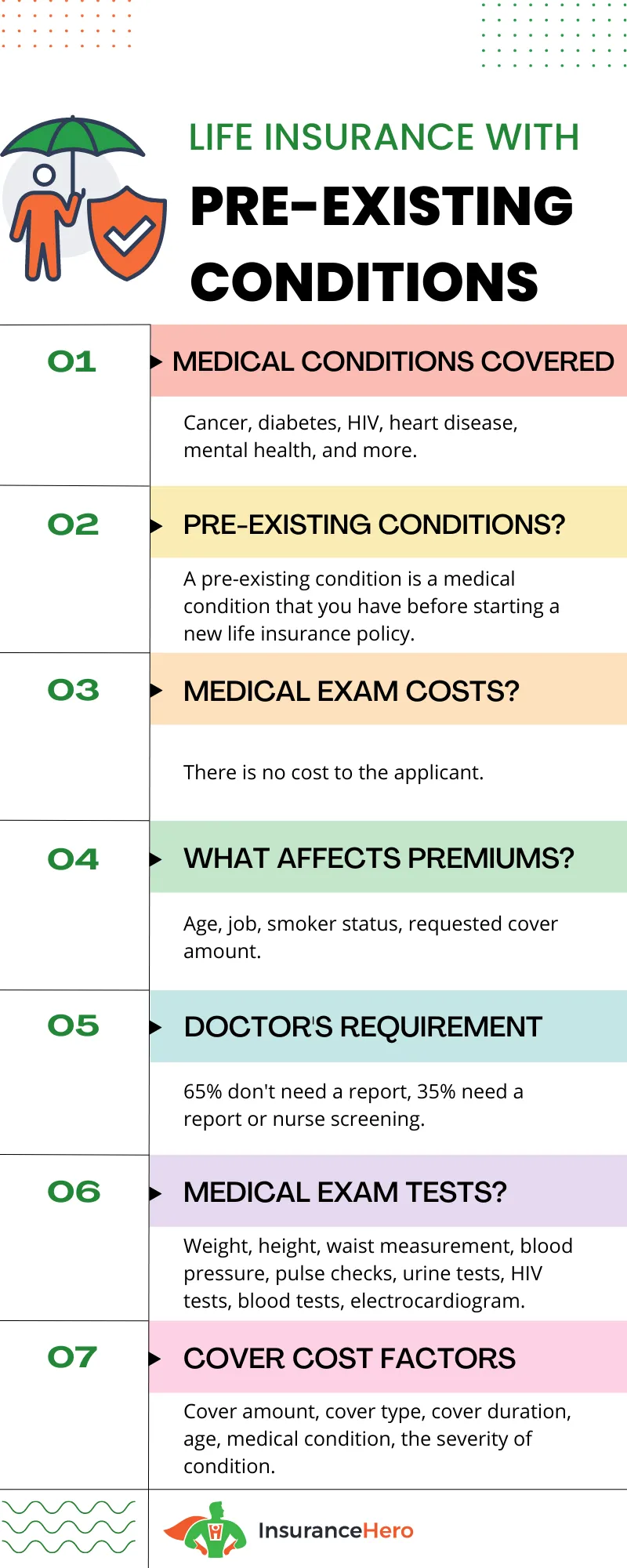

What Is A Pre-Existing Medical Condition?

Pre-existing medical conditions are a wide range of medical issues that already affect your life before you take out coverage and will affect the cost of life insurance to some degree.

A pre-existing health condition can include both life-threatening diseases, such as cancer, stroke or heart attack or manageable conditions that typically include but are not limited to the following:

- High blood pressure

- Diabetes

- Asthma

- Obesity

- Depression

- Epilepsy

- Smoker-related conditions

Manageable conditions may not necessarily impact the risk of you dying and may even see policy premiums at standard or close to standard terms.

Depending on the severity of a pre-existing condition, the life insurance provider may need to see your medical records, speak with your General Practitioner, and ask you to undergo a medical examination before they can provide a quote for life cover.

