Best Diabetes Life Insurance Coverage 2025

Some people assume it is virtually impossible to secure life insurance with some pre-existing condition. This includes diabetes life insurance.

That may have been true, but it can no longer be said today. Insurance companies have completely broadened their base of insurance available to consumers. From Over 50’s life insurance to life insurance for people with mental health issues to diabetics life insurance coverage.

Diabetics Life Insurance In Summary:

Life insurance is crucial for people with diabetes, not just for financial security but for peace of mind, with the knowledge those close to you are protected should the worst happen.

Here’s why it’s something to consider:

- Tailored Coverage: Life insurance for diabetics is designed to meet the needs of individuals with diabetes through customised coverage that acknowledges their medical condition.

- Affordable Premiums: Contrary to common misconceptions, life insurance for diabetics can be more affordable than expected, with premiums often being significantly lower, especially when managed well with stable Hba1c readings.

- Expert Guidance: Consulting with a specialist who understands the nuances of diabetes can simplify the process, ensuring you get the best rates and the right coverage without unnecessary complications.

- Wide Availability: Most well-known insurers provide life insurance options for both Type 1 and Type 2 diabetics, enhancing accessibility and offering a variety of choices to find the most suitable and cost-effective plan.

Insurance Hero specialises in finding people with diabetes the necessary life insurance policy that matches their unique lifestyle and needs.

Compare The Leading Life Insurance Companies & Get A Great Deal On The Best Life Insurance For Diabetics

Understanding Diabetes and Life Insurance

We’ll explore the ins and outs of securing the best diabetes life insurance, including understanding the relationship between diabetes and life insurance, how to apply successfully, and finding the right provider that meets your specific needs.

With this knowledge, you’ll be better equipped to protect your loved ones and secure your financial future.

- Understand how diabetes affects life insurance coverage and premiums.

- Consider necessary documentation, medical exams, and expert advice when applying for life insurance with diabetes.

- Compare companies to find the most suitable policy at competitive rates for financial security.

Life insurance is a crucial financial safety net for families, and having diabetes doesn’t necessarily mean you can’t secure a life insurance policy.

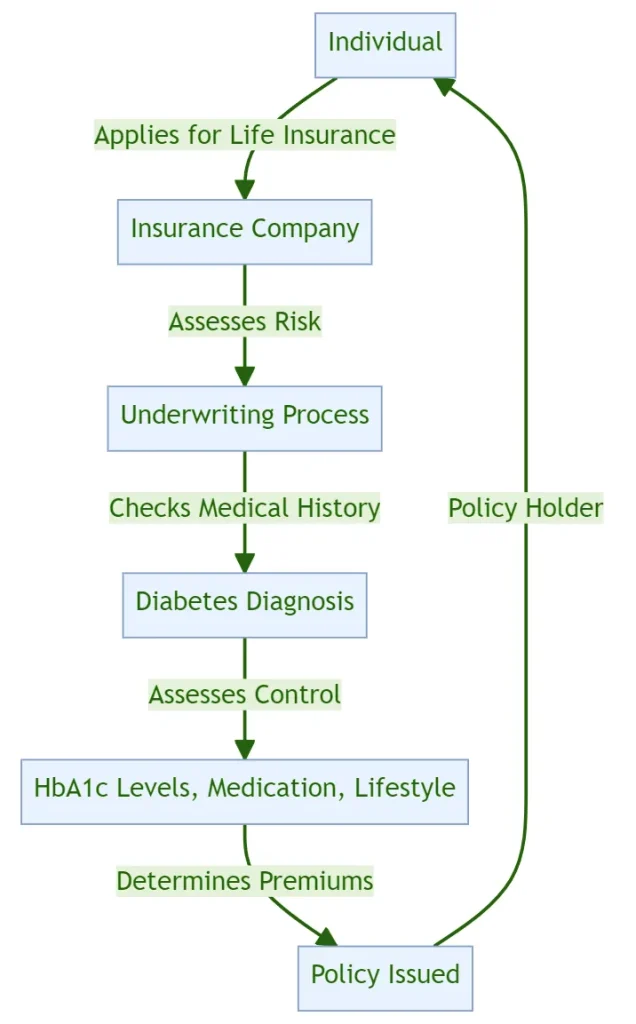

However, it’s essential to understand how diabetes affects life insurance coverage and premiums. As a pre-existing medical condition, diabetes can impact life insurance rates due to the increased risk of health complications and shortened life expectancy.

