Trusted Life Insurance Over 70 With No Medical Exam 2025

Applying for life insurance over 70 can be a hard decision to take. Do you need it? What kind of benefits will it offer? Can you lose money on its monthly payments?

These are all valid questions; naturally, you don’t want to make bad financial decisions at that stage in your life. So, what should you do?

Here, we’ll cover the benefits and downsides of senior insurance policies, explore potential options, and help you make the most of them.

Over 70s Life Insurance In Summary:

Securing life insurance over 70 offers peace of mind and financial support during your golden years.

As fewer insurers cover people over 70, people often think that coverage can be expensive or has too many exclusions.

Insurance Hero can help you discover the most comprehensive and cost-effective policies available.

Here’s why it’s worth considering:

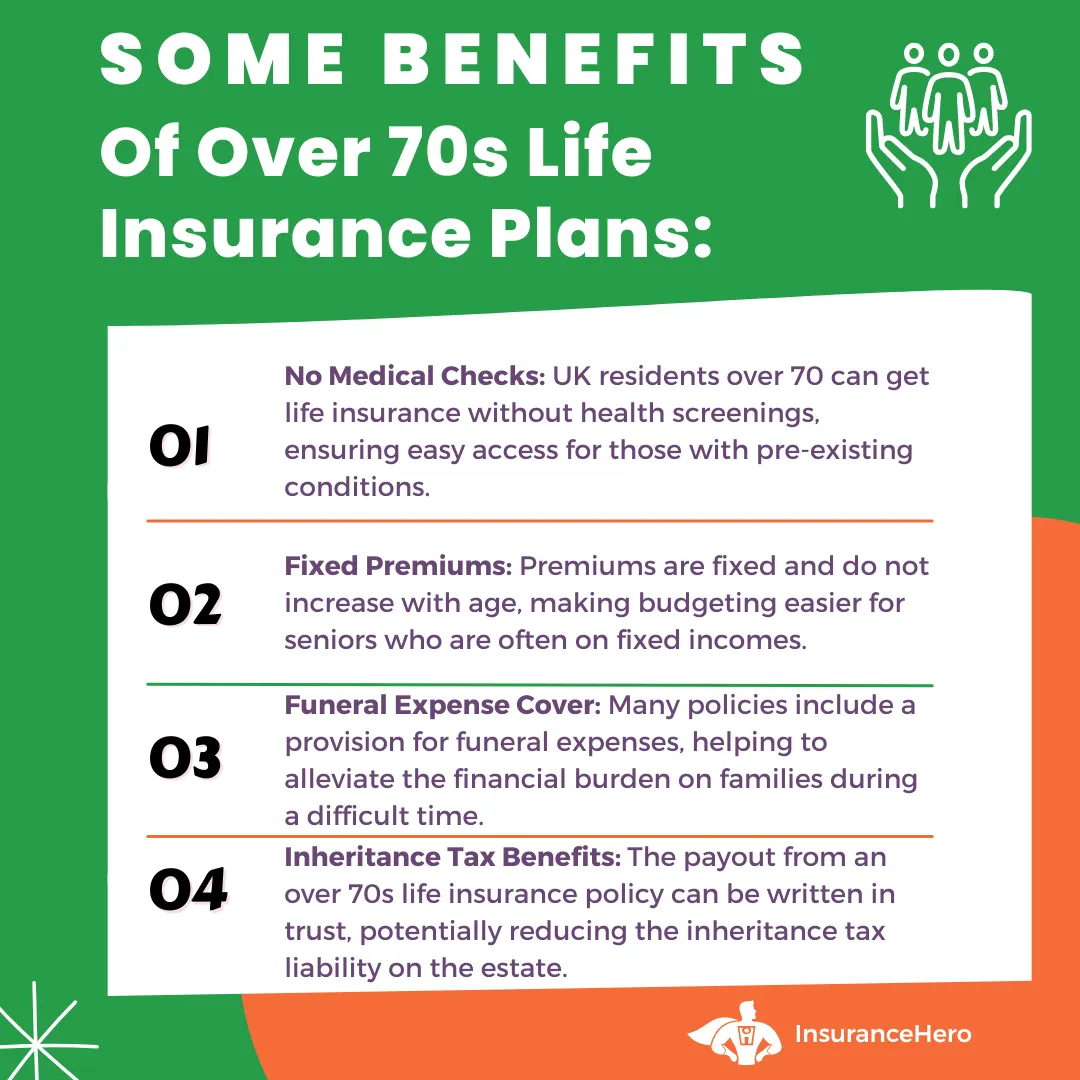

- No Medicals Required: A key benefit of life insurance for those over 70 is that it does not require medical examinations.

