Income Protection Insurance For Teachers [2025 Guide]

Receive a monthly income for as long as you need if you are off work sick or physically injured – it is that simple.

Why Income Protection?

If you are online researching income protection insurance for teachers, the thought may have crossed your mind.

“What if something happens to me?” Unfortunately, it could.

You can’t control getting sick or injured, but we can control if we’re protected. Income protection is flexible insurance that pays teachers a tax-free benefit if they are off work due to sickness or injury.

Do Teachers Need Income Protection?

The long and short – Yes. On average, teachers in the UK get only 11 paid sick days per year. The average claim with income protection lasts 18 months. An income protection policy will pay out in the event of ANY sickness or injury.

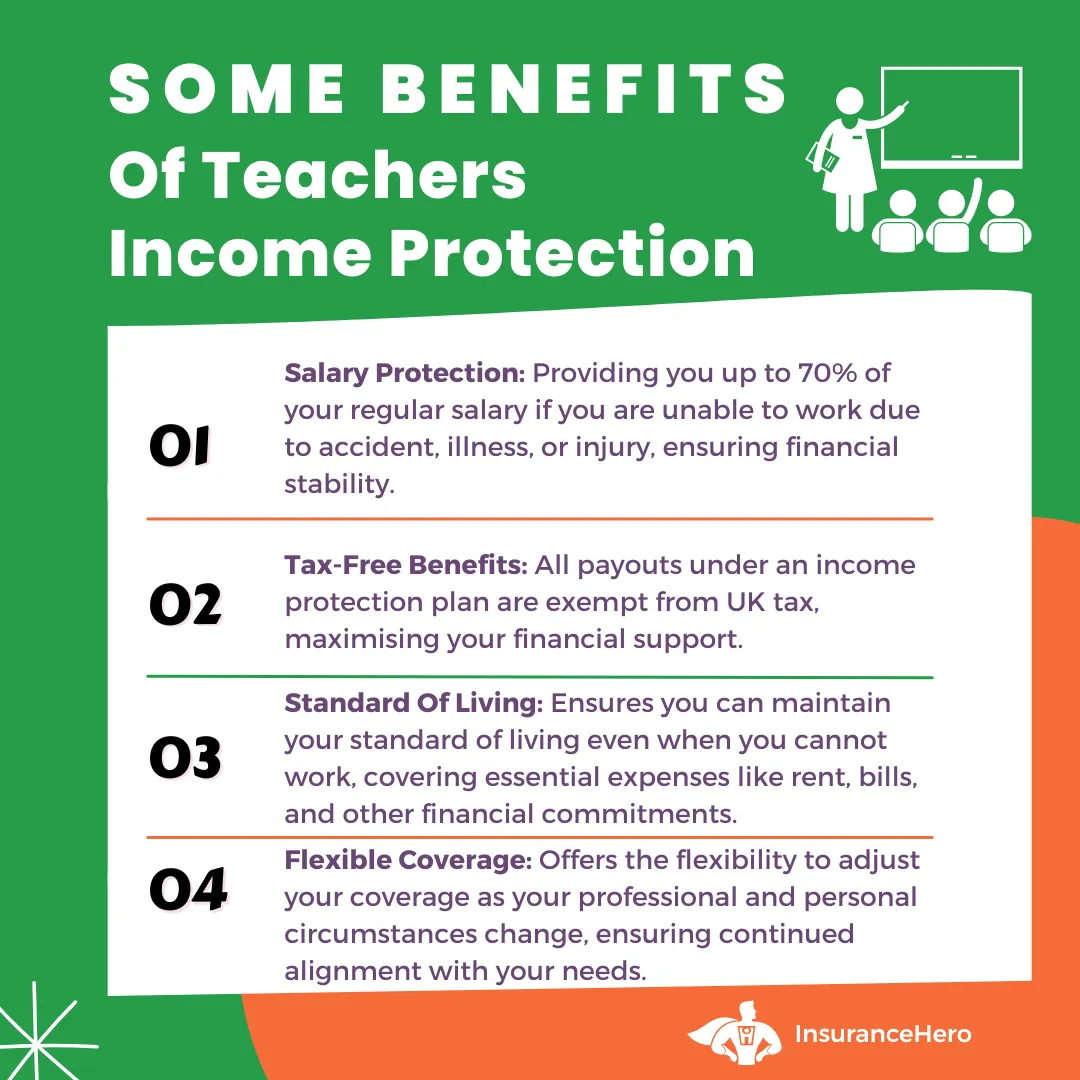

The Main Benefits Of Teachers Income Protection Insurance:

Insurance Hero can assist you in finding the most comprehensive and cost-effective income protection policies available.

For teachers, teaching assistants and lecturers, income protection provides significant advantages should you be unable to work:

- Any payout received from an income protection policy can be zero-rated for UK tax.

- Insurers will provide teachers with a replacement salary of up to 70% of pre-claim earnings.

- The money from a policy will give you the same lifestyle until you can return to work.

- Income protection plans offer flexibility and can be consistently tailored to match your evolving professional and personal needs.