Type 1 and Type 2 diabetes are the primary types that insurance providers consider when assessing life insurance applications, including term life insurance. Diabetics of advanced age may be subject to higher diabetes life insurance premiums due to the increased risk of health complications associated with age.

While diabetes is not always deemed life-threatening, unmanaged symptoms or complications can be fatal, so diabetics must maintain proper management of their condition.

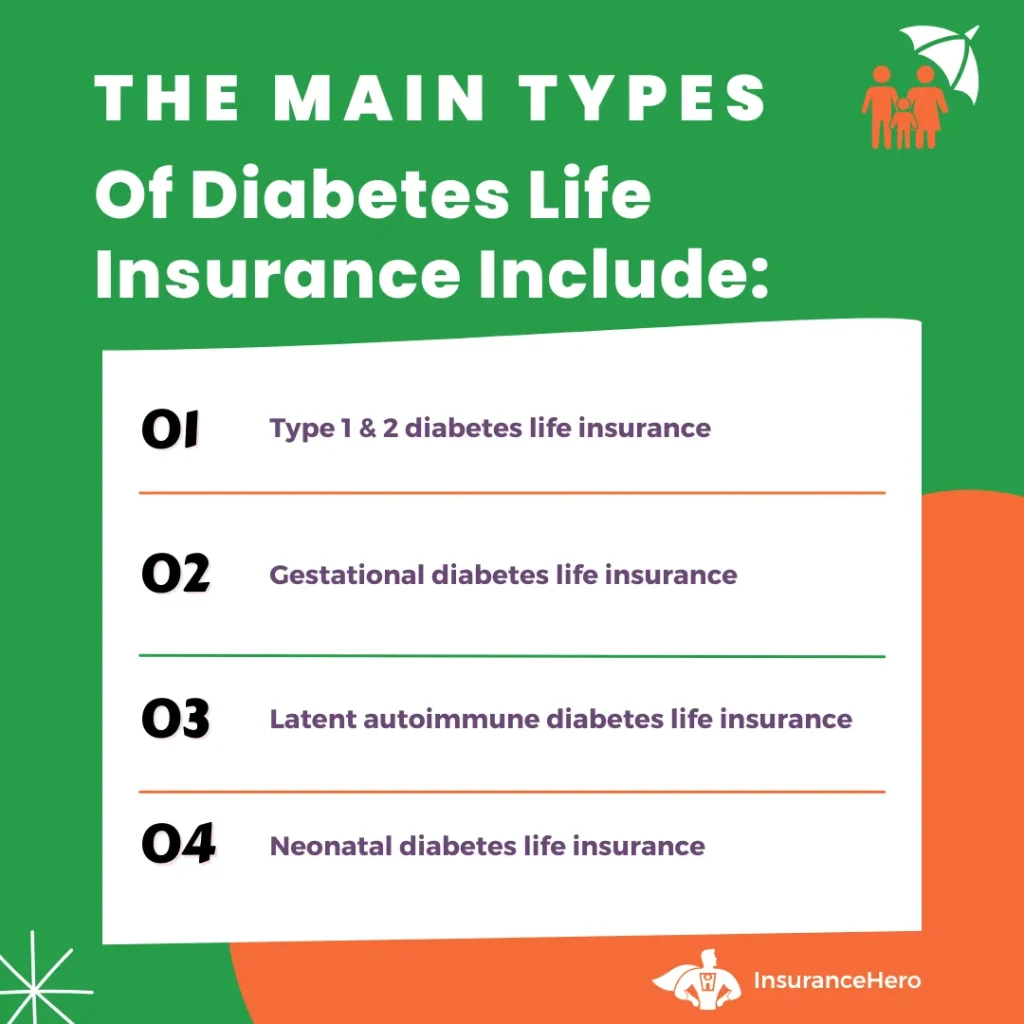

Types of Diabetes and Life Insurance Options

Type 1 diabetes is an autoimmune disorder in which the body does not produce insulin, while Type 2 diabetes is a metabolic disorder in which insulin is not utilised properly.

Life insurance options and their impacts on coverage and premiums differ for each type. Type 1 diabetics may face higher life insurance costs due to the heightened risk of developing health complications, heart attacks, and also strokes.

Diabetics must consult the right insurance provider to secure the most suitable coverage. Some providers may be more accommodating than others regarding pricing for people with diabetes.

