Income Protection Insurance For Social Workers

Social Workers Income protection insurance can cover 60-70% of a social worker’s monthly income. This provides a tax-free safety net in case of unexpected illness or injury.

Social workers face unique risks that can threaten their financial stability if they are unable to work. This insurance is vital for social care workers.

Social workers support vulnerable individuals and communities, but who helps them when they face challenges? Income protection insurance for social workers offers a monthly sum of around 60-70% of their regular income.

This helps cover essential expenses like mortgages and bills during tough times. It’s key for self-employed or agency workers who might not have the same benefits as permanent staff.

Social Worker Income Protection Insurance In Summary:

Insurance Hero can help you find the most complete and cost-effective income protection policies perfectly matched to your needs.

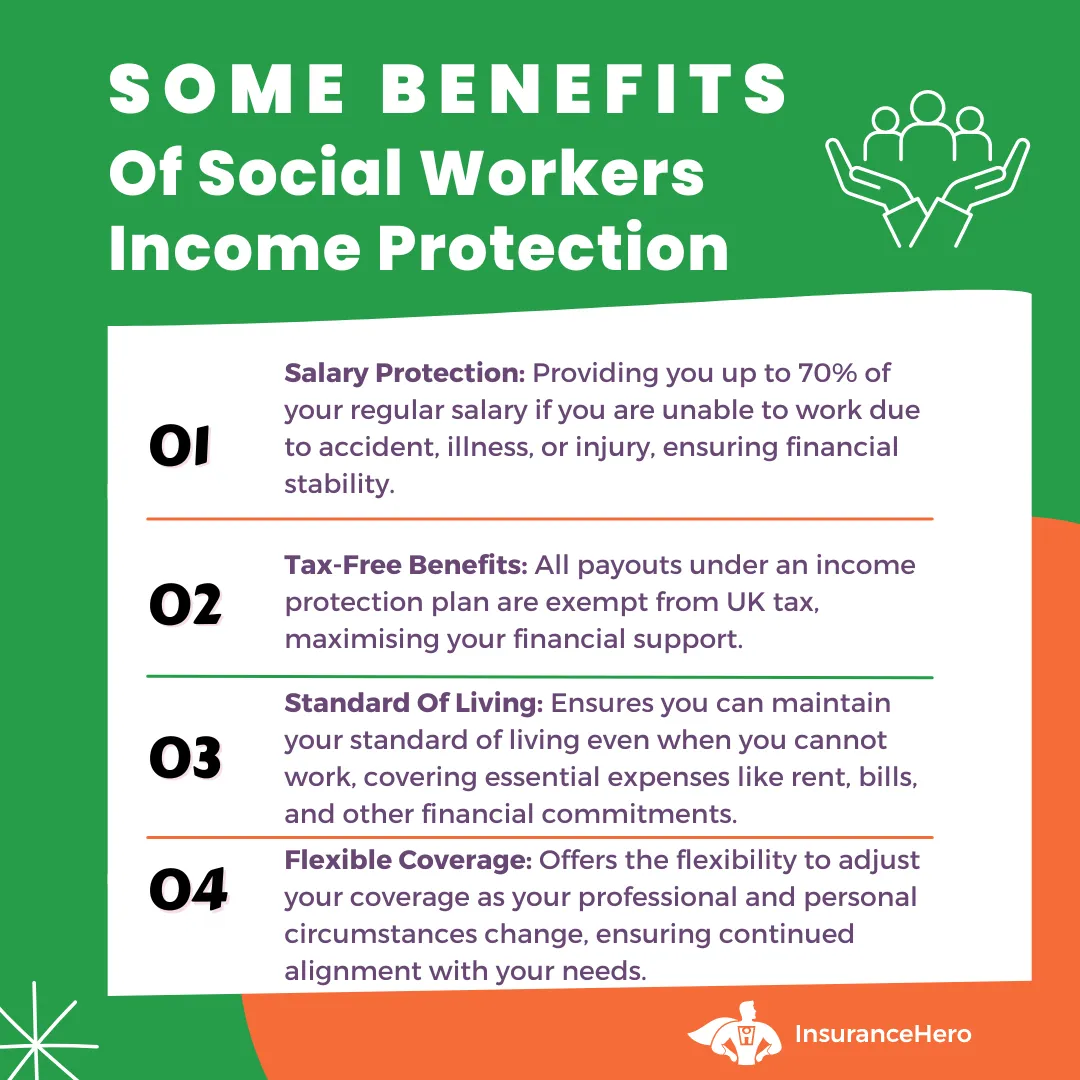

Here are some reasons why you should consider taking out the cover:

- Deferred periods for pay-outs vary from 4 weeks to 2 years, with common options at one month, two months, six months, and one year.