Insurance companies must fully understand the severity of your condition and its impact on your daily life to accurately implement a plan that closely aligns with your actual circumstances.

Life insurance with pre-existing medical conditions is a different process from traditional life insurance.

Applicants with a normal medical history are offered life insurance at standard terms through an online or voice questionnaire.

The insurance provider can quickly provide life insurance quotes without further medical consultation or examination.

According to NHS Digital’s Health Survey for England 2024, approximately 28% of adults have high blood pressure (hypertension), with many unaware of their condition. The British Heart Foundation notes that proper management can significantly reduce life insurance premiums.

What Do Insurers Think About Pre-Existing Conditions?

Life insurance providers base prices on how likely you are to make a claim. If you have a pre-existing medical condition, it can affect the life cover cost, depending on the severity.

Generally, the higher the risk of making a claim, the higher the insurance coverage. An insurance provider will calculate the cost using complex mathematical algorithms to provide a monthly premium.

Can You Be Refused Cover If You Have an Underlying Medical Condition?

In some instances, life insurance may not be offered to people with pre-existing health conditions due to the severity of the condition, and no insurance company is prepared to provide a quote.

However, using a specialist broker experienced in providing insurance to those with existing conditions can make a difference.

It can help with the quote process by ensuring accurate information and minimising the risk of underwriter rejection.

How Insurance Hero Can Help You

Insurance Hero is independent with experience providing life insurance with pre existing conditions in the United Kingdom.

As a specialist broker, Insurance Hero has relationships with underwriters who exclusively deal with people with pre-existing conditions, not generalist underwriters.

It means that Insurance Hero knows the life insurance application process for higher-risk life insurance intimately.

Through an extensive fact-finding questionnaire, Insurance Hero can provide specialist underwriters with the accurate information they need to move forward and give a quote that works in two ways:

Firstly, it allows the underwriter to accurately ascertain if they need to speak to a GP regarding your medical history and the level of medical examination you need to undertake.

Secondly, it allows the insurer to ensure that any life insurance policy with pre-existing conditions accurately reflects your circumstances. If you pass away, you must know that the document put in place is watertight and will payout.

Be Honest When Applying for Life Insurance with Pre-Existing Conditions

When answering a fact-finding questionnaire, you must answer any questions honestly to ensure a plan accurately reflects your circumstances.

Suppose you pass away suddenly, and it is found that your death results from an undisclosed pre-existing medical condition.

In that case, it may stop an insurance provider from paying out on a claim that may financially disadvantage your loved ones.

💡Need Help Understanding Your Options?

Based on the complexity of your situation, speaking with a specialist from the Insurance Hero team can help you:

- Identify insurers most likely to accept your application

- Understand what information underwriters need

- Receive accurate premium estimates

Please choose from one of the two options below:

What About Mortgage Life Insurance?

Life insurance is not a legal requirement to successfully apply for a mortgage. However, suppose you have a pre-existing medical condition.

In that case, you must consider how your dependents will pay the mortgage should something unexpected happen to you, especially if you are the breadwinner.

If a watertight policy is implemented, any lump sum payout can be used to pay off outstanding mortgage repayments, ensuring your family can live rent-free and have financial peace of mind.

What Happens If I Develop A Condition Once the Policy Has Started?

If you develop a medical condition once a life insurance plan has started, this will not affect the policy’s terms.

Suppose you were honest about any pre-existing medical conditions and developed an illness at the plan’s start. In that case, it will typically not affect the validity of your policy.

What Is the Best Life Insurance for Pre-Existing Medical Conditions?

Selecting the appropriate life insurance with pre-existing conditions coverage depends on your specific circumstances and what you are looking to cover.

There are many different elements in a life insurance policy, and we will look at those now so you can get a better understanding of how to select the right life cover. However, a proficient broker will also assist you with this.

Whole of Life Insurance

The most expensive type of life insurance is whole-of-life insurance, especially if you have a pre-existing condition.

The insurer will pay out under a policy when you die, as the insurance plan has no maturity date and is open-ended. As such, it is more expensive than a fixed-term policy.

