Best Income Protection Insurance For Contractors In 2025

Do you worry about how you will pay the bills if you cannot work? Do you have loved ones that would suffer from financial hardship without your monthly income?

This comprehensive contractors income protection insurance guide is essential reading. Find out how a modest monthly payment can provide a replacement salary and complete peace of mind.

With many people becoming economically inactive due to long-term illness, income protection insurance provides a safety net to maintain your standard of living.

Contractors Income Protection Benefits

Protect Your Income. Receive up to 70% of your income through monthly, tax-free payments, ensuring financial stability.

Insurance Hero can assist you in finding the best policies that are both comprehensive and cost-effective.

Here’s why you should consider it:

- Housing Expenses: For covering rental or mortgage payments

- Utility Bills: Such as electricity, water, gas and phone bills are covered

- Daily Living Expenses: Could include groceries and food delivery costs

- Flexible Coverage: To align with your lifestyle choices and requirements

- Vehicle & Travel: Pay towards Road Tax, MOT’s and fuel

- Waiting Periods: You can choose a time scale before payments commence, which can range from 4 weeks to 2 years, allowing you to tailor the policy to your needs

Income Protection Insurance From Trusted UK Companies. Quick Form. Start The Process Online

All About Income Protection Insurance For Contractors

Income protection is insurance coverage that provides a replacement salary if you cannot work for a time. It gives that feeling of financial well-being in return for paying a regular monthly premium into a fixed-term policy.

Why Do Contractors Need Income Protection?

As a contractor working either as a sole trader or using a limited company, you are unlikely protected by a sick pay policy as businesses offer to their employees. Depending on the industry, an employee may be paid anywhere from one month to one year of their salary when off sick.

As a contractor, if you cannot work due to illness or injury, you would receive the UK government sickness benefit, a payment of just under £100 payable for up to 28 weeks.

Depending on your ailment, further disability allowances may be available. However, for many, these low weekly payments are insufficient to maintain a reasonable standard of living.

Income protection insurance closes the black hole in earnings if you cannot do your job.

