Best Bipolar Life Insurance Options 2025

According to Bipolar UK, an organisation that provides support for people affected by bipolar disorder, 1.3 million people in the UK live with this disorder.

Bipolar, like many other disorders, can severely affect a person’s quality of life. Although it can be a challenging topic to discuss, those with bipolar disorder must receive proper support and care.

Bipolar Disorder Life Insurance In Summary:

Many people with bipolar disorder can find themselves putting off the decision to purchase bipolar life insurance, thinking it is unattainable or too expensive.

Bipolar Life insurance gives people with the disorder peace of mind and allows them to focus on their treatment instead of worrying about uncertainties in the future.

Here are the top reasons to consider this vital coverage:

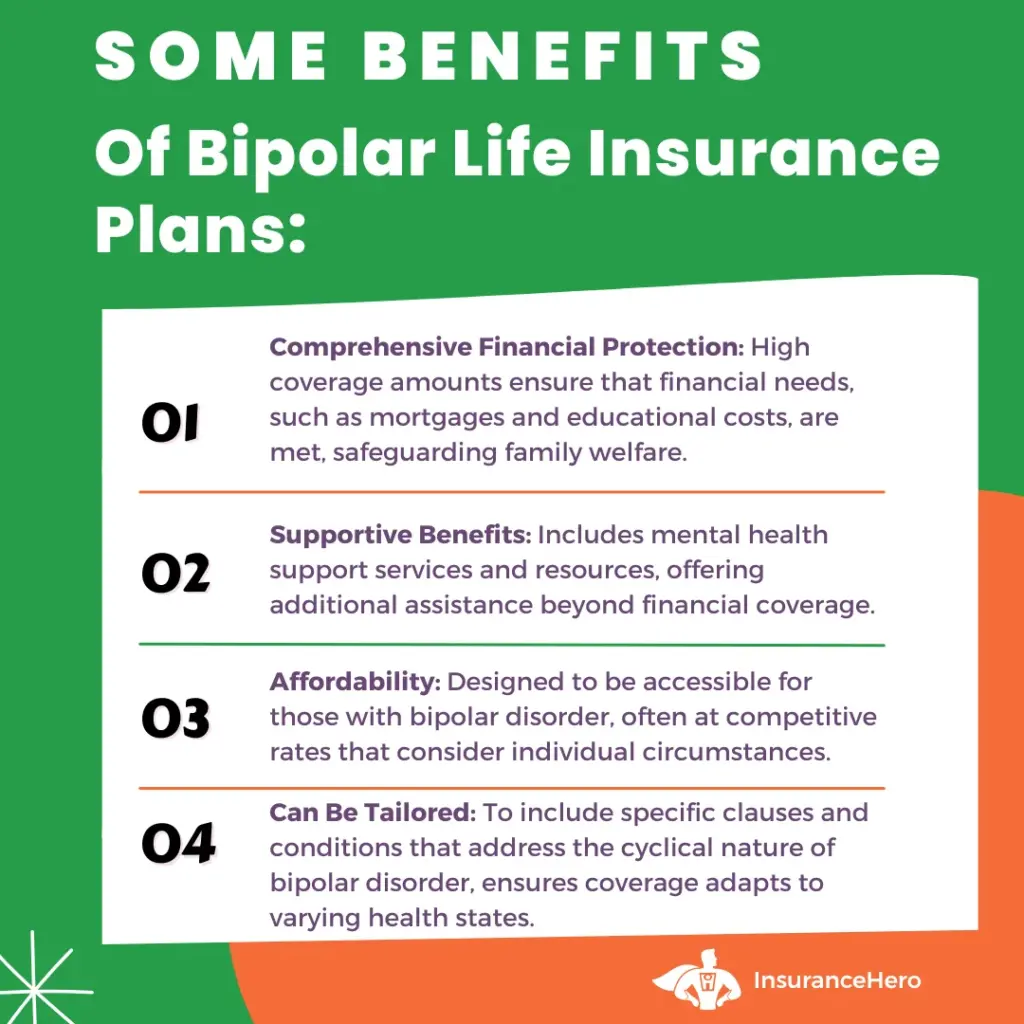

- Financial Stability: A bipolar life insurance policy offers a lump sum payout upon the policyholder’s death. This payout can clear mortgage balances, settle debts, and cover living expenses, ensuring your family’s financial stability.

- Accessibility and Affordability: Contrary to common perceptions, life insurance for individuals with bipolar disorder is both accessible and can be more affordable than expected, especially with expert guidance.

- Customised Policies: Specific types of life insurance policies, such as term life or mortgage life insurance, are available to meet the unique needs of those with bipolar disorder, ensuring tailored coverage.

- Support Beyond Financials: Life insurance policies for those with bipolar disorder often include additional mental health benefits and support, providing more than just financial assistance during difficult times.

Insurance Hero specialises in finding people who are bipolar the necessary life insurance policy that matches their unique lifestyle and needs.