It is crucial that when choosing a whole of life plan, you take it out as soon as possible, as the younger you are at the policy commencement, the lower the premium.

If you decide to take out this plan type in your forties or fifties, it can be a more expensive, albeit all-encompassing, insurance plan.

Fixed Term Insurance

Also known as term insurance, a fixed-term policy has a pre-decided duration, which may be anything up to thirty years, and may be aligned to a fixed-term financial obligation such as a mortgage.

A fixed-term insurance policy is much lower-cost than a whole-life policy. The downside is that no payout will be due should you die once the policy expires.

Over 50s plans – Life Insurance for Seniors with Pre-Existing Medical Conditions

When you reach fifty years old, it is still possible to submit a life insurance application for whole-of-life or term insurance, but it will become more costly due to an increased likelihood of you dying.

A lower-cost option is an over 50s plan.

The lump-sum payout of this product type is lower than that of other life insurance with pre-existing conditions policies.

It operates on a guaranteed acceptance basis, where you will automatically qualify for policy cover even if you have an adverse medical record.

No medical information, GP report, or medical examination is required for approval of this type of plan.

Any lump sum payout on an over 50s plan is rarely above £30,000, which is certainly not enough to pay off a mortgage.

Typically, this type of plan is used to pay off small financial obligations, such as personal loans and credit card balances. It is also often used to pay for funeral costs or give children or grandchildren a small monetary gift.

Family Income Benefit

A family income benefit plan works similarly to life insurance, providing financial cover if you pass away.

The critical difference lies in how the payout occurs. Whereas a life insurance policy pays out a lump sum upon the policyholder’s death, a family income benefit breaks the payment into monthly amounts, making budgeting easier than receiving a large lump sum.

Types Of Premiums

Life insurance is adaptable, as a policyholder’s circumstances, particularly those with pre-existing conditions, may change over the life of the policy.

Flexibility extends to the types of premiums available, including increasing, decreasing, or level cover.

Increasing cover

The monthly premium and the corresponding level of payout increase throughout the policy. The growth is in line with the UK government benchmark CPI index, a measure of inflation.

Selecting this premium option ensures that a payout will retain the same purchasing power at the end of a policy as it did at the start.

Decreasing cover

With decreasing cover, the life insurance premiums and the corresponding payout will decline throughout a policy.

This cover type is typically tied to a fixed-term plan that provides financial protection against a mortgage whose payments also reduce over time.

Level cover

With level cover, the premium and corresponding payout level will remain the same for the policy’s duration.

The disadvantage of this premium option is that the payout level may be small because inflation will erode it throughout the policy.

Associated Life Insurance Cover

Life insurance with pre-existing health conditions is a flexible type of coverage. It is often associated with other insurance policies that provide financial coverage, either as part of a broader plan or as stand-alone coverage.

Critical Illness Cover

Critical illness cover has a lengthy association with life insurance, often as an additional component within a policy.

Unlike life cover, you do not have to pass away, so you and your dependents can benefit from financial coverage.

To qualify for a payout, you must survive at least ten days from diagnosis of a qualifying illness and no longer be able to work.

Typically, a list of common qualifying illnesses is detailed at the start of a policy, but this can also be tailored to include other specific illnesses.

Standard conditions include, but are not limited to, the following:

- Parkinson’s disease

- Alzheimer’s disease or pre-senile dementia

- Systemic lupus erythematosus

- Multiple system atrophy

- Heart valve replacement or repair

- Loss of a hand or foot

- Structural heart surgery

- Heart disease

- Benign brain tumour

- Severe lung disease

- Coronary artery by-pass grafts

- Benign spinal cord tumour

- Traumatic brain injury

- Heart attack

⚕️ MEDICAL INFORMATION NOTICE

The medical condition information Insurance Hero provides on this page is for general educational purposes only and should not be considered medical advice.

For specific medical questions:

- Consult your GP or specialist

- Contact NHS 111 for health concerns

- Visit www.nhs.uk for trusted medical information

Life Insurance No Medical Exam Or Questions Required – 2025

Are you looking for a life insurance no medical exam policy? Did you know that in many cases, no medical examination is …

Is Life Insurance With A Heart Condition Possible?

