Affordable Income Protection Insurance For Dentists 2025

Are you a self-employed dentist or one working for the NHS? Do you worry about what would happen financially to you and your loved ones should you be unable to work?

This income protection insurance for dentists guide clearly explains, step by step, what you need to know about Income Protection and why it is essential. Read on to learn how income protection can help you.

About Dentists Income Protection Cover

In return for a regular monthly payment, income protection for dentists pays a replacement monthly wage should you be unable to do your job due to accident, injury, or illness. It will protect you until you can return to the workplace.

The Key Benefits of Income Protection

Income protection is a type of insurance that every dental practitioner should at least take into consideration, as there are essential advantages:

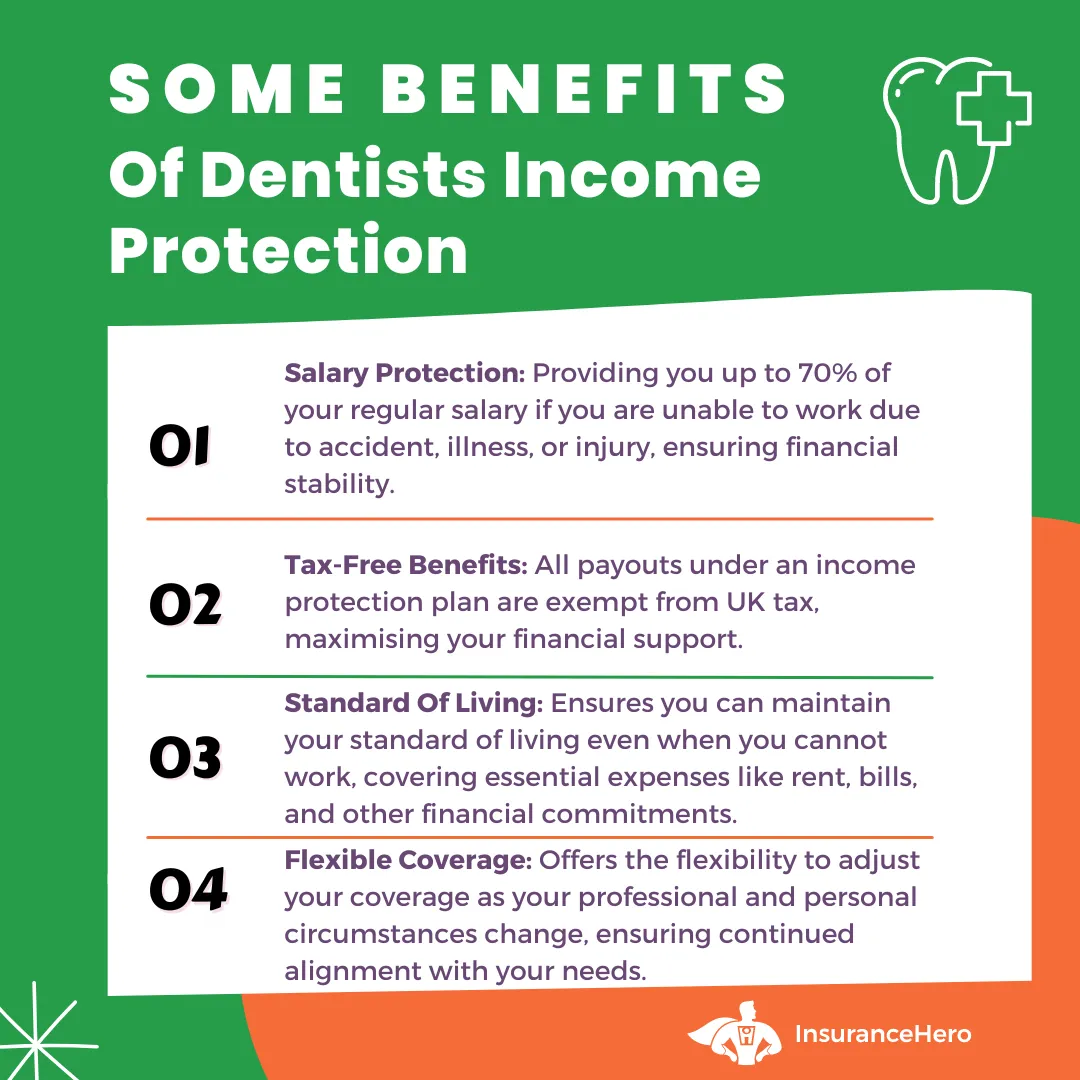

- Due to a replacement salary, your standard of living stays the same even if you are not able to work

- Any benefits paid out are free of any UK tax

- Depending on the length of the claims period, you can continue to receive payments until you return to the workplace, retire or die

- You can insure up to a level of between 60 and 70% of your gross salary if you are an employee (or 60% to 70% of net profit for the self-employed)

- Income insurance can be flexible and changed to suit your evolving personal and professional situation

Get Income Protection Quotes From The UK’s Top Companies

Why do Dentists need Income Protection?