When applying for life insurance, diabetics should be prepared to provide information regarding their current HbA1c (blood glucose) levels, which insurers use to evaluate diabetes control.

The disparity in life expectancy between Type 1 and Type 2 diabetics also plays a role in the underwriting process, with Type 1 diabetics often facing a shorter life expectancy.

Insurers often look at HbA1c levels to understand an individual’s diabetes control. Here’s a general idea of what they might consider:

Your insurance provider or a designated advisor will commonly prompt you each year to provide your Hba1c readings to your insurer, such as Aviva.

They will contact you to guide you through the necessary steps for submitting your Hba1c results as part of your insurance policy requirements.

| HbA1c Level | Diabetes Control | Potential Impact on Insurance |

|---|---|---|

| Less than 7% | Good | May qualify for standard rates |

| 7% – 8% | Fair | May face slightly higher premiums |

| 8% – 10% | Poor | Likely to face higher premiums |

| More than 10% | Very Poor | May be denied coverage or face significantly higher premiums |

Please note that this table is a general guideline. The exact impact on insurance can vary depending on the insurance company’s underwriting guidelines and the individual’s overall health and lifestyle.

Does Life Insurance Cover Type 1 Diabetes?

Can getting diagnosed with type 1 diabetes affect life insurance? Many people with type 1 diabetes lead relatively normal, healthy lives. You can get insured with Type 1 diabetes, but most insurance providers will offer you more expensive plans due to your pre-existing medical condition.

Before signing the contract, you might be asked to undergo a medical exam to check your body mass index, HbA1C readings, and other valuable parameters. Life insurance providers will want to hear about any diabetes complications you have experienced and how you manage your health.

Does Life Insurance Cover Type 2 Diabetes?

A Type 2 diabetes diagnosis does not exclude a person from getting coverage but can increase its price due to its pre-existing condition.

It can cover essential living expenses if you pass away. However, it varies between companies. In most cases, whether you qualify for insurance will be determined based on your age when you were diagnosed, whether you are living a healthy lifestyle, and how well you manage the illness.

The group with a higher chance of getting their life insurance application accepted is those who can control their serious illness through healthy living, meaning they regularly exercise and follow a strict diet.

Those people can also count on lower life insurance premiums than those who experience some health complications due to diabetes.

Please contact us today, and we will gladly offer you no-obligation assistance. Compare the leading life insurance companies and get all the relevant information from diabetes life insurance experts. Find the best insurance provider for you.

Factors Affecting Life Insurance Premiums for Diabetics

Several factors can influence life insurance premiums for diabetics, including age, lifestyle habits, and illness management.

Maintaining a healthy lifestyle can help lower premium costs for diabetics. Reducing body weight to achieve a BMI within the normal range, lowering alcohol consumption, and improving cardiovascular health may contribute to reducing life insurance premiums.

Another essential factor that can impact premiums is the management of diabetes.

To demonstrate effective diabetes management, the following factors are crucial:

- Regular physician visits

- Blood sugar monitoring

- Adherence to a nutritious diet

- Regular exercise regimen

By considering factors like how diabetes affects life expectancy, diabetics may be able to secure more affordable life insurance coverage.

Applying for Life Insurance with Diabetes

When applying for life insurance as a diabetic, it’s essential to be prepared with the necessary documentation and medical exams.

Insurers typically require evidence of adequate diabetes management, such as medical records from healthcare providers. They may also request medical examinations to evaluate the risk associated with pre-existing medical conditions.

Being candid and transparent during the life insurance application process is crucial for diabetics. Insurers will have access to all pertinent documents, and providing false information intentionally will likely result in the provider declining coverage.

By maintaining accurate and up-to-date medical records and working closely with healthcare providers, diabetics can increase their chances of obtaining reasonably priced life insurance coverage.

Necessary Documentation and Medical Exams

For diabetics applying for life insurance, the primary documentation required is evidence of adequate diabetes management, such as the level of control and how the condition is managed.

Additionally, medical examinations may be necessary to evaluate the risk associated with the condition. These exams typically include assessing blood sugar levels and other diabetes-related complications.

Diabetics need to include accurate information about their BMI in their life insurance applications, as this can impact the coverage and premiums offered by insurance providers.

By providing all the required documentation and undergoing any necessary medical exams, diabetics can increase their chances of securing suitable life insurance coverage.

Tips for a Successful Application

To increase the likelihood of a successful life insurance application for diabetics, it’s essential to maintain a consistent record of effectively controlling diabetes.