- An income protection plan can be customised to provide financial support until you can return to work or, if necessary, until retirement age.

- Securing a replacement income allows you to maintain your lifestyle until you can re-enter the workforce.

- These policies offer adaptability, enabling ongoing modifications to match your career and personal life changes.

- Comprehensive income protection policies can cover accidents, sickness, and unemployment, providing a robust safety net for social workers.

Social Worker Income Protection Insurance From Top UK Companies. Quick Form. Start The Process Online

Why Social Workers Need Income Protection

As social workers, you help others every day. But it would be best if you also looked after yourselves and your families. Income protection is key, offering a steady income if you can’t work due to illness or injury. It’s a safety net that keeps our finances secure, even when things get tough.

Risks Faced by Social Workers in Their Line of Work

Social work is tough and unpredictable. You face many risks, such as:

- Aggressive or violent service users

- Exposure to infectious diseases

- Stress and burnout

- Physical injuries from lifting or assisting clients

- Car accidents while travelling for work

These risks show why a strong income protection plan is vital. A study revealed that 8% of workers were off work for more than two months due to illness or injury in the past three years.

Another 6% were off for over eight weeks due to mental health issues. As social workers, you’re not safe from these challenges. That’s why you need the right insurance to protect your income.

Consequences of Being Unable to Work Due to Illness or Injury

Being unable to work due to illness or injury can be a big problem. Many of us, especially those self-employed or contract workers, don’t have sick pay or long-term disability benefits. This means you might struggle to pay your bills or support your family if you can’t work.

This situation is especially tough for those with dependents, such as children or elderly parents. You might have to use your savings, take on debt, or sell your assets without a steady income.

Income protection can help by providing a significant part of your regular income. This way, you can keep your standard of living and focus on getting better without worrying about money.

Income protection is crucial for social workers. You face unique risks and severe consequences if you can’t work. Choosing the right critical illness cover or income replacement plan protects your finances and supports you during hard times.

| Consequence | Impact |

|---|---|

| Loss of income | Inability to cover living expenses and bills |

| Depletion of savings | Reduced financial security for the future |

| Increased debt | Higher stress levels and difficulty in debt repayment |

| Selling assets | Loss of valuable possessions or investments |

What is Income Protection Insurance?

Income Protection Insurance, also known as salary protection or long-term sick pay insurance, helps people who can’t work due to illness, injury, or disability. It’s especially useful for social workers and those in the care sector. It gives them financial support during these tough times.

Definition of Income Protection Insurance

This insurance policy pays a regular, tax-free income if you’re out of work due to illness, injury, or disability. It covers up to a certain limit of 50% to 70% of your pre-tax income. Payments continue until you can work again, retire, pass away, or the policy ends.

It’s different from Critical Illness Insurance, which gives a one-off payment for certain serious illnesses. It’s not the same as Payment Protection Insurance (PPI), which covers specific debts like mortgages or loans.

How Income Protection Insurance Works

When you get an Income Protection Insurance policy, you pick how much coverage you need based on your income. You also choose a waiting period before you start getting payments. The longer you wait, the cheaper your premiums will be.

If you can’t work because of illness, injury, or disability, you’ll need to make a claim. You’ll provide medical evidence and proof of your income. After your claim is approved, you’ll start getting monthly payments after the waiting period.

| Factor | Impact on Income Protection Insurance |

|---|---|

| Age | Premiums increase with age as the likelihood of making a claim increases |

| Occupation | Premiums are higher for jobs seen as more risky |

| Level of Cover | The higher the percentage of income covered, the higher the premiums |

| Deferral Period | Longer deferral periods result in lower premiums |

| Policy Term | Longer policy terms typically result in higher premiums |

Getting payments from an Income Protection policy might affect your state benefits. It’s key to get advice to pick the right policy for your situation as a social worker or care sector employee.

Types of Income Protection Insurance for Social Workers

When looking into income protection insurance as a social worker, it’s key to know the different types of policies out there. This ensures you pick the right one for your needs. There are two main types: individual and group policies. Each has its own benefits and things to consider.

