Vitality Life Insurance Review 2025 Update – Should You Buy?

Vitality Life takes a more active role than most insurance providers do by helping people to live active and healthy lifestyles.

Choosing the right life insurance can be daunting, so our comprehensive Vitality Life Insurance review is here to guide you. In this review, we explore the features, benefits, and potential drawbacks of Vitality Life Insurance to help you make an informed decision about your coverage.

Who Is Vitality Life’s Target Customer?

Those who would find the cover they offer beneficial would benefit from the extra perks included because the more healthy activities you do, the more you’re rewarded with a discount on your premiums.

Vitality Life Insurance Reviews. Some Positives Worth Thinking About:

- Compared with the leading competition, they have a lower number of exclusions.

- Defaqto 5-star rated cover from only £8 per month.

- Premiums for younger men and women are consistently better than many other insurers

- Carry sound testimonials for customer care

- Feature exceptional deals for joint cover

- Better rates are obtainable for smokers and vapers.

See How Vitality’s Plans Compare Against Other Leading Life Insurance Companies – Quick Quote Form

Vitality Life Insurance Summary:

| Product | Description |

|---|---|

| Life Insurance | Lump sum to loved ones upon death or terminal illness. |

| Income Protection | Monthly income if sick or injured and can’t work. |

| Serious Illness Cover | Lump sum if diagnosed with a serious illness like cancer. |

| Mortgage Protection | Pays off the mortgage if terminally ill or pass away. |

| Term Life Insurance | Covers between five and 70 years, lump sum if you pass away within the term. |

| Whole Of Life Insurance | Lasts whole life, guaranteed lump sum to the family upon death. |