Health management tools like the Gro Health App can help diabetics uphold their:

- Nutritional requirements

- Sleep

- Mental health

- Exercise levels

Regular check-ups with healthcare providers to assess HbA1c levels and overall diabetes management can also significantly secure coverage.

When applying for life insurance, diabetics should:

- Be honest about their medical history, including any pre-existing conditions, current medications, and other health issues

- Provide accurate information

- Work closely with healthcare providers

- Obtain the most suitable life insurance coverage at competitive rates.

What If I Have a Policy Obtained Before My Diabetes Diagnosis?

Well, then, you are in luck. If you have a policy, the insurance company will unlikely void it.

A particular language would have to be used for this to happen, which is very unlikely. You would have known about such clauses before signing the contract, and it is far from the norm for something like this to be in place.

Anyone with a diabetes life insurance policy through their employer will have some concerns. If, for example, you were to leave that place of employment after being diagnosed, the insurance coverage would likely end on the last day of employment.

Employees can sometimes continue coverage independently if they absorb all costs. You may want to discuss this with your human resources department.

Does Life Insurance Pay Out for Diabetes?

If you secured coverage before diagnosis, you should maintain proper condition management and continuing documentation.

Suppose that policy became void for any reason, such as missing a premium. In that case, you must prove to a new provider that you have managed the condition correctly and are presenting minimal risk.

If you are a diabetic, getting life insurance with no medical exam can still be possible. Please get in touch with us today, and our friendly team will be delighted to answer any questions regarding life insurance for diabetics.

Critical Illness Cover and Income Protection for Diabetics

In addition to life insurance, diabetics and their families can consider critical illness coverage and income protection for financial assistance. However, the availability and eligibility for these types of coverage can vary for diabetics.

Here are some key points to consider:

- Critical illness cover does not generally include diabetes, as it is not always classified as a life-threatening illness.

- Some insurers may consider late-onset type 1 diabetes as a critical illness condition.

- Researching and comparing different insurance providers is important to find the best options for diabetics.

Do I Qualify for the Income Protection with Diabetes?

Individuals with diabetes can acquire income protection insurance. This type of insurance provides a percentage of your income if you cannot work due to illness or injury, ensuring you can maintain your usual lifestyle.

Income protection might be valuable coverage, but it’s not always the easiest to buy when you have diabetes. Income protection is paid out as a percentage of your income when you can’t work due to illness or injury.

You can still get income protection with certain insurance providers, but it can be more challenging for people with type 1 diabetes. Due to the severity of some diabetes-related complications, you might get rejected from this type of coverage.

However, if you are in good shape and provide all the necessary documentation, you might be able to get income protection on your insurance policy.

Diabetics still need to explore the availability of critical illness coverage, life cover, and income protection, as these types of coverage can offer additional financial security.

Critical Illness Cover for Diabetics

Critical illness cover for diabetics has become increasingly accessible in recent years, but it is still only available to a comparatively restricted number of sufferers due to stringent underwriting.

Critical illness coverage is generally accessible with no additional complications, such as neuropathy, retinopathy, or nephropathy.

Pre-existing diabetes is not covered by critical illness cover; however, newly developed diabetes should be incorporated if specified as a condition covered.

Some insurance providers may consider critical illness coverage for Type 2 Diabetes if the HbA1c readings are below a certain level, usually around 7.0.

A Simplified Diagram Explaining The Diabetes Life Insurance Process

Finding the Right Life Insurance Provider for Diabetics

Finding the right life insurance provider for diabetics can be daunting, as different providers may offer different policies and rates for those with Type 1 and Type 2 diabetes.

When searching for life insurance for diabetes, it’s recommended to consult an expert, such as a specialist broker like Insurance Hero or an advisor, to ensure the most suitable coverage and competitive rates.

The Insurance Hero Team has years of experience in this field and will gladly help.

In addition to seeking expert advice, diabetics should also compare various life insurance companies to find the best insurance company for their needs.

Comparing companies can help diabetics understand the differences in coverage, premiums, and policy terms and evaluate each provider’s reputation and customer service record.

Comparing Life Insurance Companies

When comparing life insurance companies, diabetics should consider the following factors:

- The coverage provided

- The premiums charged

- The policy terms

- The company’s reputation and customer service record

By considering these factors, diabetics can make an informed decision when selecting a life insurance provider.

Diabetics must approach the comparison process with a clear understanding of their circumstances, which can significantly impact the policies and rates offered by different providers.