Can I Get Life Insurance If I Have A Heart Condition Or A Stent? Providers typically ask detailed questions abo…

HIV Life Insurance Coverage – Compare Quotes In 2025

Many people think life insurance is unavailable to those suffering from HIV. The good news is that getting life insuranc…

Life Insurance For Disabled Adults And People In The UK

Insurance Hero has tried hard to find the best life cover for those with a disability in the UK. From that list…

Cancer Life Insurance And Critical Illness Quotes

When a medical tragedy strikes, knowing there is financial support for you and your family can bring a lot of relief to …

Anxiety Life Insurance Cover In 2025

In the UK, one in four people will experience some mental health issue each year, with the most common conditions encoun…

Best Diabetes Life Insurance Coverage 2025

Some people assume it is virtually impossible to secure life insurance with some pre-existing condition. This includes d…

Asthma Life Insurance Coverage Guide

Have you been suffering from Asthma and considering life insurance coverage? Maybe you’ve been turned down before and ar…

Life Insurance With High Cholesterol 2025

High cholesterol and high blood pressure affect almost 30 per cent of the population. If left untreated, these condition…

Life Insurance With High Blood Pressure – New Plans For 2025

Can someone with high blood pressure get life insurance? The simple answer is yes. We work with UK insurers that offe…

Epilepsy Life Insurance And Critical Illness Cover Guide

Pre-existing illnesses are more common now than a few decades ago. Insurance Hero is an insurance company speci…

Trusted High BMI Life Insurance For Overweight People In 2025

The average individual has a Body Mass Index (BMI) of 23. BMI is the measure of the ratio between height and weight. …

Do Any UK Companies Offer Female Cancer Life Insurance?

Cancer is a worldwide medical issue. More than 335,500 people in the UK will be diagnosed with cancer in 2025, according…

Trusted Life Insurance For Recovering Alcoholics In 2025

Life insurance is an essential product that helps individuals support their families, even when they are no longer aroun…

Cheap Life Insurance For Smokers 2025

Estimates in the UK still indicate over 9 million people smoke despite smoking restrictions in indoor public places. Smo…

Best Impaired Risk Life Insurance Cover In 2025

It is well-known that health status affects the premiums offered by most life insurance carriers. If insurance …

Best Bipolar Life Insurance Options 2025

According to Bipolar UK, an organisation that provides support for people affected by bipolar disorder, 1.3 million peop…

Life Insurance With Lupus What Are Your Options?

Are you living with lupus and worrying about how it affects your chances of getting life insurance? You’re not …

Life Insurance With Crohn’s Disease 2025

Crohn’s disease is one of the main inflammatory bowel diseases that affects 1 in every 650 people in the UK. …

A Guide To OCD Life Insurance In 2025

Navigating the world of OCD life insurance (Obsessive-Compulsive Disorder ) might seem challenging, but don’t worry – …

MS Life Insurance Multiple Sclerosis Life Cover

Insurance Hero offers MS Life Insurance plans that suit your lifestyle without restrictions. Individuals diagnos…

Is It Possible To Get Life Insurance After A Stroke?

Few things bring the fragility of life and the inevitability of mortality into focus quite like a major health event. …

Skin Cancer Life Insurance Cover, Is It Possible?

Cancer can be a devastating illness, and it can be difficult to discuss primarily because it’s not just one disease. …

Does Genetic Testing Affect Life Insurance Premiums?

A few decades ago, the idea of having your genetics tested was firmly in the realm of science fiction. Then, in 1990, a …

Low BMI Life Insurance Cover For Underweight People

You can often secure life insurance coverage even if you are underweight or have a low BMI. Many insurance companies …

Menopause Life Insurance And How To Get Cover

Life insurance is increasingly important as you age. Still, it’s common knowledge that getting good life insurance cov…

Research Sources:

- Can you get life insurance with a pre-existing condition in the UK? (Aviva)

- What are the most common pre-existing medical conditions covered by life insurance? (L&G)

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.