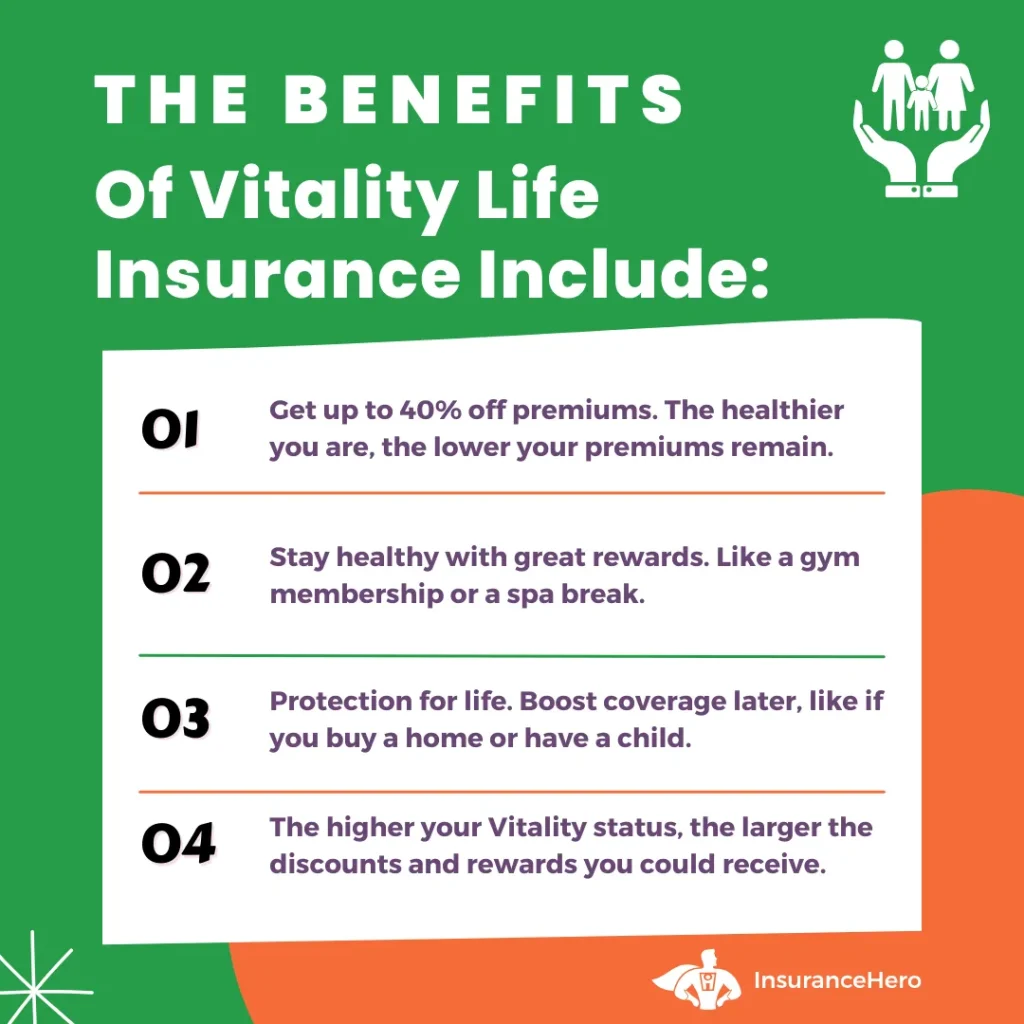

| Additional Benefits | Up to 40% off premiums, gym memberships, spa breaks, earn up to 2 months of premiums back, etc. |

How can a Vitality policy be purchased?

Purchasing a Vitality policy is a straightforward process that can provide valuable protection for you and your loved ones.

To acquire a Vitality policy, you can follow these steps:

- Research: Begin by researching the different types of policies offered by Vitality. They offer various options, including life insurance, critical illness coverage, and income protection. Determine which policy suits your needs and financial situation.

- Evaluate the Benefits: Consider a Vitality policy’s benefits and advantages. Vitality is known for its extensive range of rewards for active customers, including free items, discounts, and more. Additionally, their life cover is considered one of the most comprehensive in the UK. Assess these benefits and determine if they align with your requirements.

- Compare Quotes: To ensure you get the best coverage at the most competitive price, it’s wise to compare Vitality’s life insurance quotes. Contact our friendly team of experts who specialise in Vitality policies. They can guide you through the process, provide personalised recommendations, and assist you in obtaining multiple quotes.

- Get in Touch: Once you’ve carefully evaluated the options and compared quotes, contact our team of experts. They will be available to answer any questions and help you understand the terms and conditions of a Vitality policy. They can also assist in completing the necessary paperwork.

- Purchase: After finalising your decision and understanding the terms, it’s time to purchase your Vitality policy. The Insurance Hero team will guide you through the process and ensure that all required information is provided accurately. They will also help you choose the appropriate coverage amount and any additional options you may need.

Following these steps, you can easily purchase a Vitality policy that offers essential protection for your family, mortgage, or other financial needs. Remember, our team is here to assist you throughout the process, making it a seamless experience.

Household name online review companies indicate positive customer feedback with Vitality Life Insurance:

| Review Platform | Review Quality And Number |

|---|---|

| Trustpilot | 48,398 Reviews With An Overall Rating Of “Excellent”. |

| SmartMoneyPeople | A Score Of 4.17 Out Of 5. Based on 24 Reviews. |

| Fairer Finance | A claims score of 97.05% and an overall rating of 80.67% |

| Defaqto | Rated 5 out of 5 stars on this popular platform, showing this insurer has a high satisfaction score. |

Some Background History

They’ve been around the block long before they sprung up in 2014. Before that, it was a partnership between Prudential and Discovery trading under the name PruProtect since the insurance company launched in 2007.

In 2015, Discovery took ownership and relaunched as Vitality Life, paying out 99% of life insurance claims and a success rate of 93% of claims for serious illnesses cases submitted in 2022.

From then on, all Vitality Life reviews were based on Discovery’s sole ownership without collaboration with Prudential.

Points Reward Scheme

Every customer gets free access to this. It offers access to its exclusive cashback scheme with select partners. The partners are companies with products and services to help you live healthier.

Examples include 50% cashback when you buy a bike at Evans Cycles, or if you have a Virgin Active Health Club near you, you can use it for half the price.

You don’t need to buy fitness gear like half-price fitness wearables to benefit from the scheme.

This is open to all customers; all that is required is an activity tracker to track your activity. The example they give for their points scheme is earning 12 points by taking 12,500 steps daily twice a week.

That may sound like a challenge, but it won’t be for some, considering the recommended number of steps per day is 10,000, equivalent to walking for 5 miles.