Struggling With Bipolar Disorder And Need Cover? Compare The Leading Insurers For Quotes

Life Insurance for Bipolar Disorder

At Insurance Hero, we help people suffering from various ailments and life challenges find the best coverage suited for their needs. Here’s all you need to know about life insurance for bipolar disorder and how you can qualify for it.

Suppose you’re an individual with any disorder or have a history of chronic illnesses. In that case, your process of applying for life insurance will primarily focus on providing a life insurance company with all the necessary medical documentation.

The good news is that you can purchase a life insurance policy if you’re diagnosed with bipolar disorder. You may benefit significantly from this type of coverage for a few reasons.

Living with a Bipolar Disorder

Bipolar disorder is classified as a severe mental health condition. Some of the most apparent symptoms of the disorder are extreme mood swings, which can develop into states of mania alternately with depression. There are a few types of Bipolar disorder.

Type 1 Bipolar Disorder

Severe mood swings characterise type 1 Bipolar Disorder. An individual may experience states of mania that may be preceded or followed by states of hypomania or/and depression.

Manic states may also trigger psychosis. Without the treatment, states of mania can last anywhere from a few days to a few months, whereas depression can last up to a year.

Type 2 Bipolar Disorder

People with type 2 Bipolar Disorder will experience hypomanic episodes, but this type is more prone to cause more extended periods of depression. It’s also uncharacteristic for individuals with Type 2 Bipolar Disorder to experience mania.

Bipolar Disorder with Mixed Features

Mixed features in Bipolar disorder mean that an individual experiences both highs and lows during one episode.

A person goes through mania and depression states simultaneously or in rapid sequence. Bipolar Disorder with Mixed Features is pretty common, with half of the people with bipolar experiencing symptoms of mania during depressive episodes.

Cyclothymia

Cyclothymia is a disorder causing periods with fluctuations in mood swings that go down and up from the norm. These mood swings are not as severe as those experienced by people with bipolar disorder, but cyclothymia can develop into bipolar disorder if left untreated.

How to Qualify for Life Insurance with Bipolar Disorder?

People diagnosed with bipolar disorder can purchase life insurance with relatively standard premiums. Of course, the cost of your coverage will depend on a few conditions, like your medical status, the severity and frequency of your symptoms, and the treatments you’re undergoing.

Most insurance companies will want access to your well-documented medical history, as insurers need to estimate the risks of such coverage. For this reason, it is advisable to prepare all the necessary documentation before applying for life insurance.

Some questions regarding your condition may be asked during an interview with an insurance broker. These would be:

- When were you diagnosed with bipolar disorder?

- What type of bipolar disorder are you diagnosed with?

- What kind of treatment are you receiving?

- Have you ever sought help from a counsellor, psychiatrist, or mental health professional?

- Have you ever tried to self-harm or attempt suicide?

- Have you been hospitalised? For what reason?

- Have you been forced to take time off work related to your condition in the last five years?

Some of these questions can be considered invasive, but answering them honestly is essential. An interview with an insurance broker is often the most stressful part of the process, but it’s also essential.

Lying during an interview or in medical documentation is strongly inadvisable. If any falsifications are detected, you may be disqualified from applying for life insurance for bipolar disorder with that particular life insurance company.

Your monthly premiums will be calculated based on how much of a risk the insurance company considers you.

Unfortunately, a history of self-harm or attempting suicide may disqualify you from applying for coverage with some insurers. It may also influence your premiums, making them higher.

Suppose your bipolar disorder is well under control, and you don’t experience many severe symptoms in your day-to-day life. In that case, you will likely qualify for a life insurance policy with premiums close to a standard price.

Why Take Life Insurance for Bipolar Disorder?

Life insurance is an excellent way to provide your loved ones with peace of mind in case of your passing. You can secure your family from financial turmoil as life insurance can be used to pay for mortgages and cover living costs, school fees, and other financial obligations like debts.

This form of coverage is paid out as a cash lump sum in the event of your passing. If you have any questions regarding bipolar life insurance, please contact our experts at Insurance Hero. We can help you review your documentation and find the best insurance plans.

Bipolar Critical Illness Cover

Critical illness cover is coverage that pays a lump sum if you are diagnosed with one of the illnesses included in the policy.

The most common illnesses or conditions covered by critical illness insurance are:

- heart attack

- stroke

- cancer

- loss of arms or legs

- Parkinson’s disease

- Multiple Sclerosis, also known as MS

Of course, this list differs depending on the insurance company and specific plans. But can you qualify for bipolar critical illness cover?

Yes, individuals with bipolar disorder or anxiety can purchase critical illness coverage. Bipolar usually is not classified as a specific critical illness under this policy. However, the coverage can still protect you if you fall ill or have other serious health conditions.

The application process is similar to that of a life insurance policy. However, the requirements might be stricter for this type of coverage, as additional risk factors must be considered.

Terms can vary, as some individuals with mild symptoms and the disorder under control can expect higher premiums.