- A policy can offer financial security, ensuring coverage until retirement if you cannot rejoin the workforce.

- It helps preserve your savings by delivering consistent income during periods when health issues disrupt your ability to work.

- Peace of mind that your mortgage, rent, bills and other commitments will be protected.

Teachers Income Protection Insurance From Top UK Companies. Quick Form. Start The Process Online

Further benefits of teachers’ income protection cover:

- Monthly Rolling – You are never tied to any agreement. Income protection is entirely flexible.

- Available if you are full-time, part-time, temp or agency.

- Very affordable options can start from £10 per month.

- You will be covered instantly – as soon as today!

- Payment can be received every month until retirement.

- There are no upfront costs whatsoever.

- Existing medical conditions accepted.

- Dual deferred periods are available for sick pay that gradually reduces over time.

Factors that will determine the cost of your income protection plan

- Fixing the premium type to ensure your monthly cost remains the same

- The level of coverage you will require: you can receive a maximum of 70% or opt for a lower amount that will cover vital bills

- Your age at the point of application – The younger, the better!

- Your medical background – The more extensive, the higher the risk, but our team can find you the best option.

In your deferred period, you can select a waiting period that is applied before you receive your monthly benefit. The longer you can wait, the lower the cost.

What Government Assistance is Available for Teachers?

Unfortunately, there isn’t much support beyond receiving sick pay. SSP is currently £99.36 and is paid out for 28 weeks. An average income protection claim will last 18 months.

UK Financial Statistics

- The average household is just 24 days from the breadline, far shorter than the 90 days they believed.

- Almost half of all day-to-breadline households feel that losing their income is one of their biggest worries if they cannot work.

- 2 in 5 households have less than £1,000 in savings. 1 in 5 has no savings.

Have you considered what would happen if you could not work? If you have savings, will they cover all your outgoings for over 12 months?

The chances are, the answer to that question is no. Let us show you the affordability of this cover with a free, no-obligation quote.

1 in 20 teachers has mental health struggles that last over a year

Teaching is widely accepted as one of the most high-pressure jobs, especially after COVID-19.

Stress is one of the main conditions for which a claim is made on teachers’ income protection. This claim lasts, on average, eight months, allowing breathing space to get your mental health back on track without missing any monthly commitments.

Teachers can also fall victim to physical injuries or have an accident, leaving them unable to work. This would also result in a successful claim, allowing them to recover thoroughly and anxiety-free, knowing all financial commitments would be covered.

Get Income Protection Quotes From The UK’s Top Companies

Did you know income protection doesn’t only pay you a monthly benefit when you are sick or injured?

There is a list of great features these policies come with that nobody ever seems to discuss. The features provide care for not just you but your loved ones, too.

Additional Benefits That Come With an Income Protection Policy:

- Waiver of premium – During a claim, the insurer will pay for your policy

- Hospitalization benefit – Get £100 for each night you are hospitalized

- Trauma benefit – Receive a lump sum of £50,000 if diagnosed with specific conditions

- Fracture cover – Receive a lump sum for every fracture/broken bone and claim as many times as you want.

- It is ideal for those with sporty or active hobbies.

- Death benefit – Get a lump sum if you pass away during the policy term

- 24/7 free GP service – This includes telephone or video consultations with private prescriptions

- Private diagnostics testing for Oncology, Cardiology or Neurosurgery also protects your children.

- Family care benefit – If your partner or child has been sick or injured for three months, you can claim your monthly benefit for a whole year while they recover.

And many more extra benefits can come FREE with an income protection policy.

Here are some everyday scenarios and genuine prices:

Meet Kemal

Kemal is 45 and earns £42,000 per year. He has asthma and high blood pressure.

His total monthly outgoings are £2,000 a month.

Kemal heard about income protection from a colleague at school but felt this might be expensive due to his medical conditions.

Kemal decided to find out what was available to him. After speaking with an adviser, a policy was set up to pay Kemal £2,450 tax-free for every month he was out of work due to sickness or injury. The £450 left over is for Kemal to spend however he likes. This policy costs £19.11 per month.

Meet Claire

Claire is 34 and earns £36,000 per year. She has no medical conditions.

Claire has had her policy for two years and is, unfortunately, in a position where she needs to claim for depression and anxiety.

Her claim is immediately accepted, and she receives £1,800 every month, tax-free for nine months. Claire’s policy remains active at the same great price as she can make multiple claims due to the policy she was advised to have.

This policy costs £14.32 per month, meaning Claire paid £343.68 over two years and got back £16,200.

Meet Syed

Syed is 61 and earns £58,000 per year. He has IBS.

Syed is very active and goes mountain biking regularly as a hobby.

Unfortunately, Syed has an accident which leaves him in bad shape in hospital for 30 days. Once out of the hospital, Syed takes three months to recover.

Syed Received £ 3000 as a hospitalization benefit and £2,784 for every month he was out of work. The hospitalization benefit came at no extra cost and was added on by the adviser he dealt with.

If you’re a teacher and have found yourself reading about income protection online, don’t delay. Get a free, no-obligation quote today and start protecting your tomorrow today. Please read our life insurance for teachers guide if you are also interested in complimentary life insurance quotes.