By being knowledgeable about their condition and its management, diabetics can ensure they are well-equipped to find the best life insurance provider for their needs.

Seeking Expert Advice

Consulting an expert when selecting a life insurance provider for diabetics can facilitate obtaining the appropriate policy and enhance one’s eligibility for coverage.

The experts at Insurance Hero are well-versed in identifying the most suitable insurers for your circumstances and can provide invaluable guidance during the application process.

By seeking advice from diabetes life insurance experts, diabetics can save time and effort while searching for life insurance and ensure they receive the most suitable coverage and competitive rates.

This professional guidance can be vital for diabetics looking to secure their financial future and protect their loved ones.

Life Insurance For Diabetics Conclusion

Securing life insurance for diabetics is not an unattainable goal. By understanding the relationship between diabetes and life insurance, the necessary documentation and medical exam requirements, diabetics can secure the coverage they need to protect their families and financial future.

With the correct information and resources, diabetics can confidently navigate the world of life insurance and find the best policy to suit their needs.

Losing a loved one is hard enough, but financial worries can worsen the situation. Life insurance gives your family the security of knowing they will be financially taken care of if you die.

While no money can ever truly replace you, life insurance can help ease the burden on your loved ones when you’re gone.

Give yourself and your family peace of mind by getting a no-obligation-free life insurance quote today.

Life Insurance For Diabetics Summary Table:

| Key Point: | Explanation: |

|---|---|

| Can diabetics get life insurance coverage? | Yes, most insurance companies offer life insurance cover for people with diabetes. |

| Factors affecting premiums | Age, weight management, fitness, smoking, drinking, and the severity and management of the diabetes condition. |

| Life insurance for Type 1 diabetes | Higher premiums may be due to the increased risk of developing health conditions such as heart attack or stroke. A medical examination and detailed information about the condition might be needed. |

| Life insurance for Type 2 diabetes | Premiums may be higher depending on the severity of the condition. Medical exams and detailed information about the condition may be required. Efforts to keep the condition in check may reduce premiums. |

| Critical/serious illness cover for diabetes | Pre-existing diabetes may not be covered. If developed during the policy, it may be included depending on the policy. |

| Disclosing diabetes to the insurer | It is important to inform the insurer about the diabetes diagnosis during application. Failure to do so may result in the policy being cancelled or a payout refusal. |

| Diabetes diagnosis after obtaining insurance | It is essential to inform the insurer about the diabetes diagnosis during application. Failure to do so may result in the policy being cancelled or a payout refusal. |

How to Get the Best Diabetic Life Rates Video (US Presenter, But Still Relevant)

Life Insurance With Diabetes Case Studies

Diabetic Life Insurance Case Study 1 – Young Couple with Kids

Sophie and Alex are a young couple living in Birmingham with their two young kids, aged three and five. Both parents are currently in their early thirties.

Alex was diagnosed with Type 1 diabetes during childhood, while Sophie doesn’t have diabetes. After experiencing a health scare with Alex’s diabetes management, they became concerned about the financial security of their children’s future.

Alex started researching the costs of life insurance. He was initially concerned that the price might be exorbitantly high because of his pre-existing condition.

However, after shopping around and consulting with Insurance Hero, he found that obtaining life insurance with diabetes was possible and more affordable than he had assumed.

With the prevalence of diabetes increasing globally, insurers have adjusted their policies, offering diabetic life insurance tailored to meet the needs of people living with this condition.

After several consultations, Alex and Sophie chose a policy that best suited their needs. They discovered that type 1 diabetes life insurance provides a safety net for their children’s future and helps manage the medical costs associated with diabetes.

This made obtaining life insurance essential to their family’s financial planning. The best life insurance for diabetics they found provided them with peace of mind that their children’s financial future would be secure in the event of an unforeseen tragedy.

Diabetic Life Insurance Case Study 2 – Couple in their Fifties with Grown-Up Kids

Emma and John are a couple in their fifties, living in Newcastle. They have three grown-up kids who have recently moved out to start their own lives. Emma was diagnosed with Type 2 diabetes five years ago, following a routine health check-up.

Having recently become empty nesters, Emma and John started to think more about their retirement plans. Given Emma’s diabetes diagnosis, they were concerned about the unexpected costs that could arise should her health deteriorate.

This led them to explore the idea of life insurance, particularly life insurance with type 2 diabetes.