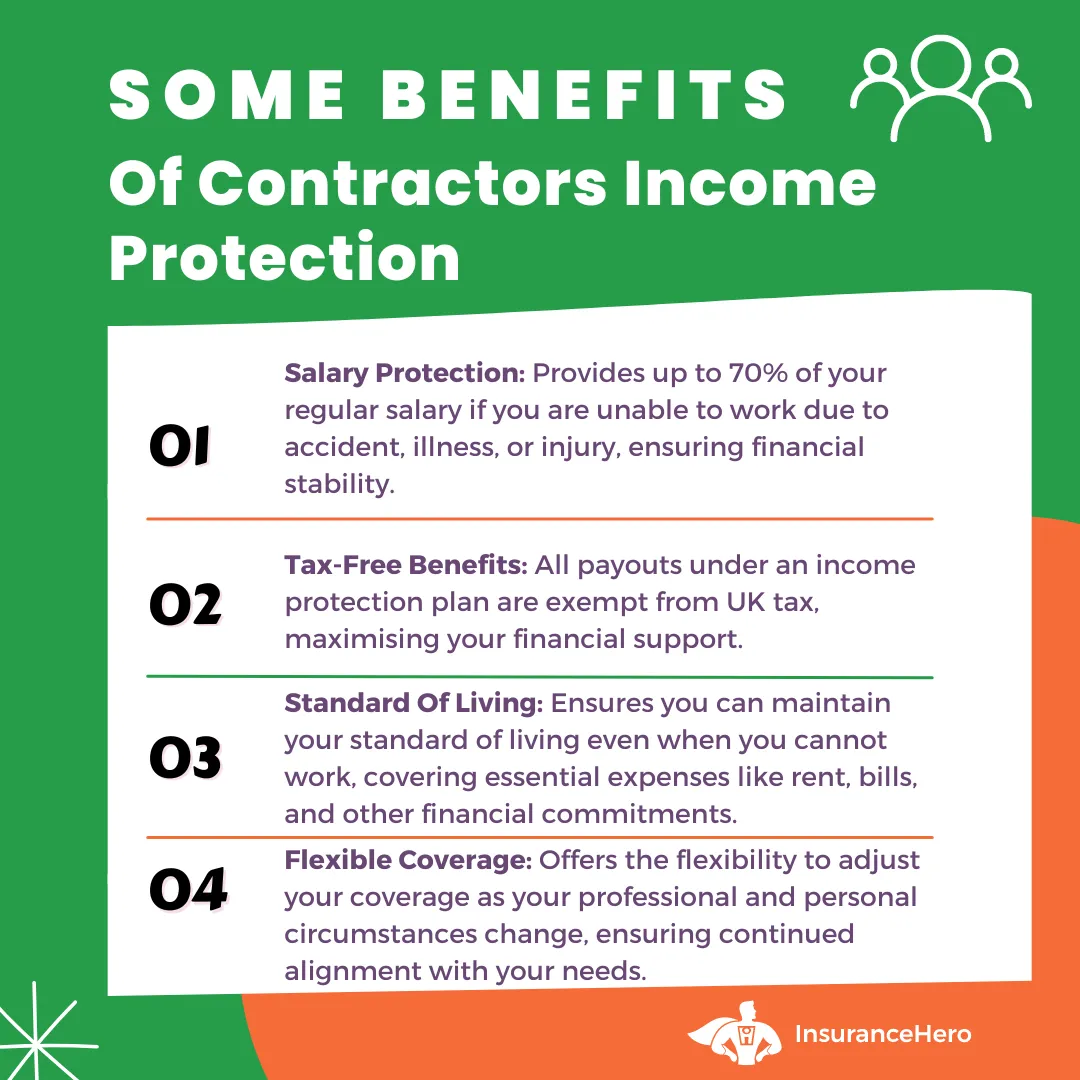

The Key Benefits of Income Protection

If you are a contractor, insurance is an essential protection that you should consider. There are crucial benefits of having a plan in place, which include the following:

- If you can’t work due to accident, illness or injury, a replacement wage will maintain your standard of living until you can return to employment

- Policies can be tailored to provide salary payments right up to your retirement if you are unable to ever return to the workplace

- Benefits that payout as part of a plan are UK tax-free

- Insurers will cover up to 70% of your salary under an income protection plan

- It is flexible insurance and can adjust to ever-changing personal and professional circumstances

Is Contractor Income Protection Relevant To Your Situation?

As a contractor, ensure you are financially secure should you be unable to work through accident, illness or injury. To understand if income protection is for you, consider the following:

Savings

Do you have enough savings as a contractor to last a year without working? Injury or illness could result in being out of the workplace for a long time.

Financial commitments

Do you have financial obligations that may come under pressure should you be unable to work? These include mortgage payments, personal loans, school and university fees, and general month-to-month living expenses.

Supporting partner

Should you be out of the workplace, does your partner earn a good salary that could help cover any shortfall in your earnings?

Keep Afloat When Life Isn’t So Buoyant. Cover Expenses If You’re Unable to Work.

How Much Does Contractors Income Protection Cost Per Month?

The following table provides sample quotes for a self-employed plumbing contractor who doesn’t smoke and is in fair health. They are earning an annual income of £45,000. The coverage extends until age 70, with a 4-month deferred time frame and a 12-month payment period.

| Age | Monthly Cost (£) |

|---|---|

| 20 | 7.84 |

| 25 | 9.49 |

| 30 | 10.23 |

| 35 | 11.61 |

| 40 | 13.14 |

| 45 | 15.56 |

| 50 | 18.94 |

While costs vary, many contractors can find well-priced coverage online. The protection provided is often seen as worthwhile, given the lack of employer sick pay for contractors.

How can Insurance Hero Help?

Insurance Hero provides income protection coverage to contractors and the self-employed.