Complete 25,000 steps in a week, and you’ll be rewarded with a relaxing drink at Starbucks and a ticket to a Cineworld or Vue cinema for any screening that takes your fancy.

To help you earn your points to get your rewards, they will also keep you motivated by boosting your rewards as you progress from a Bronze level to Silver to Gold to reach Platinum status once you’ve earned 2,400 points eventually.

The more healthy activities you do, the more points you rack up. Even just starting, you can boost your rewards to silver status by taking an online health review and a Vitality Health check.

Suppose you are active or at least interested in becoming active. This life insurance provider supports customers in leading healthy and active lifestyles.

Add-Ons that Work to Bring Your Premiums Down

There are options to add to the Wellness Optimiser for £4.50 per month and the Vitality Optimiser for £3.30 per month.

Both options get you better rewards and discounts, including an instant monthly premium discount.

It’s not a fitness cult you’re joining, though!

At this stage, you’d be forgiven for thinking that this is a membership to an exclusive healthy living group. First and foremost, Vitality Life Insurance is an insurer.

They do things a little differently as they want to be in the business of life by protecting it. That’s why there are some neat little extras in there.

The cover must be right, as they are primarily insurers. Life insurance is an investment in your family’s future, not necessarily the policyholder’s.

The Vitality Life Healthy Living Benefit Scheme supports your efforts to be around your family for as long as possible.

What are the qualifications to qualify for the Apple Watch promotion?

To qualify for the Apple Watch promotion, the following conditions must be met:

- Possession of a Vitality policy: You must have an active Vitality insurance policy.

- Minimum monthly premium: Your monthly premium for the Vitality policy must be £49.75 or higher.

- One watch per plan: Only one Apple Watch can be obtained per insurance plan. If you have a joint policy, you cannot receive two watches.

- Flexible purchase time: Purchasing the Apple Watch immediately upon policy activation is unnecessary. You can buy it at any point during your policy term.

- Activity-based pricing: The cost of the watch is determined by your level of physical activity. The more active you are, the lower the cost.

- Earning vitality points: To minimise the cost of the watch, you must earn at least 160 vitality points each month.

- Watch payment range: Depending on your monthly activity level, you can pay anywhere from £0 to £9.50 for the Apple Watch, with the cost decreasing as your activity level increases.

The Plans Vitality Life Offer

- The Lifestyle Care Cover

This plan protects your lifestyle. If your concern is being unable to care for yourself in later life, this cover is likely to be of interest.

- The Mortgage Life Insurance

As it sounds, this option is only suitable to those with a mortgage and protects your payments in the event of either death or a diagnosis of a defined critical illness.

However, for the critical illness to be applicable, it must meet the criteria set out in the policy. The fine print will be essential reading before signing the document (more on that in a bit).

- The VitalityLife Plan – Premiums starting at £5 per month

This is a level-term policy that will pay out a fixed lump sum to your family in the event of your death. Serious illness cover can be added, giving a level of protection should you become seriously ill and can no longer do your job.

The VitalityLife plan provides immediate cover, so your life insurance starts immediately rather than waiting 28 days or before any part of your policy begins.

You get instant cover, so immediate peace of mind.

The maximum coverage is £20,000,000.

- The Essentials Plan – Premiums begin at £8 per month

This is very similar to the VitalityLife plan, except for the immediate cover and a few other extras removed from this plan.

The maximum coverage is the same as the VitalityLife plan at £20,000,000.

- Serious Illness Cover

This can be added to both plans to give you additional protection should you find yourself diagnosed with a serious illness. Perhaps something that strikes, such as a heart attack, leaves you unable to work. It’s not cover based on you being diagnosed with a life-threatening illness but rather financial protection against a loss of income due to an illness preventing you from working.

- Terminal Illness Cover

Unlike the serious illness cover, terminal illness cover isn’t so great due to the restrictions in the criteria that must be met for a successful claim. A terminal illness must be diagnosed to be eligible, resulting in you having less than 12 months to live. In addition, you need to have more than a year left to run on your policy.

The Types of Life Insurance Vitality Life Offer

- Level term

The amount of coverage you take out at the start of your policy won’t change.

