Best Life Insurance For Young Adults 2025

Life insurance is an important consideration for young people, but it can be difficult to understand the benefits and costs of different plans.

Many companies offer life insurance for young adults, so it may be the best age to get such a policy. They have lower premiums than traditional life insurance plans because they’re less risky for insurers, given your age and health status.

However, finding a policy that’s right for you can be challenging since there are so many options available on the market today.

At Insurance Hero, we simplify comparing quotes from multiple providers by providing a free online platform where consumers can get matched with personalised quotes from top-rated carriers in minutes.

We also provide educational resources about choosing a plan based on your needs and budget requirements. Get started today to learn more about what life cover could do for you!

Life Insurance For Young People. Just Fill In Our Simple Form To Get Great Quotes From Top UK Insurers!

Insurance Hero offers a comprehensive range of life insurance policies for young people. The cover is much cheaper than you might think, and there is no obligation to proceed after getting a free quote.

Best life insurance companies for young adults – Why us?

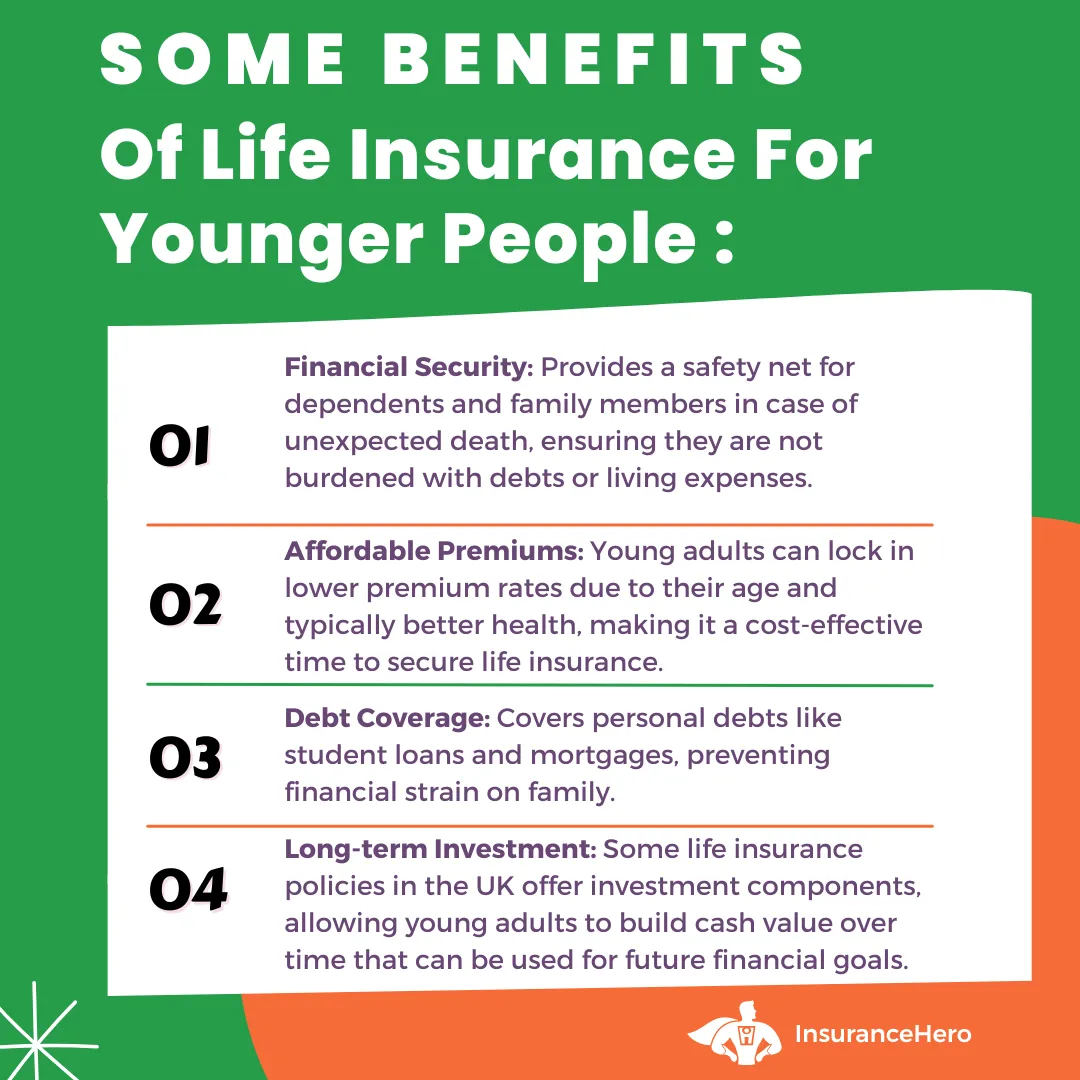

There are many benefits of young person life insurance:

- Affordable and comprehensive insurance for young adults

- Get a fast & free quote without having to go into an office

- Take out life insurance and save money on one of the most important needs in life

- There is no obligation after getting life insurance quotes from us

- Wide selection of cover choices for different lifestyles, including permanent life insurance

- Reduced prices for young persons life insurance

- Flexible coverage on whole life insurance for younger adults

- Free to get started if you are a young adult

- Save today on life insurance policies for young adults

- Younger people are more likely to be in accidents than older adults. Good cover can give you real peace of mind

- A lot of college students might not realize they need life insurance until it’s too late

- You don’t have to wait around tracking down life insurance quotes from different vendors because we offer bespoke best-deal cover for all your needs

- We’ll let you know the average costs of life insurance cover and which suits your budget, no matter how much money you currently make

- If you’re quite young and in fair health, you probably won’t require a medical exam for life insurance cover

The tables below provide a structured overview of key aspects of life insurance for a young person:

Life Insurance in Your 20s – Is It Worth It?

| Factor | Description |

|---|---|

| Premium Stability | The premium remains the same throughout the policy term. |

| Age Advantage | Younger individuals have lower premiums. |

Below is an example price comparison of a term policy with a decreasing term insurance policy. These are quotes for a £100,000 policy. This covers a 30-year period and is based on a healthy non-smoker.

| Your Age | Level Term Life Insurance* | Decreasing Term Life Insurance* |

|---|---|---|

| 20 | £4.93 | £4.58 |

| 25 | £5.38 | £4.87 |

| 30 | £5.93 | £5.36 |

| 35 | £7.98 | £6.14 |

*Medical Information required

Types of Life Insurance for Young Adults

| Type of Insurance | Description |

|---|---|

| Life Insurance | Pays out a cash sum if diagnosed with a terminal illness or upon death during the policy term. |

| Decreasing Life Insurance | Suitable for protecting a repayment mortgage as the cover decreases over time. |

| Critical Illness Cover | It can be added for extra cost and pays out for specified critical illnesses. |

Why get life insurance at a young age?

Younger people just beginning their careers do not typically think about life insurance. They are in the prime of their lives, so why would they need it? Unfortunately, death can strike at any time.

Those with debts or dependents should consider how these will be handled if they die. Rather than burdening loved ones with these financial obligations, they can spend a small amount to buy life insurance coverage that provides lump-sum payouts.

If the young person dies, beneficiaries receive the money, preventing them from dipping into their finances.

Buying Life Insurance For Young People

At the beginning of their professional lives, most people have only a small amount of savings and pension benefits. However, they may have financially dependent parents or other relatives. Some run their own businesses, increasing their financial liabilities.

Others marry or have children at a young age, increasing their number of dependents. If an individual dies at a young age, savings and pensions may not be enough to provide for these loved ones. Rising costs make it even more difficult for beneficiaries to make ends meet.

Purchasing young adults’ life insurance is a way to ensure that dependents are not left without a means of support. If the policyholder dies during the cover term, named beneficiaries file a claim to receive a lump sum payout.

This money can be used to repay the deceased’s debts, cover funeral expenses, pay for the care or education of minor children, or provide lifestyle support.

Some purchase life insurance in young adulthood or when they buy a home or car. Beneficiaries can use the cash value life insurance payout to repay the associated loan upon the passing away of the policyholder.

A life insurance provider considers a young and healthy person a lower risk. Therefore, as an added benefit, a young person’s life insurance premiums will be lower than those for someone older or suffering from a medical condition.

People can save money by purchasing life insurance when young, with premiums as low as £5 each month. Many find this affordable and can continue the cover throughout their lifetimes.

Just Fill In Our Simple Form To Get Affordable Life Insurance For Young Adults

Best type of life insurance for young family?

For young families in the UK, the best type of life insurance often depends on their specific needs and budget. Term life insurance is usually recommended due to its affordability and simplicity.

It provides coverage for a set period, ideal for covering specific financial responsibilities like a mortgage or children’s education.

Alternatively, whole life insurance, though more expensive, offers lifelong coverage and a cash value component, which can be a financial asset in the long run.