- Cover Funeral Expenses: Funeral costs can be burdensome; a life insurance policy eases this financial strain, allowing for a dignified farewell without imposing on your family.

- No Term Limits: Many senior life insurance policies do not have set terms. They remain active as long as premiums are paid and provide a guaranteed benefit to your dependents.

Searching For The Best Life Cover For Over 70? Easily Compare Over 70’s Life Cover Simple Quote Process

Why Should You Get Life Insurance If You’re Over 70?

So, you’ve successfully lived a fulfilling life, raised your kids, paid for their tuition, and might have already paid off your mortgage. Now that these responsibilities are almost behind you, you can spend the rest of your days not worrying about money or life expenses.

You probably think you don’t even need life insurance anymore. Well, you might want to hold that thought for a bit.

You don’t have to worry about most of the financial burdens young people carry. That doesn’t mean life insurance can’t offer you any value, though.

Helps With Medical Bills

As you age, you’ll probably visit the hospital more, and you already know healthcare expenses are nothing to scoff at. If you must also pay for your spouse’s medical treatment, that’s double the financial load.

These expenses won’t be cheap even if you have money saved up. You might need backup to help you survive that grind, which life insurance coverage can provide.

Covers Your Funeral Expenses

Yes, it’s a bad omen, but most people start planning for their funerals at that point in their lives, and so should you.

Do you know how much a funeral costs? You’ll probably pay £4,500-8000, depending on where you live and the type of funeral you want to have. It can be too expensive for some people.

That’s where life insurance comes in. It provides valuable financial support, allowing your family and friends to cover the burial costs and give you a proper goodbye.

It Doesn’t Have a Set Term

You probably already know regular life insurance policies last for a specific period of time. It could be 10, 20, or 50 years. That’s called a term.

If you die before that term ends, your dependents will receive a payout from the insurance company. However, if you’re still alive at the end of that period or die after it, you get nothing.

So, life insurance policies won’t benefit you or your dependents if you outlive their terms. That’s not the case with senior life insurance policies, though.

Many of them don’t have a set term. If you keep paying, the policy will stay active for as long as you live.

That means you guarantee your dependents receive a decent sum of money after your passing. Of course, some senior insurance policies come with predetermined terms, but you can easily find one that doesn’t.

Pays Mortgage Debt

Some senior citizens buy their houses later in life and continue to pay their mortgages well into their seventies. If that’s you, what do you think will happen to your family if you pass away before paying off your mortgage?

They’ll have to pay the rest themselves if they want to stay in that house, which is no walk in the park. Even if your spouse and kids are financially capable, the money they get from your senior insurance plan can help.

It might not pay off the rest of the mortgage, but it can lift some of the burden off their shoulders.

It’s Easy to Get

Regular insurance policies can be a bit demanding. Life insurance companies require you to give them your medical history and take various medical exams.

That helps them understand your health risks and set monthly premium rates accordingly.

You won’t have to do any of that with senior insurance policies, as they don’t require you to take any medical exams. Not all of them, at least.

Whether you’re 50, 60, or 80, you can always find a life insurance policy that suits your physical and financial status.

What Are the Drawbacks of Life Insurance If You’re Over 70?

Despite their value, senior insurance policies aren’t perfect by any means. To secure one, you might want to know the disadvantages to make an educated decision.

It Could Offer A Lower Payout

A standard senior insurance policy has low acceptance standards and provides needed financial support.

Many of these policies usually offer lower payouts than regular life insurance policies. Yes, you’ll still receive a decent amount of money, but it won’t be as high as you might think.

At first glance, that may not sound like a deal breaker. Big or small, you’ll still receive extra money in the end. Well, that brings up a potential second issue.

You Might Lose Money

Yes, senior insurance policies can do more harm than good—in some cases. Some seniors live longer than they initially expected but continue to pay for that insurance policy anyway.

In that case, their dependents might end up with a payout that doesn’t match the amount the policyholder invested. Of course, that depends on the type of life insurance they applied to, but it’s still possible.