Individual policies, also known as personal income protection or salary safeguard for social service employees, offer financial support if you can’t work due to illness, injury, or disability.

You can tailor these policies to fit your needs, choosing the coverage level, waiting period, and benefit duration. These policies are great for self-employed social workers or those without group coverage from their employer.

On the other hand, group policies are offered by employers as part of their benefits package. They’re a cost-effective way for social workers to get income protection, with lower premiums, because many employees are covered together. However, group policies might not offer as much customisation as individual ones and might not cover as much.

When picking an income protection policy, consider the definition of disability, how much of your income is covered, and when benefits start. Social workers are in Class 3 for income insurance, which means they’re moderate manual workers. This affects how much you’ll pay in premiums, with higher classes paying more because of the risks involved.

| Policy Type | Benefit Period | Percentage of Income Covered | Waiting Period |

|---|---|---|---|

| Low-Cost Income Protection | Up to 2 years | 50-60% | 4, 13, or 26 weeks |

| Standard Income Protection | Until retirement age | 50-70% | 4, 13, 26, or 52 weeks |

| Comprehensive Income Protection | Until retirement age | 50-70% | 4, 13, 26, or 52 weeks |

Income protection policies also limit how much you can claim based on your annual income. As of 2025, social workers can’t claim more than 70% of their annual income under these policies.

The choice of income protection insurance for social workers depends on their situation, budget, and how much financial protection they need. You can ensure you have the right insurance by looking at all your options and talking to an insurance expert like Insurance Hero. This will protect your income and give you peace of mind if you face illness or injury unexpectedly.

Key Considerations When Choosing an Income Protection Policy

As frontline care workers, ensuring income continuity and financial resilience is vital if things don’t go as planned. When picking an income protection policy, think about several key factors. These can greatly affect how much earnings assurance you get as a public sector care worker or community support professional.

Waiting Periods Before Benefits Kick In

The first thing to look at is the waiting period, also known as the deferred period, before you start getting benefits. Depending on the policy, this period can range from four weeks to two years. Longer waiting periods mean lower premiums. When choosing a waiting period, consider your finances and how long you can go without income.

Length of Benefit Payout Period

Another important factor is how long the benefit payout lasts. Policies can offer short-term or long-term coverage. Short-term plans pay out for a limited time, like one, two, or five years, and are cheaper than full-income protection policies. Full policies, however, can pay until you retire or return to work, giving more financial security to community support workers.

Percentage of Income Covered

Income protection policies usually cover a part of your pre-tax earnings, between 50% to 70%. It’s key to consider your financial needs and lifestyle to see what coverage is right for you. Remember, higher coverage means more income continuity but also higher premiums.

Premiums and Affordability

For frontline care workers, the cost of income protection premiums is a big deal. Premiums change based on age, health, job, and coverage level. As a social worker, your job is like a teacher’s, which can slightly affect your premium rates. To keep premiums affordable, get income protection when you’re younger and healthier, as it’s cheaper.

| Policy Feature | Consideration |

|---|---|

| Waiting Period | Four weeks to 2 years; longer periods mean lower premiums |

| Benefit Payout Period | Short-term (1-5 years) or long-term (until retirement/return to work) |

| Percentage of Income Covered | Typically, 50% to 70% of pre-tax earnings |

| Premiums | Based on age, health, occupation (Class 3 for social workers), and coverage level, it is more affordable when younger and healthier |

By looking at these key points and matching them with your situation, you can find an income protection policy that gives you the best income continuity and financial security. This is crucial for dedicated public sector care workers or community support professionals.

How to Find the Best Income Protection for Social Workers

As a social worker, it’s vital to have income protection insurance. This ensures you’re financially secure if you can’t work due to illness or injury. With many options out there, finding the right policy can be tough. We’ll guide you on comparing policies, working with financial advisors, and meeting professional requirements.

Comparing Policies from Different Providers

When looking for income protection, compare policies from various providers. Look at what income is covered, waiting times, and payout periods. Choose policies that cover up to 65% of your first £15,000 earnings and up to 55% of the rest, up to £250,000 a year.