Like many other professions, dental practitioners may be unable to work for a sustained period due to industry-specific injuries.

Dentists are more likely to develop musculoskeletal disorders. Research undertaken by Brown et al. in 2010 focused on why dentists retire through poor health.

Musculoskeletal disorders are the reason cited by 55% of dental professionals surveyed.

Regarding specific injuries, a study by the PMC of work-related musculoskeletal disorders in dentistry practitioners found the most common injuries suffered include:

- Neck and shoulder pain – caused by an unnatural head position when attending to patients

- Back pain – Injury caused by improper posture and repetitive strain

- Hand pain – caused by repetitive stress, such as hand pressure when scaling and polishing

High stress is another factor affecting dentists. There is evidence that the profession is associated with a high level of job stress caused by the heavy workload from running behind schedule and dealing with anxious patients.

Is Dentist Income Protection Appropriate for Your Situation?

Whether you are single or have a family with children, your immediate thoughts should be: If illness means you cannot do your job, can you pay your bills and financial commitments?

In deciding whether income protection is appropriate for you, take into consideration:

- Financial Commitments – Do you have substantial mortgage or rent payments, personal loans, car loans, overdrafts, equity release, school fees or household bills? Can you keep paying these if you are not able to work?

- Savings—If you have substantial savings, you may be able to live without a salary for a time. Will your savings last a year or more?

- A Supporting Partner – If your other half works and can sustain the family if you cannot work, then perhaps you can afford to maintain your typical day-to-day living

Depending on if you are self-employed in private practice or a dentist working for the National Health Service has additional considerations over your situation:

Income Protection For the Self-Employed Dentist

Dentists who work in or own private practices have a self-employed arrangement in place.

A self-employed dental practitioner working at a practice without being an owner should opt for standard insurance protection.

Dental owners who typically own a practice through a limited company may want to consider dentist income protection for company directors.

It differs from standard income protection insurance as it considers dividends and salaries paid through the limited company.

If you are unemployed for a period without insurance coverage, your financial fallback is the UK Government sickness benefit. It is less than £100 per week and is payable for a maximum of 28 weeks. It is not an option for many who want to maintain a fraction of a lifestyle.

Protect Your Income Today. No Obligation To Purchase. Dentist Income Protection

Income Protection For the NHS Dentist

NHS dental employees benefit from better salary protection from their employer should they not be able to work.

Depending on the length of service, an employee with more than five years of service would expect to receive a full twelve months of sick pay, full pay for the first six months and half pay for the final six months.

This means that income protection for dentists can be offset against the employer’s sick pay period. Effectively, the deferred period in the insurance coverage could start a year after an application for a benefit takes place. It helps reduce the cost of the monthly payment into the plan.

How Can Insurance Hero Help?

Insurance Hero is a broker and expert at providing plans for self-employed dentists in private practices and public sector employees.

We have relationships with an extensive network of underwriters. What sets us apart, though, is our thorough fact-finding process.

We understand the dental profession and will work with you to create a tailored package aligned with your professional and personal needs.

How Does Income Protection For Dentists Cover Your Employment?

When you set up your plan with your broker, you want to ensure it will pay out if you cannot function due to your professional dental activities.

Ensure that your insurance professionals or brokers include dental-specific definitions within the cover. If your broker is a generalist, you must consider these specifics.

We recommend setting up your plan with an adviser or broker specialising in providing an accurate dental income protection assessment.

Contact Insurance Hero, which specialises in delivering competitive, tailored quotes to the dental industry. Call our professional and friendly team of brokers today on 0203 129 88 66 for a no-obligation quote.

The key elements – What you need to know

Many different features, both standard and optional, can be tailored to your current or predicted future situation. You should be aware of these before you enter discussions or take out insurance.