Emma’s search for the right policy led her to understand that life insurance costs vary greatly based on a person’s health status, lifestyle, and the type of coverage they require. After careful consideration, Emma found a diabetic life insurance policy that met her needs.

The chosen policy offered a comprehensive coverage plan that considered Emma’s potential medical expenses due to her diabetes alongside the standard death benefit.

It comforted them to know that unforeseen medical costs would not erode their hard-earned savings and that they could continue to live their retirement as planned.

Finding the best life insurance for diabetics was a relief, and it brought peace of mind to Emma, John, and their adult children.

Are there diabetes charities and support services in the UK?

Yes, there are several diabetes charities and support services in the UK that provide assistance and information to individuals living with Type 1 and Type 2 diabetes.

Some of the prominent organisations include Diabetes UK, which is one of the leading charities dedicated to diabetes research, awareness, and advocacy.

Additionally, the Diabetes Research & Wellness Foundation focuses on funding research and raising diabetes awareness.

For children and young adults with diabetes, the Juvenile Diabetes Research Foundation offers specific support and research aimed at Type 1 diabetes.

Another resource, Diabetes.co.uk, operates as an online community and information hub for both types of diabetes.

Diabetes Life Insurance FAQs

Does Life Insurance Test for Diabetes?

Diabetes can sometimes affect life insurance rates by increasing the likelihood of complications or other health problems. Life insurance companies can test for diabetes on a condition-by-condition basis.

Each company has its restrictions on testing for diabetes, and you may have to disclose past medical history about diabetes.

What Is the Best Life Insurance for Diabetics?

According to a recent study, 44% of people with diabetes in the UK have failed to take out any life insurance.

You need coverage that will pay out a lump sum or a steady income stream in the event of a chronic illness like diabetes.

Effective diabetic life insurance would not penalise you for your condition and would still allow you to receive the necessary coverage.

What benefits can I claim with type 2 diabetes?

As someone living with type 2 diabetes, you can take advantage of a range of benefits and support programs.

These include prescription coverage, Disability Living Allowance (DLA), Personal Independence Payment (PIP), Attendance Allowance, Pension Credit, Carer’s Benefits, Universal Credit, and Employment and Support Allowance.

What factors affect life insurance premiums for diabetics?

Life insurance premiums for diabetics are largely determined by age, the management of the illness, and lifestyle habits, all of which may influence how much of a risk the individual is considered to be.

These factors can significantly impact the cost of life insurance for diabetics. Age is a significant factor; the older a person is, the higher the premiums.

Managing the illness is also essential, as those who have better control of their diabetes will likely be offered more competitive premiums.

Do I need to tell a life insurance company if I get diabetes?

Yes, it is essential to disclose your diabetes when applying for life insurance. Insurers need a complete picture of your health to provide an accurate quote and the best coverage options.

Does diabetes affect term insurance?

As a person with diabetes, your term insurance premiums might be higher than someone in perfect health. Nevertheless, the exact premium cost is influenced by the specific type, degree, and seriousness of your diabetes condition.

Is diabetes considered a pre-existing condition?

Health issues such as diabetes, chronic obstructive pulmonary disease (COPD), cancer, joint and bone inflammation and mental health issues could be examples of pre-existing medical conditions.

Is type 2 diabetes classed as a disability in the UK?

Should you live with type 1 diabetes, type 2 diabetes, or any other form of diabetes that necessitates insulin or other medications, it is typically recognised as a disability under the Equality Act 2010. If you reside in Northern Ireland, this recognition falls under the Disability Discrimination Act 1995.

Can you drive while taking metformin?

Assuming your blood glucose levels are well-regulated, using metformin should not interfere with your capacity to operate vehicles, bicycles, or handle machinery and tools.

Metformin alone doesn’t typically cause hypoglycemia, but it may be prescribed with other diabetes medications that could influence blood sugar levels.

How does gestational diabetes affect life insurance premiums?

Gestational diabetes typically does not influence life insurance premiums significantly.

This condition is generally not a major concern during the life insurance application process unless it is accompanied by additional health complications that could increase the likelihood of future health issues.

Research Sources:

- https://www.diabetes.org.uk/guide-to-diabetes/life-with-diabetes/insurance

- https://fidelitylife.com/life-insurance-basics/life-insurance-101/life-insurance-for-diabetics/

- https://pubmed.ncbi.nlm.nih.gov/15111519/

- https://www.reddit.com/r/explainlikeimfive/comments/11v8xc/eli5_diabetes/

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.