At the same time, the insurance company of their choice can reject those who experience more severe health complications. There also might be a requirement to exclude mental health issues and suicide from the coverage.

Critical illness plans are worth considering, as this type of coverage can pay you if you need to cover financial obligations. If you’re sick, for example, the cost of the treatment, mortgage, rent, other living costs, and medical equipment, like a wheelchair, are covered.

| Key Points | Details |

|---|---|

| Prevalence of Bipolar Disorder in the UK | 1.3 million people in the UK live with bipolar disorder, as per Bipolar UK. |

| Importance of Bipolar Life Insurance | Life insurance provides peace of mind for those with bipolar disorder, allowing them to focus on treatment and not future uncertainties. |

| Life Insurance Application Process for Bipolar Disorder | Applicants with bipolar disorder or chronic illnesses need to provide comprehensive medical documentation. Those diagnosed with bipolar can purchase life insurance, with premiums influenced by the severity and management of the disorder. |

| Types of Bipolar Disorder | Includes Type 1 Bipolar Disorder, Type 2 Bipolar Disorder, Bipolar Disorder with Mixed Features, and Cyclothymia. |

| Qualifying for Life Insurance with Bipolar Disorder | Those with well-managed bipolar disorder can get life insurance with standard premiums. Insurers require a detailed medical history and may ask specific questions about the condition and its management. |

| Benefits of Life Insurance for Bipolar Disorder | Life insurance offers financial security for loved ones, covering costs like mortgages, debts, and living expenses in the event of the policyholder’s passing. |

| Bipolar Critical Illness Cover | Critical illness cover pays out for specific illnesses. While bipolar disorder isn’t typically classified as a critical illness, the coverage can protect against other severe health conditions. |

| Bipolar Income Protection | Income protection provides a percentage of the policyholder’s salary if they become seriously ill or injured. Acquiring this insurance with bipolar disorder can be challenging but not impossible. |

| Other Life Insurance Options for Bipolar Disorder | Includes Term Life Insurance, Family Income Benefit, and Mortgage Life Insurance. |

Bipolar Income Protection

Another type of insurance policy worth considering is bipolar income protection coverage. This policy pays out a percentage of your salary in monthly lump sums in case you get seriously injured or ill and cannot work.

Acquiring income protection life insurance when diagnosed with bipolar disorder is not easy. There are some instances when this insurance plan can be approved for individuals with Type 2 Bipolar disorder who experience less severe symptoms.

Just like in the case of previously discussed coverage, to apply for income protection insurance, you must provide detailed documentation of your medical history, treatments, and symptoms you’re experiencing.

Similarly to critical illness coverage, mental health-related issues will be excluded from the policy, possibly resulting in slightly higher premiums.

You may benefit from a consultation with one of the Insurance Hero experts. Compare the leading life insurance companies and get all the relevant information about life insurance for bipolar disorder.

Other Life Insurance Cover For Bipolar

Other coverages are worth considering if you’re looking for the best insurance plans for an individual with bipolar disorder.

These include:

Term life insurance for individuals with bipolar can protect their families in case of death. This insurance policy pays out a lump sum after your passing if your death occurs within the term of the policy.

This cover can help your loved ones cover immediate costs, such as replacing your income, paying off debts, or paying for childcare.

Family income benefit with bipolar is another cover that is designed to pay your family a regular annual income in case of your death. The benefits will be paid out until the end of the term, which gives your loved ones time to secure their situation.

Mortgage life insurance for individuals with bipolar can protect your family after your death by covering the cost of the mortgage.

Life Insurance for Bipolar FAQs

Does bipolar disorder affect life insurance?

Yes, bipolar disorder may affect whether or not you qualify for life insurance as well as your premiums. It is essential to point out that the diagnosis is not a deciding factor when applying for life coverage.

The insurer will consider the severity of your symptoms, the course of the illness, and the treatment you’re receiving.

Many people with bipolar disorder, with a well-documented medical history, proper treatment, and mild symptoms, can expect to be eligible for life insurance with close-to-standard premiums.

Can you be denied life insurance for mental illness?

Unfortunately, life insurance companies can decline your application based on a mental illness diagnosis. Various factors are considered when insurers calculate the risks involved with providing you with coverage, your health condition being one of the most significant.

In some cases, your application may be declined. In others, you may expect higher premiums due to the risks you introduce. Different policies might be more suitable for people with a history of mental illnesses, so it’s always beneficial to consult an expert and explore all your options.

Can you get life insurance if you have major depression?

Yes, you can be eligible for a standard life insurance policy when you suffer from depression.

Similarly to other health conditions, managing your illness is crucial. If your depression is under control and you don’t experience frequent recurrences, you can qualify for coverage with similar terms and conditions as people without the diagnosis.

What is considered a mental disorder for life insurance?

A mental disorder is any disorder that impacts your mental health. Insurance companies qualify most mental disorders as pre-existing conditions. Therefore, they may reduce your chance of getting life insurance. You can also expect your premiums to be higher.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.