Also, consider the extra benefits each provider offers. Some policies include a Waiver of Premium (Sickness) benefit if you’re out sick. Others offer well-being support, health club discounts, or mental health apps to stay healthy and stress-free.

| Provider | Coverage | Waiting Period Options | Additional Benefits |

|---|---|---|---|

| Aviva | Up to 65% of the first £15,000 of pre-tax earnings, up to 55% of the remainder (max. £250,000/year) | 4, 8, 13, 26, or 52 weeks | Waiver of Premium (Sickness), Helping Hand support service, Get Active discounts, DigiCare+ Workplace app, Thrive mental health app, Red Apple Law legal services, Employee Assistance Programme, Wellbeing Training courses, Wellbeing Library |

| Legal & General | Up to 60% of gross earnings (max. £240,000/year) | 4, 8, 13, 26, or 52 weeks | Rehabilitation Support Service, Nurse Support Services, HR Communication Toolkit, Employee Assistance Programme |

| Unum | Up to 60% of gross earnings (max. £300,000/year) | 4, 8, 13, 26, or 52 weeks | Rehabilitation Services, Employee Assistance Programme, Wellbeing Resources, Mental Health Pathway |

Working with a Financial Advisor Specialising in Insurance for Social Workers

Working with a financial advisor who knows about insurance for social workers is a good idea. They understand the risks you face and can help you pick the best policy. They’ll guide you on how much coverage you need and explain policy terms.

“Working with a financial advisor who understands the specific needs of social workers was invaluable in helping me find the right income protection policy. They took the time to assess my situation and recommend a policy that provided the coverage I needed at a price I could afford.” – Jane, Social Worker

Ensuring Compliance with Professional Requirements and Regulations

Make sure your income protection policy meets professional requirements and regulations. For example, if you’re a BASW member, you might need professional indemnity and public liability insurance. Your policy should cover these needs.

If you’re self-employed, find policies that let you include business costs in your coverage. This ensures your business is protected if you can’t work due to illness or injury.

- Check with professional organisations like BASW to ensure your policy meets their requirements.

- Review your policy regularly to ensure it continues to meet your needs as your career progresses.

- Consider adding optional benefits, such as coverage for business expenses, if you are self-employed.

By comparing policies, working with a specialist, and meeting professional standards, you can find the best income protection for your needs. This gives you peace of mind and lets you focus on helping others.

In Closing

Social workers’ unique risks and challenges are crucial for income protection. They support vulnerable individuals and communities, so it’s key that they have financial security so they can focus on their work without worrying about illness or injury.

Understanding the types of income protection, like disability insurance for care workers, helps social workers make informed choices. They can pick the best cover for their needs.

Social workers should look at waiting periods, benefit payout periods, and premiums when picking an income protection policy. A financial advisor specialising in insurance for social workers can help. They ensure compliance with professional requirements and find the best policy.

By comparing policies and choosing the right cover, social workers can build financial resilience, which can help them navigate tough times.

Income protection for social workers is more than just financial security. It lets them keep doing their vital work without worrying about money if they get sick or injured. By prioritising income protection, they protect their well-being and continue to help others.

FAQs

What is income protection insurance for social workers?

Income protection insurance for social workers gives you a monthly sum. This sum is about 60-70% of your monthly income, tax-free. It’s paid if you’re sick or unwell and can’t work. It helps cover costs like your mortgage or urgent bills.

Why do social workers need income protection?

Social workers don’t have sick pay if they’re ill or injured. This could lead to big financial problems, especially if they have dependents. They face risks like aggressive service users, health issues, and near-miss car accidents.

How does income protection insurance work for social workers?

Insurers agree to pay a monthly sum if you’re unable to work. This payout continues until you return to work, the policy ends, retire, or pass away. You can make multiple claims if you’re unwell and can’t work.

What types of income protection insurance are available for social workers?

There are three types of income protection insurance for social workers: accident and sickness only, unemployment only, and accidental, sickness, and unemployment (comprehensive cover). The choice depends on your needs and the protection you want.

What should social workers consider when choosing an income protection policy?

Consider the waiting period before getting benefits when picking an income protection policy. Also, consider the length of the benefit payout and the percentage of income covered (usually 60-70%). Think about how much you can afford to pay for premiums.

The cost depends on your lifestyle, age, and the level of coverage you want. It also depends on the risk level of your job. Social workers are usually Class 3, like teachers.

How can social workers find the best income protection policy for their needs?

To find the best income protection, compare policies from different providers. Consider getting help from a financial advisor who knows about insurance for social workers. Make sure your policy meets any professional requirements and regulations.

Being a British Association of Social Workers (BASW) member can help. They offer professional indemnity and public liability insurance.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.