Using Life Insurance For Wealth Transfer Over 40

Affordable life insurance for people over forty is a wise investment, especially for transferring wealth to children, family members, and others you care about.

Your life insurance can provide beneficiaries significant financial funds to support their lifestyles. Beneficiaries can also use the money to offset debts, ongoing expenses, or inheritance taxes.

Discover The Benefits Of Over 40s Life Cover. Get A Free Life Quote Today

How to Transfer Life Insurance Wealth

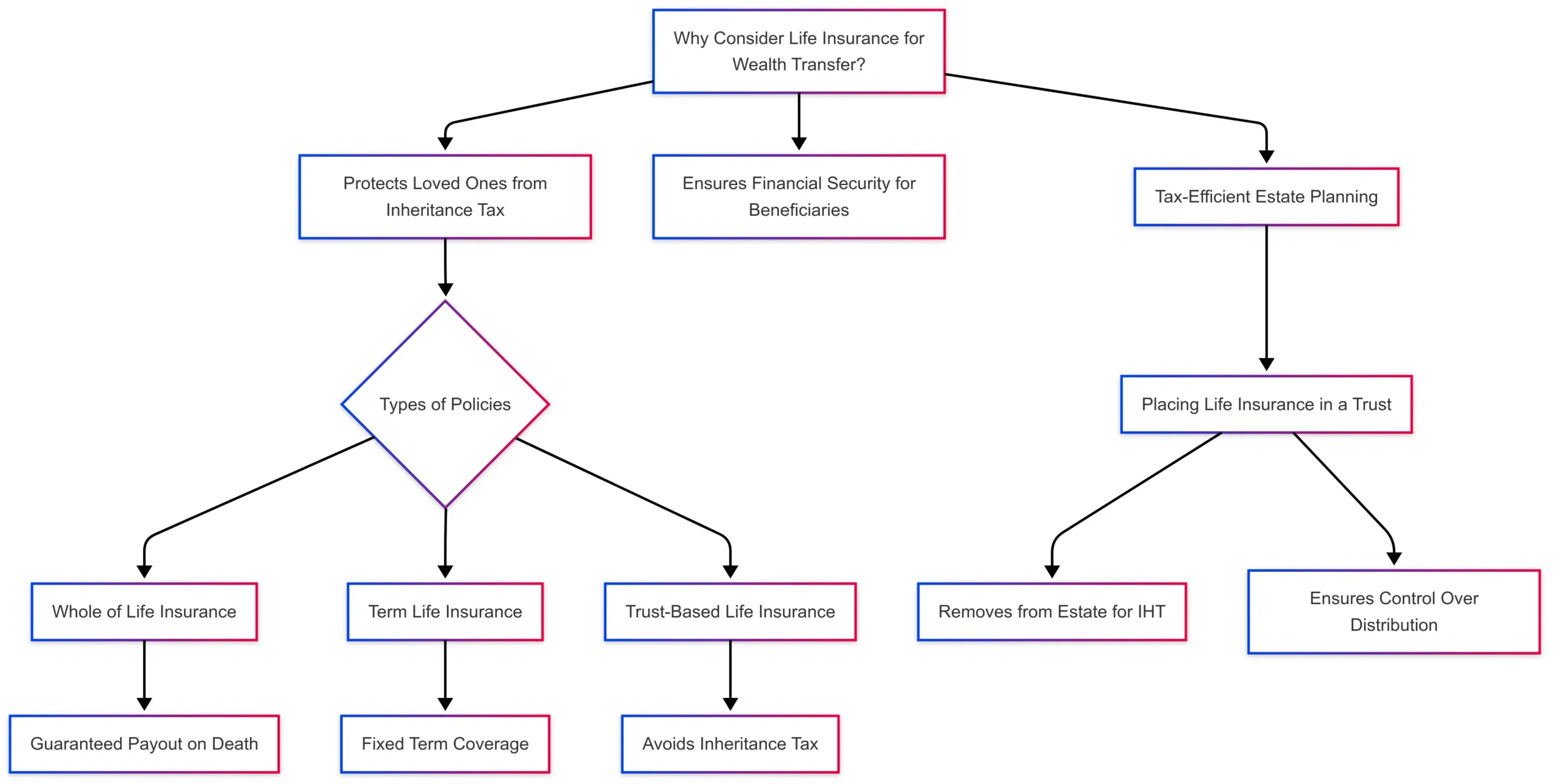

A life insurance policy can safeguard the financial wellbeing of your loved ones in the event of you passing away. It provides them with tax-free benefits that can supplement what they inherit from your estate.

Here’s how you can use life insurance for wealth transfer:

Leave a Legacy

If you’re the primary provider for your family, you might be worried about how your loved ones will cope without your income.

Your life insurance policy can give you peace of mind by providing your beneficiaries with a payout to sustain the life you have built for them.

Offset Inheritance Taxes

One of the estate-planning benefits of life insurance after forty is its ability to offset inheritance taxes. After you die, your heirs will inherit your estate. This transfer comes with a tax obligation they must settle with the UK tax authorities.

The amount differs depending on the size and value of the assets, but it can be significant and take a big chunk out of what you left for them.

Your life insurance policy can cover the required tax payments so that your loved ones can access the full amount of the legacy you worked hard to give them.

Pass on a Business

If you own a business, a life insurance policy is a smart way to protect your company and ensure it seamlessly transfers to your heirs or business partners when you’re no longer around.

This payout could be used to hire a new employee or for ongoing costs; it can also fund buyout agreements so partners or stakeholders can assume your shares and guarantee business continuity.

Choosing Life Insurance Over Forty

After the age of forty, life insurance policy options might be more limited, premiums may be a little higher, and insurance purposes might align more closely with midlife priorities, such as wealth transfer or retirement planning.

At this age, you might have to consider issues such as how diabetes affects life insurance after forty, if life insurance policies require health checks, and if policy payouts can go toward the operation of a business.

Many life insurance providers offer policies designed for people over forty. Get in touch with Insurance Hero to learn more about your options and to find the plan that suits you the best.

Insurance Hero is a free service that helps you secure personalised, competitive life insurance quotes from leading providers in the UK.

Research Sources:

- https://chestertonhouse.co.uk/the-great-wealth-transfer-are-you-ready/

- https://www.aviva.co.uk/insurance/life-products/life-insurance/aviva-trusts/

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.