Here are a few of the reasons why we can help you:

- Insurance Hero is an independent insurance broker. We do not tie to any underwriter; our service is completely impartial. It allows us to find you income protection insurance for contractors that is competitive and tailored to your circumstances.

- Access a team of professional brokers who are experts in contractor income insurance protection. All our staff understand expertly what this policy covers and have a direct line and email, ensuring you have personalised contact when you need it most.

- As brokers, we have more substantial negotiating power when dealing with insurers and can offer lower premiums than if you go direct.

- Our caring team will fully support you during the claim process should you make a claim, ensuring the income protection for contractors process is efficient and enabling you to get a prompt payout.

Contact Insurance Hero today on 0203 129 88 66 for your contractor income protection quote. Our friendly team will work with you to provide a quote tailored to your circumstances – We want to ensure your plan is watertight. Your policy is our top priority!

Income Protection for Contractors – Understanding the Main Policy Features

Understanding the main elements of income protection for contractors is vital before meeting with an insurance broker.

As a contractor, your broker should craft a policy relevant to your situation. Understanding what is relevant to you will help you make an informed decision before starting a plan.

Below are both standard terms and additional features that you should know. Your broker may be a generalist and not understand the intricacies of working as a contractor or specific medical inclusions that may be relevant to your circumstances.

Deferral Period

It is the time lapse between submitting a claim and activating your replacement salary. For employees, this ties in with an employer’s sickness policy.

A contractor is self-employed and will need to gauge the deferred period with their finances and how long they can afford not to work.

The lengthier the deferred period, the lower the premium. Conversely, the shorter the deferral period, the higher the monthly premium cover.

Level of Cover

Self-employed contractors are typically sole traders or operate through a limited company of which they are a director.

Sole traders should opt for a personal policy that allows coverage of up to 60% to 70% of their regular salary should they be unable to work.

Company Directors can opt for a plan allowing up to 80% of salary coverage. A separate section covers director income protection insurance later in the guide.

Cease Age

How old will you be when your income protection for contractors policy matures? It is normal to align the plan end date with your retirement date.

The later you leave it until retirement, the higher the cost of cover becomes. Insurance providers provide coverage up to the age of 70. Premiums will be higher than coverage for individuals retiring at 60 or 65.

Length of Claims Period

It is the period that a replacement salary will cover throughout a policy. Short-term cover typically provides a payout of one to five years.

The longer the payout period, the higher the cost of coverage. Long-term cover differs as it allows for the sum assured until retirement should you no longer be able to return to the workplace.

Studies have shown that the average length of a claim period is just under eight years in the UK. This suggests that taking out a long-term contractor income protection policy is a sound recommendation. Insurance Hero adheres to this view.

Premium – The Cost of Cover

It is the cost of cover in contractor income protection insurance. It represents a monthly amount paid throughout a fixed-term plan.

Guaranteed Premiums

The monthly premium is ‘guaranteed’ to stay at the same level for the policy duration. The insurer cannot change the premium level unless the policyholder requests it.

This premium type can be useful if a policy begins when the policyholder is young and has no medical conditions of note.

Reviewable premiums

An insurer can review the level of premium at any time, typically due to unexpected circumstances. Reviewable premiums start as a cheaper option.

Upward revisions, however, usually make the policy premiums increasingly expensive over the policy duration.

Age-banded premiums

This type of cover amount rises as the policyholder gets older. It associates increased age with the higher likelihood of an older person making a claim. Age-banded premiums are cheap at the start and rise progressively over the policy duration.

Indexation

Indexation is an integral part of life insurance, including income protection cover. The insurer uses inflation as a benchmark to raise insurance premiums.

The Consumer Price Index (CPI) or the Retail Price Index (RPI) are popular references in the UK.

There are three types of premium cover available:

Level

For the duration of the income protection for contractors policy, the premium and subsequent replacement salary remain at the same level.

Increasing

Both premium and salary coverage rise incrementally throughout the policy in line with the level of inflation.