Life insurance for young professionals before certain life events

For young professionals, term life insurance is often the best choice. It’s cost-effective and provides substantial coverage for a specific period, aligning with career growth and financial obligations like loans or mortgages.

This type of insurance is ideal for those seeking financial protection without a hefty premium. As their career and personal circumstances evolve, they can reassess their insurance needs, potentially opting for more comprehensive coverage or additional policies.

It’s an intelligent way to ensure financial security while keeping costs manageable.

Life Insurance For Younger Adults: The Long Road Ahead

Many young adults will live long and healthy lives. They have most of their working lives ahead of them, allowing them to save more money and build their pension benefits. However, this may not be enough to repay large debts, such as a repayment mortgage loan, should the individual die.

Buying a life insurance policy that covers this debt and other debts is a smart move. It prevents a spouse or dependent child from being burdened with the expense. Using the insurance payout to satisfy the mortgage balance allows beneficiaries to remain in the home without financial worries.

Looking into the future and predicting unexpected expenses is a wise approach. Death often arrives unannounced, leaving many families and surviving loved ones in emotional and financial duress.

Access to money that can cover living expenses and other costs makes life much easier for them.

Begin thinking about loved ones at an early age and make the financial arrangements necessary for them to enjoy comfortable lives. With the life insurance for young parents policy in place, you can focus on a bright future and prevent everyone from worrying.

Life Insurance For A Young Adult FAQs

What is the best life insurance for young adults?

When you’re young and healthy, most young adults likely don’t spend much time worrying about life insurance coverage and becoming older people.

But as anyone who has ever lost a loved one can tell you, life changes quickly. If you are in a position to purchase life insurance, you may wish to do it sooner rather than later. If you’re under 30, you could get lower rates by taking a longer-term policy, usually 10-20 years.

If you’ve decided you’d like to get life insurance while you’re a young adult, you may wish to use a life insurance calculator to help you determine how much life insurance you need.

So which type of young adult life cover is best?

The best life insurance for young adults is term life insurance

This coverage from life insurance companies is very affordable, protects the insured against premature death, and provides a level of protection and financial stability needed for that age group. Term life insurance is simple and inexpensive. It covers you for a specific period, and you can choose the length of your term.

There are two primary types of term-based life insurance:

Level term life insurance

Level term life insurance is likely to be the most suitable policy type for protecting future assets.

It can provide peace of mind when you need it most—whether that’s two years before your mortgage interest rate leaps up or if you have other major expenses on the horizon, like buying a property and starting a family!

The sum assured with level-term cover holds its value throughout all stages; so even if death comes unexpectedly (at any age), your loved ones will always receive an amount totalling what they were insured against

Decreasing term life insurance with no pre existing medical conditions

Decreasing term life insurance offers financial protection and is a great option for those who want to make sure they’ll receive payment in case something happens. However, as the decreasing term cover amount of risk decreases over time term covers become cheaper than level plans because there’s no need for an increased sum assured. This means you could save money on your life policy premium payments.

What about whole life insurance for younger people?

Whole of life insurance is a type of insurance policy that guarantees coverage for the policyholder’s entire lifetime. It is different from term life insurance, which only covers a certain period of time.

With whole life insurance, the policyholder can pay slightly higher premiums throughout their lifetime, and the policy remains in effect as long as premiums are paid. If the policyholder dies during the term of the policy, their beneficiaries will receive a payout. If they survive to the end of the policy, they will receive the total value of the premiums paid minus any fees or withdrawals taken out.

Whole life insurance can be a good option for people who want guaranteed coverage for their entire lifetime. Some whole of life insurance plans also offers a cash value that the policyholder can access during their lifetime. This cash value accumulates over time and can be used to pay premiums, cover healthcare costs, student loans or supplement retirement income.

Should I get life Insurance in my 20s? Is life insurance for young people worth it?

It depends on a few factors, general health and individual circumstances. Are you ready to settle down and start a family? Do you want to provide for your family? Do you have debts that you need to pay off? When deciding if you should get life insurance in your 20s, these are all questions you need to ask yourself. We can help you choose cheap life insurance policies from the top life insurance brands and are happy to answer any questions you might have without obligation.

It is recommended that young people buy life insurance after they have enough money saved to cover funeral costs, outstanding debts, and any other obligations. It might be necessary if someone has a child or is supporting other people financially. Life insurance is a cost-effective form of protection, and you should evaluate how much protection you need based on your current situation, your family’s needs, and your future goals.

How much is life insurance for a 20-year-old with a cash lump sum death benefit?

