Poverty In Later Life & Old Age Poverty UK Statistics

A recent Prudential study revealed shocking statistics regarding the financial status of older UK residents.

Poverty in later life has become an alarming reality in the UK. A particularly notable finding was that one of every five people retiring in Britain this year will fall under the income poverty line.

Although the levels of poverty are lower than they were a decade prior, the most recent statistics reveal that 2.1 million people (18 percent) of pensioners across the UK are living in poverty.

In 2025, fourteen per cent of British retirees depend solely on the state pension, a paltry £110.15 per week.

These individuals have made no other pension arrangements, and their financial troubles will be passed along to their beneficiaries when they die.

Old Age Poverty Shocking Study Findings

These sobering statistics are broken down by gender, revealing that eight per cent of men and 23 per cent of women will enter their retirement years dependent only upon the state pension. Though having a private pension can be beneficial, it does not guarantee an income above the poverty line.

People with small private pensions may earn under £8,253 a year, the estimated poverty line.

The Issue

Overestimating the amount received from the state can lead to people retiring without sufficient pension coverage. When asked to estimate how much they would receive, study respondents reported an average of £600 per year more than their actual entitlement.

Approximately one of every ten surveyed claimed no idea what the state pension would pay. Though retirees in London are not in an enviable position by any means, the Welsh are even worse off, with 25 per cent of Welsh retirees falling below the poverty line.

According to retirement income experts, increasing living expenses have rendered the basic state pension insufficient for anyone who wants to live comfortably during retirement.

Ideally, the state pension should be considered a portion of retirement income, not the sole source of funds during retirement. For many UK citizens, this advice comes too late.

Poverty in later life research from the pension consulting firm Hymans Robertson revealed that many people will be forced to work long past the state pension age to maintain their living standards.

To generate £25,000 in gross pension income each year, a 65-year-old male would require an approximately £500,000 pension pot.

This does not take into account the impact of inflation. Many people find it impossible to save enough money for retirement by age 65.

This past April, the Office of National Statistics stated that the pension fund required to purchase a £5,000 annual income during retirement had increased 29 percent over the previous three years to an eye-popping £152,800.

Employers are eliminating final salary schemes, leaving many employees without enough money to afford retirement. These older generations are staying on, preventing younger jobseekers from securing employment.

Why Is There Still Poverty in the UK Video

Implications for Beneficiaries

If this is not bad enough, the problems may trickle down to beneficiaries. Some retirees may turn to credit to maintain their lifestyles, taking out loans and accumulating other debts. If these individuals die in debt, beneficiaries must repay what is owed.

Left with an estate of little value, surviving family members will be forced to dip into their own savings. This situation could force some of them into bankruptcy.

A life insurance policy for retired people is one way to cover final expenses, but with limited income, retirees may be unable to afford this benefit.

Those who must continue working may actually be in a better financial position because they will not only continue to earn income but also be eligible for life insurance offered by their employers.

Beneficiaries can use the payouts to help settle their estates if these workers die with life policies in force.

How does age play a role in poverty?

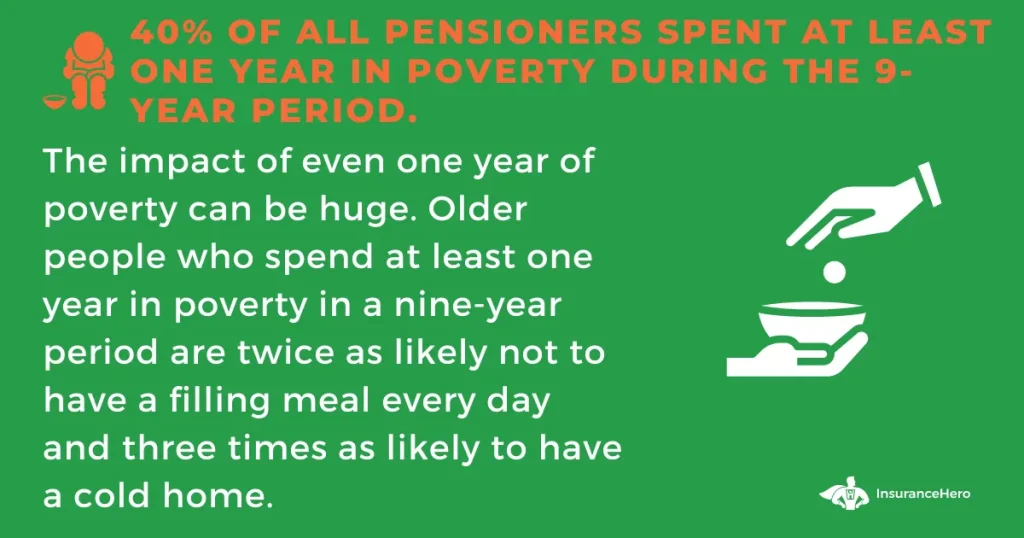

Age does play a role in poverty in the UK. Older people are more likely to experience poverty than any other age group.

This is partly because they are more likely to have lower incomes and partly because they are more likely to have higher costs (such as for heating and housing).

There are several reasons why older people are more likely to experience poverty:

Firstly, many older people have low-income levels, often due to working for many years in low-paid jobs.

Secondly, many older people face high costs for essentials such as heating and housing.

And finally, many of the oldest people find it difficult to access good quality services such as healthcare and social care, which can help them stay healthy and independent.

What is the impact of poverty on health and well-being for individuals in later adulthood?

Poverty has a significant impact on the health and well-being of older individuals.

Poverty can lead to poor nutrition, contributing to health problems such as obesity, heart disease, and diabetes.

Poverty can also lead to stress and anxiety, harming mental health.

Finally, poverty can limit access to healthcare and other essential services, reducing overall health and well-being.

What are 5 effects of poverty?

Poor health – due to a lack of education and access to healthcare, those living in poverty are more likely to have health problems.

Hunger and malnutrition – many people living in poverty don’t have enough food to eat, leading to malnutrition and other health problems.

Limited opportunities – poverty can limit someone’s education, employment, and financial stability opportunities.

Increased stress levels – people living in poverty often experience stress due to difficult circumstances.

Social isolation – because of the challenges associated with living in poverty, many people living in poverty feel socially isolated from their friends and family members.”

Old age poverty sources:

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.