Types of Income Protection for Teachers

| Type | Description | Key Insurers |

|---|---|---|

| Short-Term Income Protection | Provides coverage for a limited period (1-5 years) for each claim. It can be ideal for temporary conditions or injuries. | Aviva, Vitality |

| Long-Term Income Protection | Offers benefits until retirement age or until recovery from illness/injury. Ideal for chronic or long-term conditions. | Legal & General, LV= |

| Own Occupation | It covers the teacher’s role, ensuring benefits if they can’t perform their teaching duties due to illness. | Zurich, British Friendly |

| Suited Occupation | It covers the teacher’s job role, ensuring benefits if they can’t perform their teaching duties due to illness. | Royal London, AIG |

| Any Occupation | Provides benefits only if the teacher cannot work in any occupation, making it harder to claim. | Aviva, Legal & General |

Additional Benefits with Income Protection

| Benefit | Description | Key Providers |

|---|---|---|

| Waiver of Premium | The Insurer pays the policy premium during a claim period, ensuring the policy remains active. | Royal London, LV= |

| Hospitalisation Benefit | Offers a fixed amount per night if hospitalized, e.g., £100 per night. | Aviva, British Friendly |

| Trauma Benefit | Provides a lump sum (e.g., £50,000) for specific critical conditions like cancer or heart attack. | Zurich, AIG |

| Fracture Cover | Pays out for fractures or broken bones, which is especially useful for active teachers. | Vitality, Royal London |

| Death Benefit | Offers a lump sum to beneficiaries if the policyholder dies during the policy term. | Legal & General, Zurich |

| 24/7 Free GP Service | Includes telephone or video consultations with private prescriptions. | LV=, Aviva |

| Private Diagnostics Testing | Pays out for fractures or broken bones, which is especially useful for active teachers. | British Friendly, AIG |

| Family Care Benefit | It covers tests for conditions like cancer, heart disease, and neurosurgery, sometimes extending to children. | LV=, Legal & General |

Factors Affecting Premiums for Teachers

| Factor | Description | Outcome |

|---|---|---|

| Age | Younger applicants generally get lower premiums. | Increases premiums with age |

| Medical History | Pre-existing conditions may increase premiums. | Higher risk can mean higher premiums |

| Deferred Period | Length of time before benefits are paid after a claim; longer periods reduce premiums. | Short periods increase, long periods decrease premiums |

| Policy Type | Choosing between level, age-banded, or reviewable premiums can significantly impact costs. | The Level is stable; age-banded increases; reviewable fluctuates |

| Occupation Definition | “Own Occupation” provides the most comprehensive cover but at higher costs. | Own Occupation increases premiums |

Mental Health and Stress Coverage

| Aspect | Description | Key UK Insurers |

|---|---|---|

| Stress Inclusion | Some policies exclude stress, while others cover mental health problems if not pre-existing. | Vitality, British Friendly |

| Mental Health Support | Some insurers offer additional mental health resources, including counselling and therapy support. | AIG, LV= |

| Long-Term Mental Health Claims | Coverage duration can be crucial for conditions like depression or anxiety, which may require extended time off. | Aviva, Zurich |

Government and Employer Support

| Support Type | Description | Relevance to Income Protection |

|---|---|---|

| Statutory Sick Pay (SSP) | Government support of £99.35 per week for up to 28 weeks. | Typically insufficient, making Income Protection essential |

| Teacher Sick Pay | Up to six months full pay and six months half pay; varies by employer. | Helps in setting a deferred period for the policy |

| Employment and Support Allowance (ESA) | A state benefit that can be as low as £74.70 per week. | Often inadequate, highlighting the need for additional cover |

Income Protection For Teachers FAQs

Does Income Protection cover permanent disability?

Yes, income protection insurance can provide coverage for permanent disability. This type of policy can help replace a portion of your lost income if you cannot work due to a disabling injury or illness.

Many policies will provide benefits up to 60-70% of your regular earnings, which can often be paid until age 65 or 67.

Does Teacher Income Protection cover stress?

Teacher Income Protection does not explicitly cover stress, but it can help you financially if something unexpected happens that causes you to lose income.

For example, if you are diagnosed with cancer and have to take time off work for treatment, Teacher Income Protection would help replace some of your lost income.

Stress can affect your health, so finding ways to manage it is essential. Some strategies that may help include exercise, relaxation techniques, and spending time with friends and family.

Don’t hesitate to seek professional help if the stress becomes overwhelming.

What is the maximum Income Protection benefit amount?

The maximum income Protection benefit is contingent on the insurance company. It is possible to insure between 50 and 70% of total income through Income Protection, based on your chosen insurance company.

Are income protection policies worth it?

They can provide a financial safety net if you experience an unexpected loss of income.

On the plus side, an income protection policy can give you peace of mind, knowing that you’ll have some financial assistance if you’re ever laid off or experience another sudden loss of income. It can also help cover your living expenses if you cannot work due to an injury or illness.

On the downside, however, income protection policy premiums can be quite expensive.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.