- Flexible Cover

Before you take out insurance, you can decide how long before a pay-out occurs should you not be able to work or when you want your replacement salary payments to begin.

- Variable or fixed benefits

Depending on your professional and personal circumstances, you can choose whether you want your payments to increase, decrease, or stay on hold.

- The Deferred Period

When setting up your insurance, you will conduct a thorough fact-finding exercise with your insurer. It will advise you on tailoring everything to your personal and professional needs.

One area that needs to be adapted is the deferred period.

It is the gap between when you make a claim and when the replacement salary kicks in. If you are not self-employed, it can vary from the next day to one year and be tied to match your employer’s sickness terms and conditions.

- The Sum Assured

The sum assured is the salary you would receive should you submit a qualifying application for benefit due to injuries or illness.

Policies will typically not exceed 60% to 70% of your previous wage to encourage a return to the workplace. It is up to you to select how much of your salary you want to pay. The higher the salary to be covered, the higher the cost.

- The Cease Age

It is merely the age you will be at the plan’s maturity. It is standard practice to align this with your retirement date. The older you leave it to retire, the higher the premiums will become.

- The Length of Claims Period

When you take out insurance, you need to decide whether you want it for a shorter duration of up to 5 years or a longer duration that will protect you until retirement.

Short-term cover limits the payout duration. Popular protection durations are between one and five years, and there is usually a cap.

Long-term cover: This protection is more expensive in terms of monthly cost but will provide you with a monthly salary either until you can return to paid employment or until retirement if you can never operate again in a dental practice.

Like most other professionals, Insurance Hero recommends a long-term policy. Statistics undertaken in the UK indicate that the average claim length is over seven years, significantly more than the five-year cap on short-term protection. Cheaper is not always better.

Understanding Indexation and Premiums

Indexation is the possibility of tying your protection plan with movements of the Consumer Price Index (CPI), a measure of inflation used by the UK government.

There are three types of cover associated with indexation:

- Increasing

The level of premium and subsequent replacement salary will rise in regular increments, tracking movements in the consumer price index. This type of cover is also known as Index-Linked Cover.

- Level

With level cover, the premium and subsequent replacement salary will stay the same throughout the plan duration.

- Decreasing

This type of protection is typically associated with an expected reduction in outgoings, such as mortgage payments.

A premium is a monthly payment paid throughout the fixed-term duration of the cover, and an underwriter calculates this value.

There are three options for the ongoing premium which you pay every month:

- Age-banded

It works to increase the monthly payment amount due as the policyholder gets older and a higher associated risk of older people going on to make an income protection request for benefit.

Age-banded premiums are typically cheaper at the outset, increasing incrementally over time.

- Guaranteed

The underwriter cannot change the monthly payment due throughout the duration of the plan. This is guaranteed unless the policyholder makes changes to the policy.

Guaranteed premiums can be a cost-effective option over the policy’s term, particularly if taken out when the policyholder is young with no underlying medical conditions.

- Reviewable

A reviewable premium means the underwriter can review the level of protection at any time. This might be due to unforeseen circumstances increasing claims.

It allows the underwriter to adjust the monthly payment amount. Despite starting at a better value over a policy’s lifetime, a reviewable option tends to be more expensive due to periodic upward revisions.

What Is Covered Under Income Protection?

As mentioned, dental income protection pays out if you are not working due to becoming ill or suffering an accident.

Being unable to do your job is defined differently by different underwriters but can include any of the following:

- Inability to undertake any type of paid employment

- Failure to carry out your actual job

- Failure to do your job or one that you are similarly qualified to do

Dentist sickness insurance that provides cover if you cannot do your actual job will always be the most expensive coverage, unlike being unable to do any job.

Specific policies will make what is known as a proportionate payment. It will top up earnings if you return to full-time employment but in a lower-paid job.

Not Covered

Most policies do not payout as long as you receive a full salary, and all plans limit the claim amount to ensure that you do not make a profit.

As previously mentioned, the maximum coverage provided is 70% of the actual salary.

Insurers will not pay out if you cannot work due to any of the following:

- Existing medical issues that you had before taking out protection. These are also known as pre-existing medical conditions

- Inability to do your job due to drug or alcohol abuse

- Participation in extreme sports or activities that did not form part of a list at the policy’s outset

- Childbirth and pregnancy

Additional features that provide Further Cover

Further income protection features, both standard and optional, that you and your broker or advisers should be aware of include the following list:

- Childcare benefits

This feature will pay a set amount for each of your children when you are not working. It helps with further childcare costs you may face not working, including a live-in nanny or additional child-minder requirements.