The Death Benefit Waiting Period Is Sometimes A Little Excessive

Most life insurance companies have a death benefit waiting period for senior citizens. That’s the time between when your company starts collecting premiums and when your dependents are eligible to receive that death benefit money.

Unfortunately, that window can be too long, about one or two years. If you pass away during that time, your beneficiaries won’t receive the money.

Looking For Affordable Life Insurance For Over 70s? Complete Our Questionnaire And Find Your Cheapest Quote

What Are the Best Life Insurance Options for People Over 70?

There are numerous types of life insurance policies on the market, each with different perks. The most suitable policy for you depends on your circumstances, budget, and the type of policy you want.

Over 50s Life Insurance Policy

As the name suggests, you can become eligible for that plan if you’re 50-85. It’s a classic choice and what most senior citizens imagine when considering senior life insurance.

Rest assured that life insurance companies will accept your application for an over-50s plan without medical exams. So, you can guarantee your loved ones will receive a payout after your passing.

Depending on how you want to approach it, the policy can last for the rest of your life or until you reach a certain age. The premium rates are determined by your age and the lump sum the company pays.

Their prices are fixed, so you don’t have to worry about potential fluctuations. However, as a long-term option, an over-50s insurance policy isn’t a simple financial obligation. So, consider your budget before applying and choose a plan you can afford.

Whole Life Insurance Policy (Permanent Policy)

Like the over-50s option, a whole-life policy stays active as long as you keep paying, meaning it can last until you pass away. That’s why some call it a permanent policy.

Ultimately, these permanent life insurance policies are targeted toward 70-year-olds who are in good health. Unlike the over-50s plan, applying for this involves answering several health questions and maybe even taking a medical exam.

The company might also ask you to provide details of your medical history. As you can tell, life insurance rates are determined by your age and health.

So, you want to ensure you’re in good shape before you apply. Remember that premium rates are usually higher in this policy than in the over-50s plan.

Term Life Insurance Policy

A term policy for senior citizens isn’t that different from a regular insurance policy. The plan remains active for a set period, ranging from 5 to 20 years.

If you pass away during that term, your beneficiaries receive a payout. Outlive the policy’s term, though, and you won’t get anything.

If you apply for a term policy, you must choose between level term and decreasing term insurance. What’s the difference?

Level-term policy: Your dependents’ payout stays the same throughout the term, making it ideal for covering demanding life costs.

Decreasing term policy: As the name suggests, the payout this policy offers decreases the longer you live. So, that type of coverage is more suitable for small expenses.

In this type of policy, the company will ask you to provide details of your medical history so that premium rates can be set accordingly. So, if you have any life-threatening health conditions, expect your rates to be higher.

Funeral Insurance Plan

Funeral insurance, or final expense insurance, is an ideal option for seniors who want to cover their funeral costs. It takes the burden of all these arrangements off their loved ones’ shoulders.

You can choose the available services and amenities depending on your budget and the type of funeral you want.

How to Get the Best Price for Life Insurance If You’re Over 70?

So, you’re interested in securing senior life insurance now. That is great; however, it is not wise to wander into a nearby insurance company and apply for a random plan.

No, you want to do it smartly and find a suitable plan with affordable premiums. How can you do that?

Identify Your Needs

At this point, you know each insurance plan serves a different purpose. Yes, they all aim to give your beneficiaries some money when you pass away.

However, the amount they receive differs from one plan to another. So, you should identify your needs and financial standards and choose the policy that meets these needs.

For example, a funeral insurance plan might be the better choice if you want to cover only your funeral costs.

Do you only want an affordable, accessible plan that offers your dependents a smaller amount of money? In that case, an over-50 policy makes sense.

Are you a financially well-off senior with good health seeking to leave your beneficiaries a decent sum of money? In this situation, permanent or whole of life coverage is a better option.

Secure Your Policy Sooner

With senior life insurance policies, the sooner you apply, the better a deal you’ll get. You see, the premium rates of most senior insurance plans depend on your physical health.

The better your health, the more affordable your premiums will be. As with most people, your physical health will probably deteriorate as you age.

If you apply for life insurance soon enough, you give yourself a good chance to get affordable premiums.

Stay in Good Health

This one ties in with the previous point. The most effective way to get the best deal from an insurance company is to stay in the best shape possible.