Decreasing

The premium decreases throughout the insurance. It can be helpful if it protects financial commitments like a mortgage which also has a fixed maturity date and reduces over time.

Additional Cover Features

You should be aware of other standard features and optional features of income insurance cover before taking out a UK policy.

Death benefit

If you die while receiving income benefits, this feature allows designated beneficiaries to receive a one-off lump sum payout. A payout may not be due should the injury or accident prove to be fatal.

Specified injury or trauma

A specific type of illness or injury can be included at the start of a personal plan. An additional payout is due if you can’t work due to this inclusion.

The extra payment is usually added to the regular amount when a claim occurs, but sometimes, it can be a lump sum payout.

Childcare benefit

If you cannot work, the childcare benefit pays out a further fixed amount for each child specified in the policy. This additional payout is useful for any other nursery, childminder or nanny requirements.

Freezing Insurance

As a contractor, there may be periods when you are in between jobs or voluntarily not working. Pausing can be useful until you are back working.

The policy does not pay if you are not working, and it makes no sense to pay monthly premiums, hence the benefits of freezing.

Involuntary Dismissal

It is perhaps just as relevant for a self-employed contractor as an employee of a company and worth being aware of.

Some insurers will include involuntary dismissal as an additional option to a policy. If you think the nature of your job warrants such an inclusion, it is worth speaking to your insurance broker to find out more.

What Comes Under Self-Employed Income Protection?

If you are a self-employed contractor, the attraction of contractor income protection is to provide a replacement salary while you cannot work.

Income protection for self-employed contractors covers against wide-ranging illnesses, injuries and accidents, but there are areas that you should be aware of that are not covered:

- When an incident occurs, if you are working overseas in a country or location not included under the initial terms, this may stop any payout

- Any participation in high-risk activities or extreme sports not declared at the beginning

- Alcohol or drug abuse

- If you are pregnant and in childbirth

Pre-Existing Medical Conditions

Declaring pre-existing medical conditions is crucial at the start of a plan. An insurer will have to be aware of any medical issues within the last five years, and these are interpreted in any of three ways:

- The medical problem is excluded from the policy

- The medical condition provides coverage on standard terms

- The disease has the cover but results in a higher premium level

Own occupation / any occupation

When taking out income protection for self-employed contractors, it is essential to understand how your insurer defines your job.

If you cannot work, different insurers define your inability to do your job differently. There are three types of interpretation:

- Failure to do your job or a similar one that you are qualified for

- The failure to undertake your actual job

- Failure to do any kind of paid work

Should you specify this in your policy, the highest level of coverage (and most expensive) is the inability to do your job.

Proportionate payment

A further contractors income protection feature you should be aware of is proportionate payment. If you return to paid employment but are in a lower-paid role, the policy can top up your earnings.

Director income protection insurance

Contractors who are sole traders can operate using a standard income protection personal plan.

Director income protection insurance is relevant for a contractor using a limited company.

All salary and dividends are paid to a contractor through their limited company. The policy is set up in the name of the company, and the business pays the monthly premiums.

If a claim occurs, any benefit is taxed as income. This differs from personal plans, where the benefit is tax-free due to premiums paid from post-tax income.

Pre-tax income using a limited company enables a higher level of up to 80% of regular salary compared to the lower levels of a personal plan.

Insurance Hero is an independent broker that helps contractors with insurance policies tailored to their personal and professional circumstances. Contact our expert team of brokers today on 0203 129 88 66 for a competitive no-obligation quote. We are here to help you!

Understanding the contractor’s income protection claims Process

If you cannot work and need to submit a claim as part of your income plan, here are the simple steps involved in the claim process.

Step 1: Contact your broker

Contact your broker or insurer and request an application form to make a claim. You can make contact by phone, email, web chat or written correspondence.

Step 2: Complete an application form

Once you have received the claim form, you will need to complete it and provide any requested information.

