Is Stand Alone Critical Illness Cover Worth It?

Every year, half a million women across the UK are diagnosed with breast cancer.

The same illness affects men, too, and it’s estimated that around 400 males who are diagnosed with breast cancer each year.

This is only one of many conditions for which critical illness plans are available to ease the financial worries that follow the emotionally charged diagnosis.

Thankfully, awareness has risen over the years, leading to many cases being diagnosed early, resulting in faster treatments and much higher survival rates. That’s the good news.

The bad news is that for those who are diagnosed with any critical illness, the financial ramifications will lead to higher stress levels and money woes, which can impact recovery time.

It’ll also affect your quality of life if you can’t afford home adaptations or your mortgage payments if you need to stay off work beyond what’s covered by your employer’s statutory sick pay (SSP).

Critical Illness Insurance Policies cover more than just cancer. Insurers typically categorise forty to fifty different types of illnesses as critical. Generally speaking, a critical illness is any life-threatening diagnosis requiring urgent medical treatment.

The most prominent you’ll get cover for are heart attacks, strokes and cancer. A definition will accompany the list of illnesses covered by each policy.

Compare Critical Illness Cover From The UK’s Top Providers, Completely Free Service, Save Money Now

Keep in mind that, as it is a dynamically developing industry, it’s worth being up-to-date with all the latest life insurance news.

One to note from the definitions on that page is the definition of cancer, which states “excluding less advanced cases”.

What that translates to is that they don’t cover early-stage cancer, which, as we already mentioned, the earlier you’re diagnosed, the higher your chance of survival.

Zurich, though, does cover Cancer in situ. Its guide to coverage states, “… an early-stage cancer that has stayed in the same place from where it began and has not spread to neighbouring tissue or organs.”

A prime example of this might be benign skin cancer. Many life insurance policies are available for people who have or have had skin cancer in the past.

Every provider has different policies on what they cover as critical. What’s notable, though, is that not all will pay the sum agreed upon, as there are policies that provide partial payment for early diagnosis.

In all cases of critical illness, cover pays out – the cover ends. These are one-time policies, meaning they are over once they’ve paid out. You can’t pay to continue the policy once it’s been claimed.

Our advice is to look for a plan that covers at least forty illnesses that the insurer classifies as critical. If you get any lower, you’ll likely find a better plan elsewhere.

Always pay attention to the details, though, because not every insurer will cover an early diagnosis if they believe or can prove via medical research statistics that your early diagnosis gives you a high probability of survival and, therefore, categorise your illness as non-life-threatening.

Always check the definitions.

What else can you get included?

It would be best if you didn’t settle for the plan with the most illnesses covered, full or partial payments for early diagnosis and certainly never for the cheapest you can find.

When you shop around, you’ll soon find that the insurance markets are competitive, which swings things in your favour.

There are critical illness policies that give added value, some of which can include:

- Early access to medical experts for advice and/or opinions

- Professional counselling services are available upon receiving a diagnosis

- Family members are included in your policy at no extra cost to you. However, once the policy has been claimed, it’s ended. No other family member will be covered under the same policy.

This is also an ideal policy for individuals without dependents. Life insurance is ideal for every family, but it may not be a priority for someone who is single and has no dependents to support financially.

However, with critical illness cover, it ensures that your financial commitments can be met if you’re unable to work due to a long-term illness being diagnosed.

Life Insurance and Critical Illness Combined

With many life insurance policies, you can add critical illness coverage at an additional cost. Life insurance will only pay out upon the policyholder’s death, regardless of whether a terminal illness has been diagnosed beforehand.

For the sole breadwinners of the household, the additional coverage may be worth the financial outlay because if you lose the primary income, state benefits might not provide enough money for you to meet the financial obligations necessary.

Suppose you feel that you would be unable to work for a prolonged period of time or indefinitely, which may require you to sell your home and other material possessions, downsize, or do anything else to get by.

In that case, it’d be worth considering adding critical illness to your life insurance policy.

If you’re unsure about benefits payable to you when you’re off work sick…

Your employer covers your Statutory Sick Pay for the first 28 weeks, which is taxable income. Lump sum payouts from insurance policies are tax-free.

After 28 weeks, there will only be state benefits, often leaving people worse off financially.

What sort of pressure would your household finances face if you were off work for six months or more?

Gone are the Dark Days of Critical Illness Cover

Many people know they could benefit from this level of protection, but feel wary because this cover has been associated with bad press.

A while back, Critical Illness plans were notorious because they covered fewer illnesses, and the firms selling them were secretive about the success rates of claims processed.

These days, more illnesses are included in the plans, and the Association of British Insurers reports the statistics of insurance claims processed and the number that are unsuccessful.

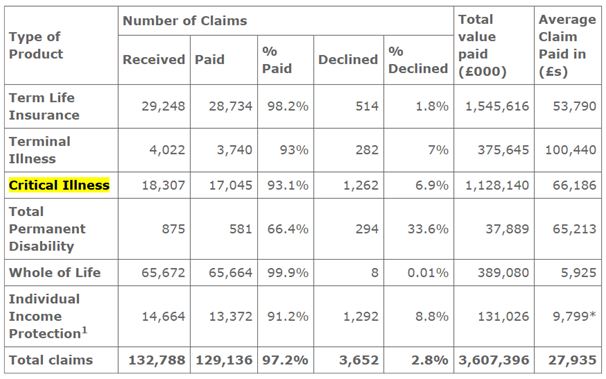

The table below shows the total statistics for 2025 insurance claims so far:

Source: ABI (Association of British Insurers)

As you can see, 93.1% of claims are paid successfully. When a claim is made unsuccessfully, it’s usually due to the illness not being covered in the policy or by what insurers call non-disclosure.

This is when they feel they issued cover to someone who did not disclose pertinent information during the application process.

Always be honest about any conditions you’ve had and disclose anything that requires ongoing treatment, as this can impact your claim.

Related Reading:

Did The Flagship AIG Critical Illness Plan Just Improve Further?

Critical Illness Cover Explained

Total & Permanent Disability Insurance (TPD)

Latest News From The Life Insurance Industry

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.