If you’re reading this as a younger person contemplating the benefits of senior insurance, it might be time to start hitting the gym. You also want to avoid smoking.

If you know anything about life insurance, you know smokers always pay more for premiums.

Compare Different Insurance Companies

Just because life insurance companies have similar senior insurance plans doesn’t mean they all offer the same prices.

Some will be more expensive, and others will be more affordable. So, you want to take your time, do thorough research, and compare the prices of all the available options. Insurance Hero can guide you through this process and offer quotes from some of the leading life insurance providers in the UK.

Can You Get Critical Illness Insurance If You’re Over 70?

Yes, you can. Critical illness coverage offers you a decent sum of money if you’re diagnosed with life-threatening illnesses.

These include heart attacks, loss of limbs, cancer, Parkinson’s disease, multiple sclerosis, blindness, and more. Treating these diseases/disabilities can empty your wallet in the long run, preventing you from paying your mortgage and securing your family’s future.

The money you receive from that policy can help you with that financial burden. You can use it to cover your medical bills, pay for everyday expenses, or pay off the mortgage.

Most insurance companies offer two types of critical illness insurance policies: Combined and standalone coverage.

In combined coverage, you combine critical illness and life insurance in one policy. It’s usually more affordable, but you only get one payout.

In a standalone policy, though, you pay for that coverage separately. Unfortunately, critical illness insurance doesn’t cover terminal illnesses.

So, if you’re diagnosed with dementia or chronic obstructive pulmonary disease, that may not be the most suitable policy for you.

How to Get An Insurance Quote If You’re Over 70?

Getting an insurance quote is fairly simple. You could contact the main insurance companies you want to work with and meet their requirements.

They might ask you to complete a health questionnaire, provide detailed medical records, or take a medical exam.

They will consider your age, health, smoking status, and the type of life insurance you’re applying to give you a quote. You then compare the different quotes and choose the most suitable one.

At Insurance Hero, we streamline the process for you. Complete a brief form requiring essentials like your desired coverage amount and contact details.

Once submitted, we’ll gather competitive quotes from top insurance providers across the UK. Your only task is to review these quotes and select the one that aligns with your requirements.

Ready to begin? Click here to start the process.

What Are the Best Insurance Companies for Seniors?

Now that you understand how helpful senior insurance policies can be let’s examine two of the best insurance providers on the market.

Aviva

You have probably already heard about Aviva. It’s one of the industry’s most trusted and efficient insurance companies.

How efficient? You won’t have to wait more than 3-5 days to get paid for your claims.

The company offers premiums ranging between £5 and £ 100 a month. So, regardless of your financial status, Aviva has a coverage option for you.

It’s not just about convenience, though. The company cares about its applicants.

That’s why it gives you access to its exclusive app, Aviva DigiCare+. The app offers regular health checkups, mental health, bereavement, and nutrition support.

AIG

AIG is all about offering the most seamless insurance process. The company guarantees that it will accept your application for its over-50 policy and provides you with protected benefits.

That means if you decide to stop paying for premiums, AIG can still keep the insurance but for a small amount. That only works if you pay half the premiums, though.

The company has an award-winning customer service team. So, if you’re facing any trouble, you know the AIG team will have your back.

Should You Write Your Senior Insurance Policy in Trust?

As a UK citizen, you’re probably familiar with inheritance tax. If your estate is worth more than £325,000, all the money above that threshold is subject to a 40% tax.

Writing your insurance policy into a trust ensures your beneficiaries get a full payout and speeds up the probate process.

If your life insurance policy is subject to inheritance tax, it’ll go through the probate process. That involves organizing your assets and distributing them after paying taxes.

On average, it takes 4-6 months to conclude. So, your loved ones won’t have access to the insurance money before that period ends, which is too inconvenient.

Ultimately, writing your insurance policy in trust helps you get the most out of it, giving you the peace of mind every insurance applicant wants.

You might want to consult a financial advisor to ensure you go through all the steps properly.

Life Insurance For Over 70 Final Thoughts

Ultimately, getting life insurance over 70 can be simple, depending on your life choices. If you take good care of your health, stay in shape, and avoid smoking, you’ll get an excellent deal with affordable premiums.

That doesn’t mean any insurance company will fulfil your needs, though. So, identify your needs as an applicant, consider multiple insurance companies, and choose the one that meets these needs.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.