An insurer requires standard information, such as a GP report outlining the medical condition keeping you from working.

Additional financial information such as payslips, P60s, business accounts and tax returns are required. The nature of the information needed will depend on whether you are a sole trader or using a limited company.

Step 3: How is a claim assessed?

The insurer will first check that your circumstances meet the criteria in your policy. The insurer will then check that the replacement salary is still correctly tied to your salary when you stopped working and verify other payout requirements.

Step 4: Once a claim receives approval

Once an application is signed off, you will receive a call to confirm your bank payment details and the date the first payment will occur.

Until this happens, you must keep paying your monthly premiums per the policy. The claim will be reviewed from time to time until you can return to the workplace.

FAQs Around Contractor Income Protection Insurance

Why is my replacement salary not adequately covered?

This insurance type has a cap on how much of your regular income you receive in your plan.

The reason is simple. It will encourage a claimant to return to work. The policy is not to put you in a better financial position than working.

Income insurance for contractors is rarely above 70% for personal plans, and in fact, you can choose a lower level of coverage if you want to keep insurance premiums down.

Is unemployment insurance for all contract workers?

The answer is yes. You can take out a policy regardless of whether you are a contractor operating as a sole trader or using a limited company.

The requirements are being 16 years of age or above, registered to pay UK tax, registered with a UK medical practice for the last three years and having a UK bank account.

Is Income Protection the same as ASU?

No, they are not the same. Accident, sickness and unemployment cover is a cheaper alternative. It does not offer a long-term option and does not have full medical underwriting.

For contractors, are there other alternatives to full income protection cover?

Yes, there are alternatives, typically lower cost but less comprehensive:

- Accident and sickness insurance: Low-cost cover which covers for accidents as well as illness

- Sickness insurance for contractors: A cheaper alternative for contractors, this is just cover for illness

- Unemployment insurance for contract workers: Specifically covers events in the workplace

- Redundancy protection cover: Its sole purpose is to protect against involuntary dismissal.

- Mortgage payment protection: A consideration if your primary concern is protecting your mortgage payments against a possible job loss.

What is the cost of income protection contractor insurance?

Without getting a quote, this is difficult to answer as so many variables exist. These include some of the following:

Factors include the length of the claim period, your age and any underlying medical conditions, the percentage of salary covered, the duration of the policy and whether you want the plan indexed to take inflation into account.

How flexible is income protection to changing circumstances?

Insurers understand that your circumstances will evolve over your working lifetime as a contractor. If you have a change in circumstances, a policy can change.

Changes as part of your private and professional life may include a new mortgage, the birth of a child, or an increase or decrease in salary. You should contact your broker whenever you think you have a change in circumstances that will affect your contractor’s income protection policy.

Can I have more than one protection policy?

Yes, this is possible. There are genuine reasons that someone may choose to have more than one policy in place.

What should be of note is any payment benefit resulting from all your total benefit claims cannot exceed 75% of your regular salary.

What is the difference between income protection and life insurance?

Income protection intends to provide a regular payment (salary) if you can’t work due to illness or injury. The plan can ensure financial security until you return to work or until you retire if you take out a long-term policy.

Life cover provides a lump-sum payout, not a regular payment; there is only a benefit if the policyholder dies.

Can you get a policy if you have an existing injury?

Yes, this should be fine. You must declare your pre-condition at the outset of your policy—the extent or type of injury impacts how an insurer will consider it.

There are three ways an insurer deals with a pre-existing injury. Firstly, they may exclude it altogether from coverage. Then, they may include it but with an additional premium and finally, they may accept the condition in the policy at standard rates.

Is income protection and critical illness different?

Yes, there is a fundamental difference. Income protection insurance for contractors pays out a monthly benefit payment that is up to 70% of your regular salary—its intention is for you to be able to return to the workplace. Critical illness provides a one-off lump sum payment if you live longer than ten days after diagnosis. It assumes that you may never return to the workplace.

Other income protection pages (by occupation):

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.