Life insurance for 20 year olds can represent exceptional value for money. Monthly costs for a mortgage life insurance policy for a 20-year period are around £8 per month, level term life insurance at £4.50, and decreasing term life insurance at £4.70. If you are a smoker, expect to pay around £5.80 monthly.

How much is life insurance for a 25-year-old with a good medical history?

Life insurance for 25 year-olds can again be secured for a low monthly outlay. The amount or total cost you could expect to pay for a mortgage life insurance plan for a 25 year period would be about £6.82 per month, level term life insurance at £5.26, and Decreasing term life insurance at £7.24. If you are a smoker, expect to pay around £5.80 per month.

How much is life insurance for a 30-year-old?

Young people should get young persons insurance because they will not be able to support their dependents if they are ill or injured, and it costs less than you might think.

The monthly cost for mortgage life insurance for a 30-year-old is roughly £8.10 per month, Level term life insurance at £5.50, and decreasing term life insurance at £5.15. If you are a smoker, expect to pay around £9.83/month.

All the Quotes for the three age ranges mentioned are calculated based on individual circumstances on a level term policy worth £100,000 of coverage over a 30-year policy term.

Young people often think they don’t need life cover. With our types of life insurance, you can guarantee those close to you a protected future.

For example, if you have dependents who rely on your income or someone else’s financial support, arranging life insurance now through an appointed representative will ensure they can continue living the lifestyle they’re accustomed to after you pass away.

We’ll cover funeral costs for you and your family. Customers say they feel more secure knowing they have a robust life policy.

Are life insurance policies for young adults a good investment?

Young adults and young mums have several reasons to take out life insurance, including the low premiums that come with being in your 20s or early 30s. Life insurance is often a good investment for young people.

If you take off life coverage until later in adulthood, premiums can increase as your birthday rolls around. Ultimately, it becomes harder to get affordable rates on policies due to the greater size of the risk to the life insurance companies associated with being older.

Contact our team now if this sounds worthwhile – we’re happy to help, ensuring everyone gets what they need at a cost-effective and affordable price from the best life insurance companies in the UK.

Best Life Insurance For Young People Summary Table:

| Key Point | Notes |

|---|---|

| Types of life insurance available | Whole Of Life Insurance, Decreasing Life Insurance, Level Term and Critical Illness Cover for life changing illness risks. |

| Minimum age for life insurance | 18 years old |

| Maximum age for life insurance | Up to 85 years of age but premiums will be high |

| Factors affecting life insurance cost | Health, lifestyle, smoker status, participation in dangerous sports, occupation, type and amount of cover, length of coverage |

| Example cost of monthly premiums for £450,000 worth of coverage | Up to 85 years of age, but premiums will be high |

| Reasons to consider life insurance as a young adult | If someone else depends on you financially, it may be wise to consider life insurance, depending on your circumstances, rather than delaying the decision. |

Life insurance for young married couples in 2025

Young people should purchase life insurance before they get married. It’s always best to be prepared for the unexpected; life insurance is a way to prepare for a sudden and tragic loss.

As a young person, your future self will thank you for being smart about your finances. Take the opportunity to secure a life insurance policy and take advantage of a reduced price for young people without restrictive age limits! Educating yourself about the importance of living an active, healthy life is also essential.

When are you too old for life insurance? Many life insurance policies will let you take out a policy until around 80-90 years old – however, this depends on the provider, and there is no common upper age limit.

Example, the price of life insurance for a younger person

Beagle Street—£4.87 per month life insurance quote is based on an 18-year-old non-smoker with decreasing term cover of £100,000 for 9 years. Prices as of October 2024 are subject to change.

Decreasing Life Insurance For Married Couples Under 30

This type of life insurance helps to protect a repayment mortgage and can be very cost-effective. And a joint policy can be even more effective. If you are under 30 the cover can be surprisingly inexpensive.

Contact us today at Insurance Hero or visit our registered office for more information about how we can help protect what matters most with affordable life insurance from an expert provider. The cost of life insurance need not break the bank, and we think you will be pleasantly surprised at how small the outlay can be. We are the life insurance experts.

Other things that you should consider before you choose your exact policy

- Do you think your living costs may increase?

- What term length is best for you?

- What is the remaining balance on your mortgage?

- Is there a risk you may need to cancel the policy early?

- Do you drink alcohol to excess?

- Do your mortgage repayments include interest and principal?

- Do you have health problems in your family?

Related To This Topic and info on what affects life insurance premiums:

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.