- Specified trauma or injury benefits

You are entitled to an additional payout if you get a specific illness or injury listed on your policy under this inclusion. It is typically a regular payment topping up the standard monthly replacement salary but can sometimes be paid out as a one-off lump sum.

- Death benefits

Taking out this option will allow your dependents to receive a lump sum payout should you die while receiving income protection benefits. It should be noted that if an accident or injury proved fatal at the time, a payout might not be due.

- Pausing or freezing your policy

Policies cannot pay out a portion of your salary if you are not working when an incident happens. In the event of unemployment, it is often possible to freeze your plan until you return to employment.

- Involuntary Redundancy

It is often possible to include an additional option in an income protection policy to cover involuntary dismissal. You can discuss the policy terms with your adviser when deciding on them.

- The Claims Process

You have made the right choice by having an income protection for dentist plan in place, but what is the claim process if you suddenly find you cannot keep working?

How to make a claim

- Contact your insurance broker by phone, email or correspondence and ask for an application form.

Required Information

- Return the completed form together with the requested information, which will typically be:

- A GP or Specialist medical report of your condition

- Financial information, including payslips and P60 for employees and tax returns and accounts for the self-employed, including limited companies

How A Claim is Assessed

- Your insurer will review if your current circumstances meet the policy definitions

- The payable benefit is typically tied to your salary when you were working, and the maximum payable amount is in the policy documentation. It may be lower should your salary fall once a policy is in place

- You must keep paying your premiums until your insurer has contacted you

Once a claim has been accepted

- Your insurer will confirm payment details and when you should expect payment

- The benefit application periodically reviews while you are not working

Call today for an income protection quote and your coverage options. Our friendly team of brokers only provides watertight protection products so you can receive income when needed. Phone Insurance Hero, your professional dental insurance company, on 0203 129 88 66

FAQs About Income Protection for Dentists

Can any dental professional apply for income protection?

Any dentistry practitioner can apply for cover, irrespective of whether you operate as self-employed in private or public practice.

The criteria for applying for plans are:

- You are aged 16 or over

- Not older than 63 when completing an application form

- You have a UK Building Society or Bank account

- You have a registration with a UK medical practice for at least three years

- Are currently subject to the payment of UK income tax

As a dentist, how much will cover cost me?

Numerous factors will affect the monthly payment you will make. These include, but are not limited to, the following:

- Will you be taking out short-term or long-term cover?

- How long do you want the length of claim period to be?

- How old are you, and do you have any underlying medical conditions?

- What percentage of your salary do you want to include under the policy?

- Do you want indexation in your policy?

- Do you want the policy to cover an inability to do your specific job or to include any job?

How much of my income is covered?

For both a self-employed and employed dentist, the maximum amount of coverage is 70% of your regular gross income.

You can choose less than 70% to keep your monthly payment down. A coverage cap encourages claimants to return to the workplace, which may be more challenging if the salary is paid at 100% within the insurance coverage when they are unable to keep working.

It should not put you in a better financial situation than if you had never made a claim and were working.

Will I be able to find competitive quotes as an NHS dental professional?

For public sector dentists, premiums can be tailored around the NHS sick pay scheme. Typically, this will reduce premiums to less than for a comparable dental professional working in the private sector.

As mentioned in the article, public sector dental employees who have worked more than five years in the organisation will be covered to a varying level for up to one year if they cannot undertake their job.

For more information on the NHS statutory sick pay, please refer to Section 14 of the National Health Service terms and conditions of service handbook.

Can I receive other claim money besides my income protection dentist plan?

This is fine if the total income received from different sources does not exceed 75% of your pre-claim income.

You will be unable to receive more than 75% of your monthly income, such as other injury or sickness benefits from other claim sources.

Can I make policy changes once I take out insurance cover?

Personal and professional needs tend to change. Salaries may increase, more children may become part of the household, or a mortgage may be repaid—the list is endless.

It is common sense that you can increase or decrease the level of your income protection to match your changing circumstances.

Other Pages Of Related Interest:

- Income protection cover for the self employed

- Income protection guide for Doctors

- Income insurance for Vets explained

- Contractors income protection for UK residents

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.