- Indexed

Index cover protects against inflation. Your policy’s pay-out sum ensures that your beneficiaries will increase annually on the anniversary date of your policy.

- Decreasing term

On a decreasing term plan, your payout decreases annually. It’s generally used as a mortgage insurance product. The more you pay towards your home, the less the outstanding balance will be.

Therefore, a lesser sum would be required to repay the mortgage balance. It’s the cheapest of all products, with the most affordable option on the Essential Plans providing the bare bones of a life insurance product.

How can I cancel my Vitality life insurance policy?

To cancel your Vitality life insurance policy, you have a few options. Firstly, contact Vitality directly and inform them of your decision to cancel. They will guide you through the necessary steps and provide any additional information.

Alternatively, if you prefer assistance during the cancellation process, our team of friendly experts is here to help. They can walk you through the process, answer any questions, and even help you find a new policy with a provider that better aligns with your needs.

Whether you contact Vitality directly or seek guidance from our experts, we are committed to providing the support you need to cancel your life insurance policy smoothly.

Overall Thoughts

At the outset, you might find it challenging to understand the terms of each Vitality Life plan and add-ons.

They miss the mark on transparency, but most insurance providers are the same. A lot of jargon is in the fine print, and even talking to company representatives leaves you with more questions than when you asked the first.

The customer experience reports from Fairer Finance, an independent consumer help group, scored Vitality Life just 52% for transparency, which is below the average for most providers.

Of the 28 life insurers listed on Fairer Finances consumer reports data, Vitality Life ranks 22nd. Claims handling and approvals are good, but transparency is their Achilles heel.

They excel at being involved with customers after the sign-up process. Often, a life insurance policy is taken out and never given a second thought.

It’s just a small premium that shows up on your bank statement each month for years or the rest of your life on whole-of-life policies with no correspondence after taking the policy out, other than when changes are being made.

Vitality Life interacts with its customers more than any other insurance provider. It’s not about life insurance, but let’s face it: Would you look forward to a monthly e-magazine discussing life insurance?

Neither do they, and it’s probably why they don’t. They focus on helping their customers live healthier lives for longer.

They have an active user group of fitness enthusiasts. They publish and send you their e-magazine, which includes success stories, motivational columns, and a push to inspire and keep you on track with healthy living.

All the rewards partners are focused on healthy living, so if that’s not interesting to you, you won’t find Vitality Life any different than the rest, as you’ll likely disregard them as another insurance provider—a company you pay monthly for something you’ll never see.

For those trying to live a healthy lifestyle and finding it does cost in gym fees and gadgets, and you’re looking to get life insurance or perhaps switch to a provider who will support your efforts, Vitality Life would be worth investigating a little deeper.

Remember to scrutinise those terms and conditions and all-important policy documents to ensure you understand what all the T&Cs mean, as that’s the only genuine concern with Vitality Life.

While they do well in helping their customers live healthy lives, they are remiss in their use of industry jargon.

Want to find out how Vitality Life stacks up against the most suitable insurance providers for your current lifestyle?

At Insurance Hero, our primary role is to provide life insurance quotes that meet customers’ needs and provide excellent value at the lowest possible price point.

We search, compare, and analyse the policies from over 300 insurance providers, returning only the most suitable providers and policies that meet your needs and budget.

On your shortlist of suitable providers, Insurance Hero can include Vitality Life so you can see firsthand how their policies and price points compare to those of their competitors.

There is no cost to you and no obligation, either. It’s just an expert hand matching you with the right provider, policy, and price.

The best life insurance UK plans can be within your reach. We also hope you have found our Vitality Life Insurance review helpful and look forward to helping you secure the best policy for your unique needs.

When my children get to a certain age, I plan to get divorced – how does this affect my life cover needs?

Even though a joint life insurance policy can be more cost-effective, getting a single policy could be wise. Or you could think about life insurance for dads or life insurance for new mums.

Further Information:

Head Office: Vitality, 4th Floor, 70 Gracechurch Street, London EC3V 0XL.

VitalityLife Customer Services, Sheffield S95 1BW

Telephone: 0808 256 6753

Website: https://www.vitality.co.uk/life-insurance/

E-Mail: lifecustomerservices@vitality.co.uk